Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Any Stock Tips? - Part 3

- Thread starter Aquamarinejewel

- Start date

- Tagged users None

I see multiple factors affecting Perth property house prices. Some of these are tied together but here's a general list...imo of courseWhat do you see driving down Perth property? Banks tightening lending?

Banks tightening lending

Unemployment increasing

Migration numbers decreasing

Economic worries

A slowdown in infrastructure spending once Elizabeth Quay, the new stadium and the Perth/Northbridge Link have been completed

Unemployment increasing

Migration numbers decreasing

Economic worries

A slowdown in infrastructure spending once Elizabeth Quay, the new stadium and the Perth/Northbridge Link have been completed

I still see decent short-medium term opportunities in Perth, mainly based around infrastructure, rather than a general up lift in property prices.

For instance I think the suburbs immediately surrounding Northbridge will see no fall or an increase with the Northbridge/City link. Properties in close proximity to the new stadium will also see no fall or have a slight increase due to the gentrification of the surrounding area.

Vic Park is an interesting one. I feel as though the Albany Highway strip has had "potential" for decades and that prices have mostly already had the potential of a high class shopping/restaurant/bar strip factored in to them. I think once the building of the stadium has finished it will speed up the gentrification of the Albany Highway strip to give attendees of the stadium another option outside of Burswood. I can see a small increase in prices or a flat period

East Perth is another suburb I think that will do well from the stadium with the pedestrian footbridge. If I was looking to buy, I'd be looking for places in close proximity, within a 1km walk, to the footbridge.

In general I think prices will head down and reasonably quickly. If you are going to buy then you wont be able to just buy anywhere and have prices trending up. You need to be looking for suburbs that are going to have an increase in quality of life and that's going to come from already funded/planned projects as I see a decrease in infrastructure spending once current projects have been completed.

Power Raid

We Exist To Win Premierships

80s?

87 and 92 but they hardly measure on a graph

Power Raid

We Exist To Win Premierships

What do you see driving down Perth property? Banks tightening lending?

wages

I wouldn't have thought that wages would decrease significantly enough to effect house prices, considering current rates. If rates start heading up then I would agree.

I feel property will stand pat and not move all that much, the far out suburbs may see negative growth, but I hope/do not expect declines in the 20% range. That would be catastrophic. Although personally it would afford a heap of opportunity.

I feel property will stand pat and not move all that much, the far out suburbs may see negative growth, but I hope/do not expect declines in the 20% range. That would be catastrophic. Although personally it would afford a heap of opportunity.

I wouldn't have thought that wages would decrease significantly enough to effect house prices, considering current rates. If rates start heading up then I would agree.

I feel property will stand pat and not move all that much, the far out suburbs may see negative growth, but I hope/do not expect declines in the 20% range. That would be catastrophic. Although personally it would afford a heap of opportunity.

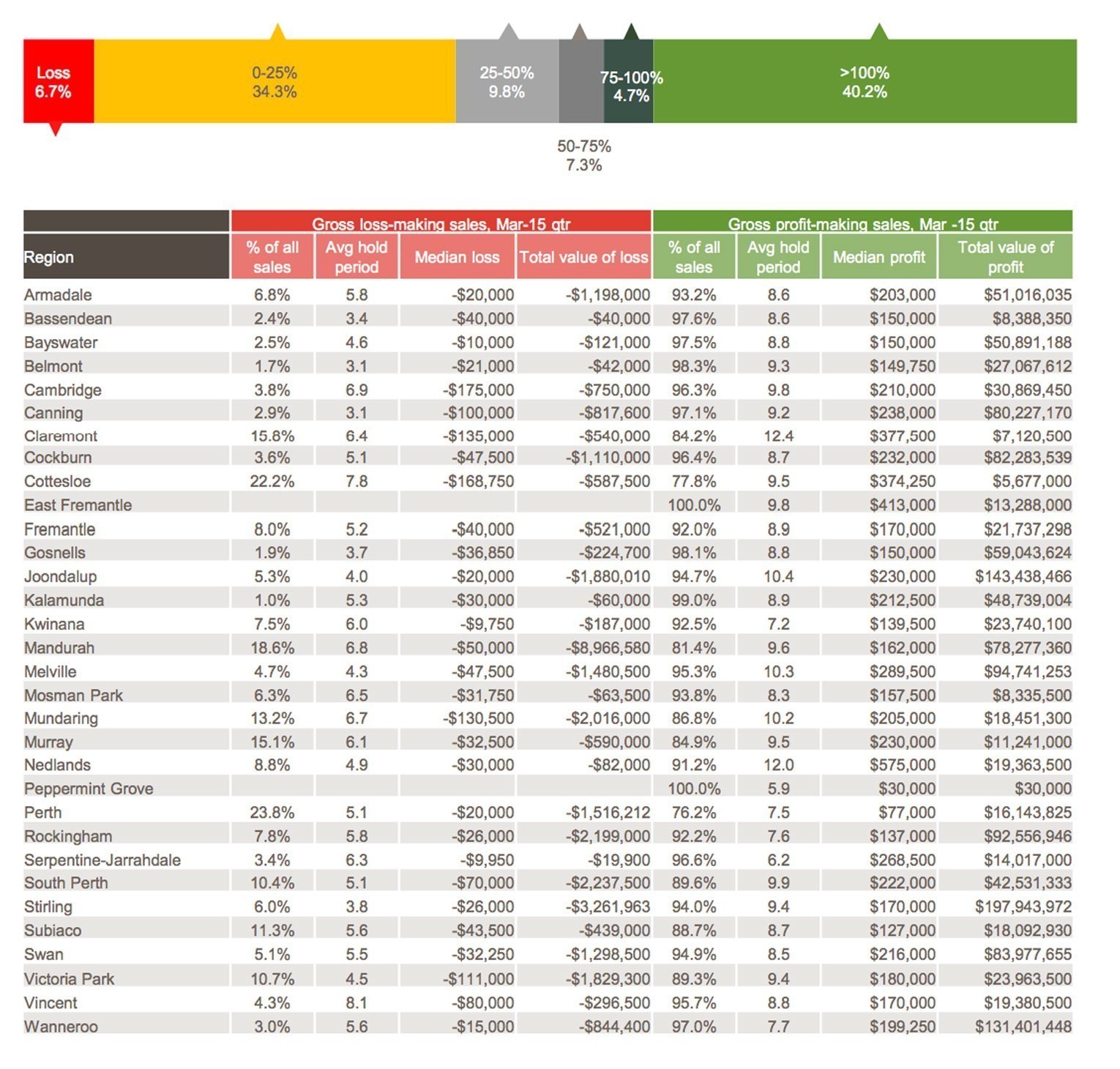

In the last 3 months, 22% of the homes sold in Cottesloe have sold for less than what they were previously purchased for. Other suburbs considered to be "blue chip" are also having higher rates of loss making sales

Subiaco is over 11%

Claremont is over 15%

Perth is over 23%

South Perth is over 10%

Vic Park is also over 10%

Historically these suburbs have all been around the 2 to 5% mark.

I think it's exactly that. Wages not increasing leads to negative sentiment in the property market. If wages aren't increasing, house prices aren't increasing so what's the point in owning an investment property? If house prices aren't increasing, people sell. More properties on the market equals longer time on the market leading to discounted sales and decreasing property pricesI wouldn't have thought that wages would decrease significantly enough to effect house prices, considering current rates. If rates start heading up then I would agree.

I feel property will stand pat and not move all that much, the far out suburbs may see negative growth, but I hope/do not expect declines in the 20% range. That would be catastrophic. Although personally it would afford a heap of opportunity.

There are about 15,000 properties for sale in Perth at the moment while there were 9,000 for sale at the same time last year.

In the last 3 months, 22% of the homes sold in Cottesloe have sold for less than what they were previously purchased for. Other suburbs considered to be "blue chip" are also having higher rates of loss making sales

Subiaco is over 11%

Claremont is over 15%

Perth is over 23%

South Perth is over 10%

Vic Park is also over 10%

Historically these suburbs have all been around the 2 to 5% mark.

Each to their own, I don't see see house prices in Cottesloe dropping a further 20% on top of the above losses. I guess it is possible though.

According to the CBA app 12 month growth figures of:

- Cottesloe was 0%

- Subiaco was 1%

- Claremont was -6%

- Perth was 22%

- South Perth was 3%

- Vic Park was 1%

Each to their own, I don't see see house prices in Cottesloe dropping a further 20% on top of the above losses. I guess it is possible though.

According to the CBA app 12 month growth figures of:

I am surprised at the percent of loss making sales, I would have thought that if most of the purchasers in those types of areas would have been able to hold out and wait for some capital growth considering the low holding costs.

- Cottesloe was 0%

- Subiaco was 1%

- Claremont was -6%

- Perth was 22%

- South Perth was 3%

- Vic Park was 1%

An interesting table

Where do you see the increase in prices coming from?Each to their own, I don't see see house prices in Cottesloe dropping a further 20% on top of the above losses. I guess it is possible though.

According to the CBA app 12 month growth figures of:

I am surprised at the percent of loss making sales, I would have thought that if most of the purchasers in those types of areas would have been able to hold out and wait for some capital growth considering the low holding costs.

- Cottesloe was 0%

- Subiaco was 1%

- Claremont was -6%

- Perth was 22%

- South Perth was 3%

- Vic Park was 1%

- There are not going to be any significant wage increases for some time

- Everything points to a very small decrease in unemployment at best. More than likely a small to medium increase

- Looking at the RBA minutes, they will be very reluctant to decrease the interest rate any further

- Banks have "voluntarily" increased rates on investment only loans

- Banks have marked "black spots" around Australia where there lending criteria will be a lot stricter

- Banks have tightened up lending criteria, requiring more evidence of saving history and spending habits

- A decrease in infrastructure spending once Perths 3 largest projects have finished

- A slow down in mining activity, evident by the simple fact that miners are reducing operations and there are minimal new planned mine openings over the near future

- Immigration numbers are decreasing

I just dont see where any increase in house prices can come from

Embleberry

All Australian

- Sep 5, 2012

- 690

- 346

- AFL Club

- Collingwood

I wouldn't mind that. I've been meaning to increase my investments in blue chips, ETF, LIC (for long term hold) for a while but didn't want to enter those positions while the market was on a high. Today was surprising, I was expecting some more pain with DJI taking a hit over night and even Shanghai Composite continuing to get smashed. I think I will wait a week or so and see if this stablises.4.3%. Will be below 5,000 for the first time in a whie

Thoughts/recommendations on LICs with US/international exposure?

Power Raid

We Exist To Win Premierships

I wouldn't have thought that wages would decrease significantly enough to effect house prices, considering current rates. If rates start heading up then I would agree.

I feel property will stand pat and not move all that much, the far out suburbs may see negative growth, but I hope/do not expect declines in the 20% range. That would be catastrophic. Although personally it would afford a heap of opportunity.

Some wages have dropped 95%

Some wages have dropped 95%

Is there enough of these 95%ers to influence the property market? I have no doubt that a sea of people with wages decreasing by 95% would see all markets being smashed.

Power Raid

We Exist To Win Premierships

Is there enough of these 95%ers to influence the property market? I have no doubt that a sea of people with wages decreasing by 95% would see all markets being smashed.

in the western suburbs there would be plenty.

One guy in iron ore was offered a job at $400k pa but had to turn it down because his interest bill was bigger than that. I dare say that household budget will end in tears.

I can see FIFO workers getting 40% hair cuts and that is the lucky 50% as the other 50% will lose their jobs and go back to driving buses or taxis on $50k pa.

Not too mention the 30% devaluation on the $ being a hidden pay cut on top of that.

It is not a bad thing but it will take some readjusting including asset value expectations.

$400,000 pa? Would have to have been a $12,000,000 house. Not a lot of them around Perthin the western suburbs there would be plenty.

One guy in iron ore was offered a job at $400k pa but had to turn it down because his interest bill was bigger than that. I dare say that household budget will end in tears.

I can see FIFO workers getting 40% hair cuts and that is the lucky 50% as the other 50% will lose their jobs and go back to driving buses or taxis on $50k pa.

Not too mention the 30% devaluation on the $ being a hidden pay cut on top of that.

It is not a bad thing but it will take some readjusting including asset value expectations.

in the western suburbs there would be plenty.

One guy in iron ore was offered a job at $400k pa but had to turn it down because his interest bill was bigger than that. I dare say that household budget will end in tears.

I can see FIFO workers getting 40% hair cuts and that is the lucky 50% as the other 50% will lose their jobs and go back to driving buses or taxis on $50k pa.

Not too mention the 30% devaluation on the $ being a hidden pay cut on top of that.

It is not a bad thing but it will take some readjusting including asset value expectations.

Fair enough. I guess the wage decrease is a lot wider-spread than I previously thought.

Power Raid

We Exist To Win Premierships

$400,000 pa? Would have to have been a $12,000,000 house. Not a lot of them around Perth

come to dalkeith and peppie

Power Raid

We Exist To Win Premierships

I also assume the interest cost were not on a family home alone.

Commercial property etc.

I didn't ask but did think to myself WTF. How can you be a MD if you can't balance your own books.

Mayne Phama (MYX) announced a new CFO two weeks ago and also appointed a guy who specialises in mergers and acquisitions to the board as well. One to keep an eye on over the next 12 months.

ThePezDispenser

Norm Smith Medallist

- Mar 22, 2010

- 9,715

- 3,649

- AFL Club

- North Melbourne

Maybe start a WA economy thread, guys?

- Banned

- #1,149

Mayne Phama (MYX) announced a new CFO two weeks ago and also appointed a guy who specialises in mergers and acquisitions to the board as well. One to keep an eye on over the next 12 months.

Finished strongly today ahead of results...usually a good sign

Market is rigged