View attachment 182772

Central Banks Lose Bond-Market Credibility as Woes Mount

Andrea Wong Anchalee Worrachate

October 5, 2015

More and more, bond traders are drawing the same conclusion: central bankers globally are coming up short in their attempts to combat the world’s economic woes.

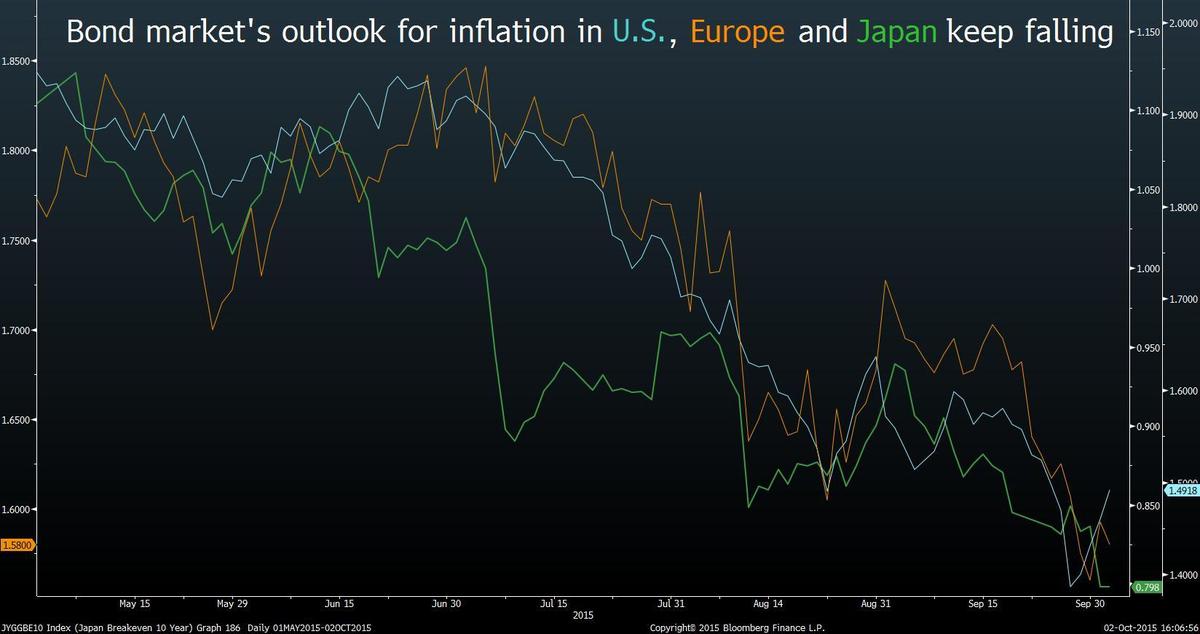

Even after hundreds of interest-rate cuts and trillions of dollars in quantitative easing, the bond market’s outlook for inflation worldwide is approaching lows last seen during the financial crisis. In the U.S., Europe, U.K., and Japan, those expectations are now weaker than they were before their respective central banks began their last rounds of bond buying.

That’s leading investors to write off the Federal Reserve’s chances of raising interest rates this year and increase their bets that it will tighten less than policy makers forecast in the years to come. Speculation has also increased that the European Central Bank and Bank of Japan will need to step up their quantitative easing in the face of deflationary pressures, despite statements to the contrary from their own officials.

“There’s a lack of faith in monetary policy -- you’ve thrown the kitchen sink at it, you’ve cut rates to zero, you’re printing money -- and still inflation is lower,” said Lee Ferridge, the head of macro strategy for North America at State Street Corp. “It leads to a risk-off environment.”

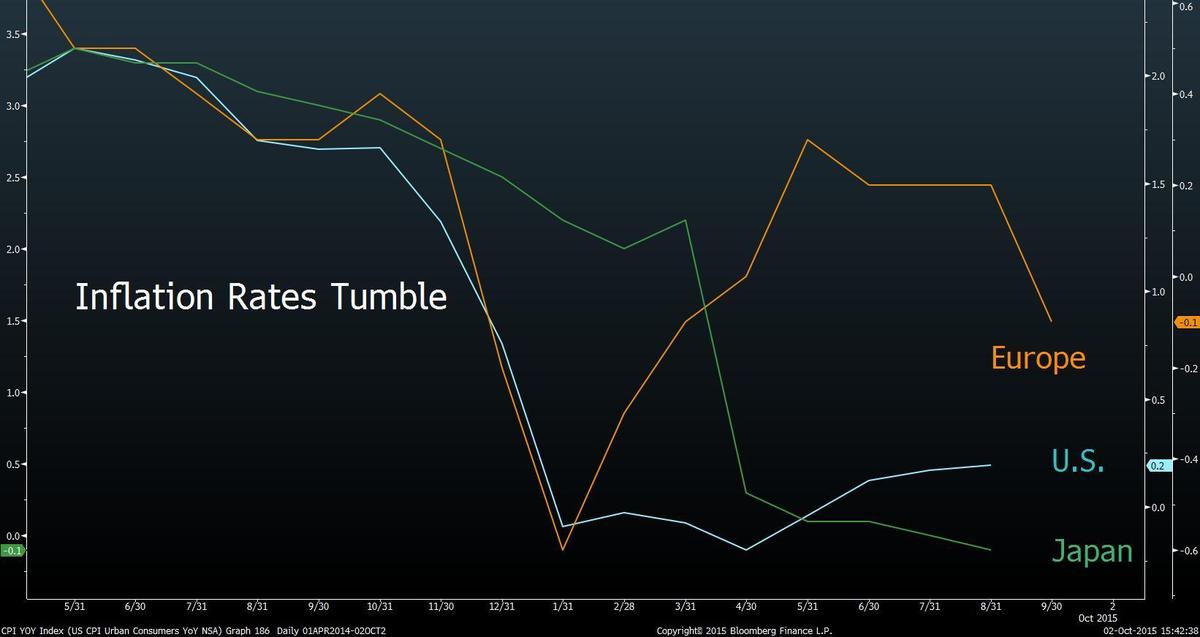

Recent economic reports have renewed calls for major central banks to do more. Consumer prices in the euro region unexpectedly fell, deflation re-emerged in Japan, while wages in the U.S. stagnated yet again. International Monetary Fund Managing Director Christine Lagarde also signaled the organization is preparing to lower its outlook for the world economy.

Term Premium

Those worries have caused investors to pile into haven assets such as Treasuries and German bunds in the past month. That’s driven down government bond yields in developed markets to just 1 percent, or within 0.2 percentage point of an all-time low, index data compiled by Bloomberg show. Last week, yields on the U.S. 10-year note ended below 2 percent for the first time since April, and was 2.02 percent as of 9:30 a.m. on Monday in New York.

As a result, investors are demanding virtually no additional compensation to hold 10-year Treasuries instead of investing in a series of shorter-term notes. On the eve of the last three Fed tightening cycles -- in June 2004, June 1999 and February 1994 -- the “term premium,” as they say in the bond market, was far higher, averaging 1.8 percentage points, Fed data compiled by Bloomberg show.

Some Fed officials, most notably, Chair Janet Yellen, still say they expect to raise rates this year, despite the uncertain global outlook. That comes after Yellen cited China’s economic slowdown as a reason for holding the line in September.

Credibility Gap

Traders aren’t buying it. After Friday’s weaker-than-expected jobs report, the odds of the Fed moving by March are now just a coin flip, based on futures trading. That assumes the first increase will bring the effective rate to 0.375 percent. The Fed has kept borrowing costs close to zero since 2008.

“The Fed may have lost a great deal of credibility” after its September decision and statement that followed, said Stephen Jen, the co-founder of London-based hedge fund SLJ Macro Partners LLP, and a former economist at the International Monetary Fund and Morgan Stanley.

Yellen and company are also having a tough time convincing the bond market that inflation will reach the Fed’s 2 percent target any time soon. Based on differences in yields, traders expect inflation to average less than 1.5 percent per year over the next decade. That’s the weakest outlook since April 2009, when the U.S. was still struggling to emerge from its worst economic crisis since the Great Depression.

It’s not just a U.S. phenomenon. Globally, the bond market’s estimate of how much the cost of living will rise slowed to 1 percent last month, data compiled by Bank of America Corp. show. The outlook has worsened despite the fact that central banks in Europe and Japan, which face even less growth and bigger risks of deflation, are already using extraordinary measures in an attempt to jump-start demand.

In Europe, where ECB President Mario Draghi’s QE program has been in effect for seven months, consumer prices actually fell in September. A measure of future inflation, which Draghi himself cited in justifying the need for extraordinary stimulus, tumbled the most since the three months ended September 2011.

Global Mindset

Deflation also re-emerged in Japan, just as Prime Minister Shinzo Abe declared that Japan had successfully shrugged off its “deflationary mindset.” Economists blamed it on weak domestic demand and plunging oil prices, which effectively wiped out the impact of the BOJ’s most-aggressive round of bond buying yet.

“The next stage for both the Bank of Japan and ECB is more easing; they’re going to keep putting fuel on the fire, but at some point the fire’s big and there’s nothing left to burn -- What do we do?” said Philip Moffitt, the Asia-Pacific head of fixed income at Goldman Sachs Asset Management, which oversees about $1 trillion globally. “So your immediate response to that would be a huge sell-off in risk assets.”

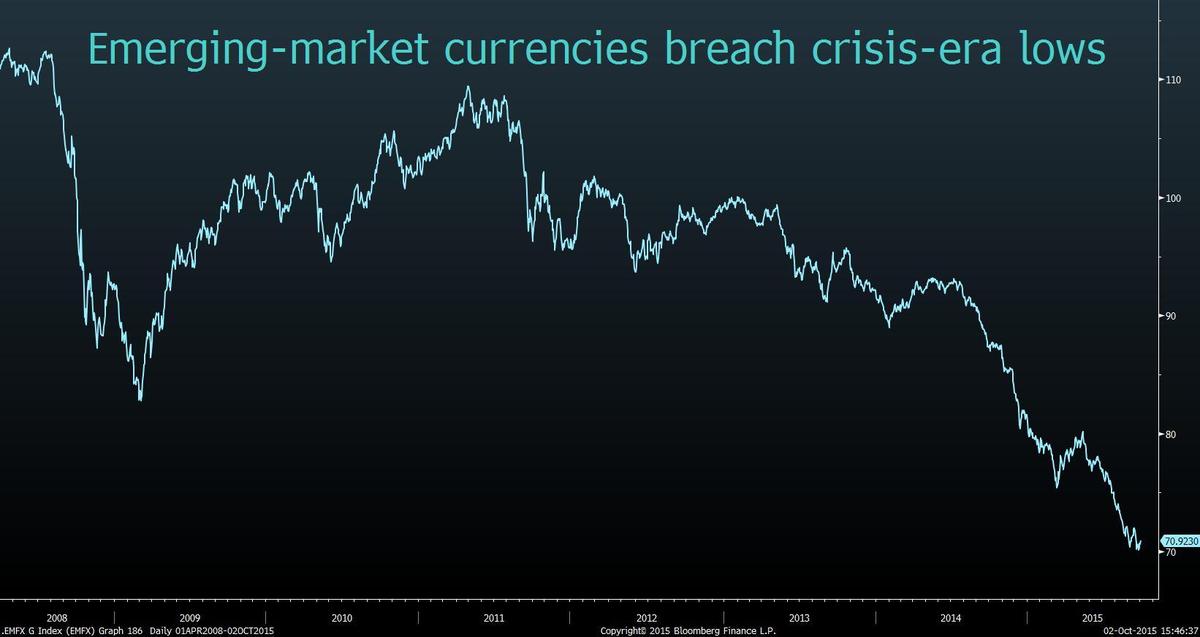

That’s already started to happen. While government bonds in developed nations rallied last quarter, an exodus from developing nations, commodities and corporate credit accelerated. Compounded by China’s shock devaluation, an index of 20 emerging-market currencies plummeted to the lowest level on record, while the Bloomberg Commodity Index suffered its worst quarterly decline since 2008. Yields on junk company bonds soared past 8 percent to the highest in three years.

Deutsche Asset & Wealth Management’s Stefan Kreuzkamp says fixed-income investors should be wary of piling into government bonds because central banks like the Fed and the ECB will ultimately win the fight against disinflation.

“We believe that these central bank policies will work,” said Kreuzkamp, the Frankfurt-based chief investment officer at Deutsche Asset & Wealth Management for Europe, the Middle East and Africa, which oversees $1.3 trillion.

Some say central banks are making things worse by sending mixed signals.

‘Crying Wolf’

When Yellen cited financial-market volatility stemming from China’s slowdown as a reason for not raising rates in September, it deepened concern the Fed was straying further from its official mandate of maximum employment and price stability, said UBS Group AG.

The confusion has pushed up volatility across bonds, currencies and equities in the past two months.

“It is a bit of crying wolf,” said John Wraith, the head of U.K. rates strategy at UBS. “The market is sort of saying that, ‘You are telling us one thing and doing another, so we are in the meantime going to look at the data and evidence. We think there are some cause for concerns really.”’

Wtf does this have to do with FFC retirement and delistings? How about you take it, I dunno....anywhere else. I'm sure there's plenty of fapping threads on the Hawks board for you to derail.