Cash is king again.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Followed this twitter account recently, some good quality content

Record price for Pilbara lithium more evidence share sell-off is overdone

a few seconds ago

Barry FitzGerald

Independent Journalist

MD Dale Henderson says “evidence at the coal face with our customers suggests demand remains incredibly strong”. Record sale comes as market prepares for news of Liontown’s third major lithium offtake deal. Plus, Mincor banks its first cheque from BHP and lots of smoke billowing from Nimy’s nickel hunt in WA.

Lithium producer Pilbara (PLS) has served up the best rejection to date of last month’s call by Goldman Sachs that the bull market in battery metals was over because of an outsized supply response by the industry.

Pilbara’s rejection came in the form of its advice to the market that its latest spot sale of lithium-bearing spodumene concentrate for shipment in July covering 5,000t had gone off at a record $US7,017/t on an adjusted basis.

Pilbara began auctioning off spot cargoes in July last year on its BMX platform, with the first cargo going off at an adjusted $US1,420/t. Again reflecting the wall of demand, the latest cargo was sold ahead of the next planned BMX auction.

The buyers could not wait it seems. They obviously did not read the Goldman note.

Remembering that production costs for the spodumene concentrate producers are well below $US1,000/t across the WA industry, the record price says the boom is alive and well, and that the sell-off in the lithium stocks has been overdone.

The Goldman call that the boom was over was followed up by a similar assessment by Credit Suisse, and when combined with the general market selloff on interest rate/recession fears, the double-whammy effect pulled the rug on ASX lithium equity valuations.

Spot sales are not reflective of the realised prices, which continue to dominated by fixed-price contracts. But the industry is fast moving to increasing the component of spot/index pricing with their customers. Pilbara’s development of the BMX platform is part of that process.

It means that the lithium producers will be capturing a greater share of the massive margin that spodumene convertors are enjoying after the 500% increase in prices for the battery precursors of lithium hydroxide/carbonate they produce to around $US70,000/t.

Pilbara’s incoming MD Dale Henderson put the record price for the spodumene shipment into a broader context:

“This is an exceptional outcome which provides further evidence of the unprecedented demand for battery raw materials being experienced across the global lithium-ion supply chain at this time,” he said.

"Contrary to recent suggestions that the market has peaked, the evidence we are seeing at the coal-face with our customers, including this pricing outcome, suggests that demand remains incredibly strong, with a continued healthy outlook for the foreseeable future.”

Pilbara shares nevertheless closed a shade lower in Thursday’s market at $2.05. That’s down from the 52-week high in January of $3.89 which goes to the suggestion that the sell-off in the lithium stocks has likely been overdone.

Canaccord summarised the record price achieved by Pilbara, saying lithium pricing keeps on giving. It has a $3.60 price target on the stock.

While the news from Pilbara was clearly heartening stuff for the sector, it has to be remembered that there is also nothing homogenous about the sector. The absolute thrashing of Lake Resources (LKE) highlights that in no uncertain terms.

What was a $3.5b company earlier this year is now valued at $960m.

There is a component in there from the broader market sell-off, and the second hit all lithium stocks took in the wake of the Goldman missive. But the collapse in Lake’s share price is very much stock-specific, the main factor being the shock departure on Monday of its MD Stephen Promnitz.

Unexplained departures of MDs never goes down well. It means Lake has become a short-sellers plaything, and that investors have been left to ponder where to next in its aggressive development planning for its Kachi lithium project in Argentina, one based on an adapted water treatment technology yet to be proven for lithium extraction at commercial scale.

Liontown:

Pilbara’s tonic on just where the lithium market is at did not spark a broad rush back into the sector.

So it seems the other lithium stocks are going to have to do some heavy lifting themselves to begin to recapture the higher ratings they had before the Goldman report landed, and before the general market sell-off.

Positive newsflow is what it is all about and according to a diary note, Liontown (LTR) could soon deliver on that front.

The diary note was made two weeks ago when Liontown’s MD Tony Ottaviano gave a strong hint that the lithium developer was close to securing a third offtake agreement for its Kathleen Valley development in WA, following on from the two already in the bag with Tesla and Korea’s LG.

The former BHP senior executive told the Resource Rising Stars conference on the Gold Coast that the company was in deep discussions on a third and final offtake for the project.

“I can see their eyes (albeit) across the virtual table. They don’t wave the Goldman Sachs report at me,” he said.

As might be expected given the quality of counterparties in the first two offtakes, and his BHP background, Ottaviano said Liontown was being “very deliberate around our offtake strategy (first production is possible in two years)”.

“We have learnt from the mistakes of the first generation of lithium producers – the quality of your counterparty is crucial.” Given a final investment decision on Kathleen Valley is planned by the of this financial year, the naming of the third “quality” off-taker can’t be far off now.

Liontown closed 8% lower in Thursday’s market at 88c. That compares with its 52-week high of $2.19. Another big name offtake partner won’t hurt its share price rebuilding cause.

Mincor:

Talking about quality offtakers, Mincor (MCR) has no less than BHP’s Nickel West nickel unit as its customer for its restarted Kambalda nickel business.

It has just received its first cheque from Nickel West ($25.3m) for concentrate deliveries, and it has confirmed that against the odds, it completed the restart on schedule and under budget.

There was only a small celebration in Mincor’s share price, which put on 3% to $1.66, leaving the stock well short of its recent peak of $2.84 a share. Funnily enough, RBC has a price target on the stock of $2.85 a share now that the cash is flowing in.

Key to a re-rating from here will be the acceptance that elevated nickel prices are here to stay, not at the crazy levels of earlier this year when China’s Tsingshan was caught out in a short-squeeze on the LME, but elevated, nevertheless.

Mincor’s feasibility study released in March 2020 in support of an economically-robust Kambalda restart was based on a A$22,500/t nickel price assumption.

And here we are with the nickel price sitting at $A36,175/t. Over the initial five-year life-of-mine for the restart (63,000 tonnes of nickel-in-concentrate), the revenue difference would be worth more than $860m.

That goes to the suggestion last week that there was a disconnect between commodity prices and resource company equity prices. The disconnect has narrowed with price falls in iron ore and other commodities, but it is holding true in nickel.

Beyond the acceptance of higher-for-longer nickel prices, Mincor’s next re-rate event will be off the back of a maiden resource estimate next month for the previously-unexplored ground between its Durkin North and Long mines.

It will start the market thinking about mine life extending well beyond the five years initially planned, a sure-fire re-rate event.

Nimy (NIM):

The exploration juniors have been particularly hard hit in the broader market sell-off, even if commodity prices on the whole have remained supportive.

There are plenty of examples of 80% share price hits. But there’s not so many where interest in a particular project has enabled the junior to either swim against the tide, or at least hold on to much of the higher levels that prevailed before the big sell-off got going.

Nickel explorer Nimy Resources (NIM), mentioned here at its 20c a share IPO last year and in April when it was commanding 50.5c a share, is in the latter category with its no-complaints close on Thursday of 40c a share.

That’s because of interest in Perth mining circles around drilling results from its flagship Mons nickel-copper project, 140km north of Southern Cross in WA.

It covers is a lightly explored 80km northern stretch of the Forrestania nickel belt.

Latest drilling at the Dease prospect within the broader Mons project area tested a conductive anomaly which returned elevated copper, silver and zinc sulphide mineralisation values over a thick intersection.

It was followed by a deeper and thicker ultramafic interval carrying nickel and copper mineralisation, as was the case in earlier drilling at Godley prospect.

Early stages but a lot of smoke building up in the hunt by the lightly capitalised Nimy across what can now be said to be multiple mineralisation styles at Mons.

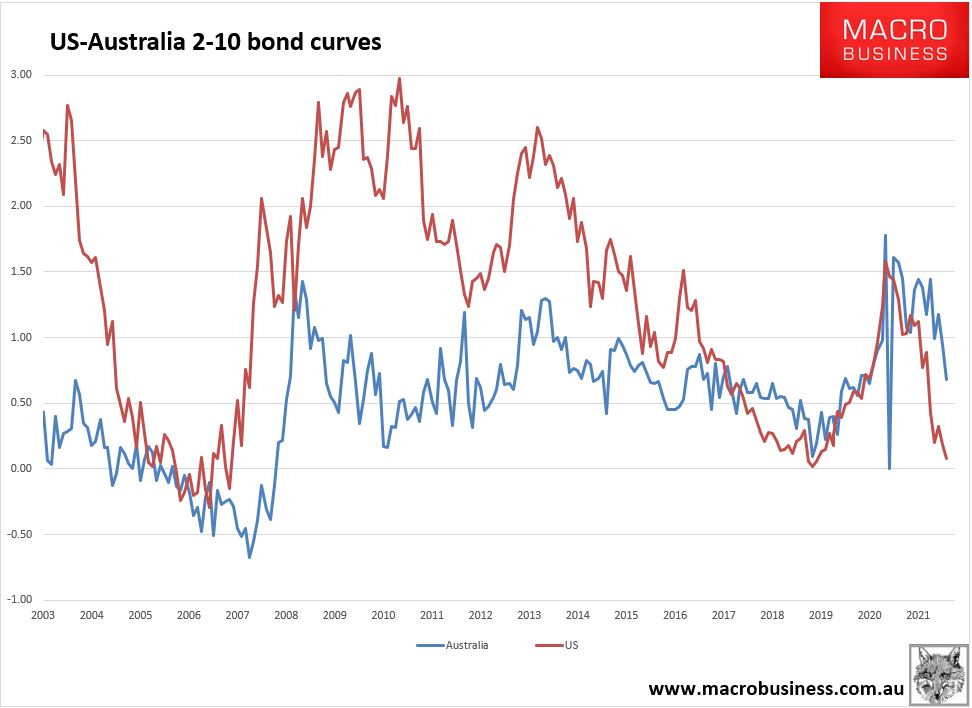

There are signs yields are peaking, especially at the long end...I bought around $US675 of (US) GOVT ETF bonds after looking at this graph:

You people here probably already know this, but a 2-10 bond curve spread being near, at, or below zero signifies an impending recession.

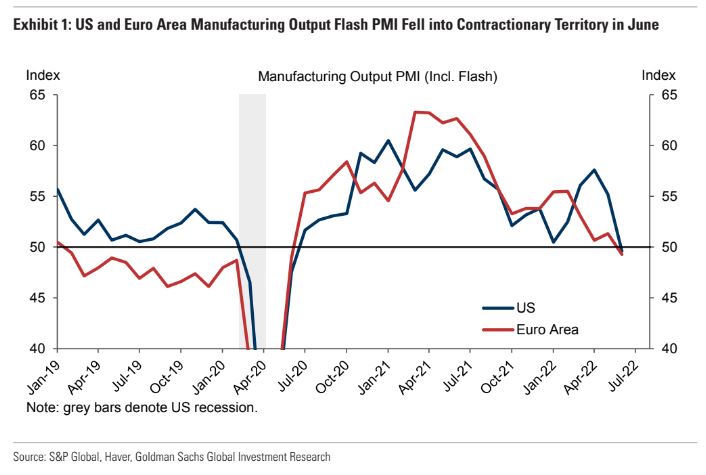

That, coupled with collapsing US/EURO PMI's:

...means that 10/20-year US government bonds are undervalued, as are EURO bonds.

If I didn't have any in to begin with (in retrospect, I bought a couple of months too early), I'd be advising people to buy at least $AUD1250 worth of GOVT, IEF (10 year bond) and TLH (10-20 year Treasury bond). Unlike corporate bonds, even high-quality ones, Treasury bonds are seen as a safe haven during recessions because there's no chance that the US government will fall, Trumpists be damned. US GOVT and TLH ETF's haven't been this low for over a decade and IEF hasn't been this low for almost 9 years.

RE Euro bonds, just invest $AUD1250 in the BNDX ETF if you haven't already - this is hedged to the USD, which offers further recessionary protection given that the US is a safe haven. Again, BNDX hasn't been this low for almost 9 years.

Of course, some other oil/commodity shock could screw with things again, but this is a damn good starting point nonetheless. Just go to Selfwealth, set up a US account, and watch for brokerage (US$9.50). That's why I spend such large sums on my US account.

You guys probably already know that longer-term bonds are more volatile because their longer date to maturity means that their yield and therefore price will fluctuate more - yield and price are inversely correlated.

Place A$1250 in USDU, UUP and USD ETF's if you haven't already. IMO, anywhere from 10%-20% of your portfolio should be hedged in domestic/foreign currency. IMO that you shouldn't have more than 20% in currency because it doesn't pay a yield and has relatively high management fees, but anything less than 10% means that you don't have a great hedge.

As per the late, great Yale financial head honcho David Swensen, ideally you shouldn't have more than 30%, and certainly not above 35%, in any one asset class. He didn't take into account currency, though, because his book Unconventional Success was geared towards US investors.

A guide I would do for one 25-35 poster now is:

Asset allocation (60/40) - split between one Vanguard growth and one Betashares balanced with green bonds - 30%

Currency - USDU/UUP/USD/FXA - 20% (5% each) - the FXA is there so one can sell their USD/USDU/UUP proceedings and then place them into FXA, since FXA and USD directly counteract each other

Inflation-Linked Bonds - TIP/WIP/ILB - 7.5% (2.5% each) - overall, I expect deflation going forward

Infrastructure - Vang Global Infrastructure Non-Hedged Index Fund - 7.5% - again, infrastructure is very good RE deflation and inflation but struggles with rising interest rates => the latter is a problem especially because I still expect the Fed to overshoot, but for how much longer?

International Equity - 27.5% - around 55-60% of this should be in utilities/old-school telcos/consumer staples/health care overall (include infrastructure fund in calculations); can include covered call/high-yield/quality/min vol/moat ETF's because these are most likely to survive recessionary conditions

Australian Equity - 7.5% - same principle if possible (if not don't worry too much), but ASX is made up in large parts of financials/materials so it isn't where you want to be if you want to survive a global recession - buy same ETFs as before given conditions

My regret was not placing more in asset allocation funds, because those perform about average every year.

Regardless of conditions, I would include at least one ETF or stock covering the following factors:

1) Market Cap/Market Weight - e.g. ASX 300, S&P 500

2) Equal Weight

3) ESG - find one that overlaps heavily with growth otherwise there's not enough diversification (Betashares ETHI/FAIR)

4) Moat (competitive advantage)

5) Dividend/yield

6) Covered Call

7) Size (in AUS, mid-caps outperform small-caps; small-caps may outperform mid-caps in the US so can include ETF for both in US)

8) Min Vol

9) Momentum (use multi-factor fund to compensate in AUS or buy momentum stock/s; can buy momentum ETF in US)

10) Quality

Those factors were inspired by this; I added the ESG and moat ones. Companies with higher ESG ratings are likely to have fewer accidents which would undermine shareholder confidence; companies with big competitive advantages should do reasonably well in all conditions. Covered call ETFs do well in bear markets, OK in stagnant/slowly rising markets, and poorly in bull markets.

I wouldn't place more than 5% of my portfolio in individual stocks unless I really knew what I was doing (which I don't). Picking individual stocks is very difficult and requires good knowledge of technicals + investing cycles + contemporary economic factors which suggest that a cycle may shift soon. You can include some stocks to exploit a business cycle.

From the resident know-nothing, thanks for reading.

EDIT: Yes, I did regret investing in CVX, NHC and ORG - I bought them for extra yield, to hedge against my deflation stocks and exploit a rising AUD, and because gas/coal will still be an issue in AUS after the downturn due to the energy cartel's doing. I will get out of all 3 as soon as it is expedient (will BTFD with CVX at between $70-$110). Not sure about the other two.

As a generally ethical investor, that's what happens when you sell your soul. The Devil always collects...

The indicator that proves the lithium sell-off is overdone

"Evidence at the coal face suggests customer demand remains incredibly strong," says Pilbara Minerals (ASX: PLS) managing director Dale Henderson, as detailed in the following wire. We discuss the record sale as the market prepares for news of Liontown's third major lithium offtake deal. And...www.livewiremarkets.com

I bought around $US675 of (US) GOVT ETF bonds after looking at this graph:

You people here probably already know this, but a 2-10 bond curve spread being near, at, or below zero signifies an impending recession.

That, coupled with collapsing US/EURO PMI's:

...means that 10/20-year US government bonds are undervalued, as are EURO bonds.

If I didn't have any in to begin with (in retrospect, I bought a couple of months too early), I'd be advising people to buy at least $AUD1250 worth of GOVT, IEF (10 year bond) and TLH (10-20 year Treasury bond). Unlike corporate bonds, even high-quality ones, Treasury bonds are seen as a safe haven during recessions because there's no chance that the US government will fall, Trumpists be damned. US GOVT and TLH ETF's haven't been this low for over a decade and IEF hasn't been this low for almost 9 years.

RE Euro bonds, just invest $AUD1250 in the BNDX ETF if you haven't already - this is hedged to the USD, which offers further recessionary protection given that the US is a safe haven. Again, BNDX hasn't been this low for almost 9 years.

Of course, some other oil/commodity shock could screw with things again, but this is a damn good starting point nonetheless. Just go to Selfwealth, set up a US account, and watch for brokerage (US$9.50). That's why I spend such large sums on my US account.

You guys probably already know that longer-term bonds are more volatile because their longer date to maturity means that their yield and therefore price will fluctuate more - yield and price are inversely correlated.

Place A$1250 in USDU, UUP and USD ETF's if you haven't already. IMO, anywhere from 10%-20% of your portfolio should be hedged in domestic/foreign currency. IMO that you shouldn't have more than 20% in currency because it doesn't pay a yield and has relatively high management fees, but anything less than 10% means that you don't have a great hedge.

As per the late, great Yale financial head honcho David Swensen, ideally you shouldn't have more than 30%, and certainly not above 35%, in any one asset class. He didn't take into account currency, though, because his book Unconventional Success was geared towards US investors.

A guide I would do for one 25-35 poster now is:

Asset allocation (60/40) - split between one Vanguard growth and one Betashares balanced with green bonds - 30%

Currency - USDU/UUP/USD/FXA - 20% (5% each) - the FXA is there so one can sell their USD/USDU/UUP proceedings and then place them into FXA, since FXA and USD directly counteract each other

Inflation-Linked Bonds - TIP/WIP/ILB - 7.5% (2.5% each) - overall, I expect deflation going forward

Infrastructure - Vang Global Infrastructure Non-Hedged Index Fund - 7.5% - again, infrastructure is very good RE deflation and inflation but struggles with rising interest rates => the latter is a problem especially because I still expect the Fed to overshoot, but for how much longer?

International Equity - 27.5% - around 55-60% of this should be in utilities/old-school telcos/consumer staples/health care overall (include infrastructure fund in calculations); can include covered call/high-yield/quality/min vol/moat ETF's because these are most likely to survive recessionary conditions

Australian Equity - 7.5% - same principle if possible (if not don't worry too much), but ASX is made up in large parts of financials/materials so it isn't where you want to be if you want to survive a global recession - buy same ETFs as before given conditions

My regret was not placing more in asset allocation funds, because those perform about average every year.

Regardless of conditions, I would include at least one ETF or stock covering the following factors:

1) Market Cap/Market Weight - e.g. ASX 300, S&P 500

2) Equal Weight

3) ESG - find one that overlaps heavily with growth otherwise there's not enough diversification (Betashares ETHI/FAIR)

4) Moat (competitive advantage)

5) Dividend/yield

6) Covered Call

7) Size (in AUS, mid-caps outperform small-caps; small-caps may outperform mid-caps in the US so can include ETF for both in US)

8) Min Vol

9) Momentum (use multi-factor fund to compensate in AUS or buy momentum stock/s; can buy momentum ETF in US)

10) Quality

Those factors were inspired by this; I added the ESG and moat ones. Companies with higher ESG ratings are likely to have fewer accidents which would undermine shareholder confidence; companies with big competitive advantages should do reasonably well in all conditions. Covered call ETFs do well in bear markets, OK in stagnant/slowly rising markets, and poorly in bull markets.

I wouldn't place more than 5% of my portfolio in individual stocks unless I really knew what I was doing (which I don't). Picking individual stocks is very difficult and requires good knowledge of technicals + investing cycles + contemporary economic factors which suggest that a cycle may shift soon. You can include some stocks to exploit a business cycle.

From the resident know-nothing, thanks for reading.

EDIT: Yes, I did regret investing in CVX, NHC and ORG - I bought them for extra yield, to hedge against my deflation stocks and exploit a rising AUD, and because gas/coal will still be an issue in AUS after the downturn due to the energy cartel's doing. I will get out of all 3 as soon as it is expedient (will BTFD with CVX at between $70-$110). Not sure about the other two.

As a generally ethical investor, that's what happens when you sell your soul. The Devil always collects...

July 2022

Since I started WealthLander at a time of irrational exuberance and extreme bullishness in January 2021, this is the best period I’ve seen to make a case for a new bull market in equities. This may relieve some of my followers who were used to seeing my bearish outlook in one article after another! This article will highlight the real bull case. Nonetheless, I still discard the usual bull market argument you’ve heard repeated a thousand times before in the hope that repetition will make you believe it and highlight the importance of being more selective.

But don’t despair - the bear is still here today – so I will also argue what the continuing big bear market case is for markets. Of course, I will be grossly redacting the current state of the world – which is incredibly nuanced and complicated – in favour of highlighting what is generally underappreciated, crucially important, and not given enough emphasis elsewhere in decision-making. You can make up your mind about what works for you, but I will highlight why I think it is essential to have a balanced and broader perspective, and not be all in or all out of cash.

The Bull Case for Markets

The Common Bull Market Reason to Invest Today

“Buy when there is blood in the streets”. Investors are bearish, and no one wants to invest. Many active managers are down 50% or more from their highs in 2021 and have suffered heavy redemptions. Numerous market indicators indicate extreme bearishness. If it feels uncomfortable to invest right now, that’s precisely why this is the time to invest – before it gets more comfortable.

The potential problem with this view – which would otherwise be sensibly contrarian - is although investors feel bearish, they are still positioned quite bullishly. Usually, at the end of bear markets, investor allocation to equities is 20% below where it is today and equities are loathed. That is not the case today – Investors feel crappy about the outlook but haven’t yet withdrawn in mass from markets (and may not). There hasn’t been any capitulation, but merely a grinding and slow bear market as liquidity is removed.

Nonetheless, this bull case is a whole lot better than the usual bull market case where markets always go up! Don’t be fooled by this market propaganda– look back a century, and you will find many long-term periods when markets didn’t go up and where many markets were effectively nationalised or destroyed (for example, by being vanquished in war). Hence saying markets always go up is a simple case of selection bias and misleading marketing.

The Real Case for a Bull Market

The real reason to be bullish is based on two factors which are not yet widely appreciated:

(1) The first – and most important - is that central banks may soon be forced to give up on tightening financial conditions aggressively and that markets will begin to anticipate this as underlying inflationary pressures are already easing and the economic outlook is rapidly deteriorating. Central banks will slow down the rate hiking cycle or stop it and hence fail to meet or exceed aggressive investor expectations for interest rate hikes, i.e. central banks will be more dovish than bond markets have been pricing in.

Interest rate hikes have to stop at some stage because vast amounts of unproductive debt mean that unless central banks want widespread defaults and a deflationary economic collapse (they almost certainly don’t), they have to eventually err on the side of tolerating some inflation to whittle away the debt through nominal inflation and currency (cash) and bond (fiat) depreciation (in real terms). We live in a credit-drive and Ponzi-like global economy which demands easy money to continue to avoid a “Minsky Moment”, with the alternative being the Minsky moment - doing the same until the Minsky Moment is unavoidable. The Minsky Moment may be inevitable, but it is likely not (at least in our view or that of most informed parties) unavoidable today. Human action (central bank tightening) is the main factor driving today’s difficult markets, and this human action can be ceased on a whim.

Of course, any caring human would prefer policy be built around more equitable economies focussed on real productivity and real economic growth rather than fake wealth and easy money, but alas that hasn’t been the emphasis of policy in recent decades. This is unlikely to change soon given the state of the world and bureaucratic and political emphasis in many countries. As investors, we need to cope with the hands we’ve been dealt even if politically and socially we are outraged with the historic misdirection and misallocation of capital, and hence a waste of opportunity to build more productively for our future. We obviously need to be more productive as populations age and in the face of geopolitical threats to the status quo (which have been so beneficial to Western economies in times past and allowed us to become so complacent).

(2) The second reason to be less bearish or long-term bullish is that many assets are worth buying on valuation grounds alone today. It is easy to find suitable long-term value in markets today, even when many other assets remain overpriced. Examples of good value assets with fundamentally strong outlooks over the medium term include many inflationary assets (highlighted in my previous Livewire articles), which have done relatively well in recent months but have been recently sold off in response to a recession being priced in and China woes. Research-based active, fundamentally researched, and value-orientated managers hence have a better long-term outlook. Valuation doesn’t help much with short-term returns. Still, it does suggest longer-term returns are likely to be satisfactory for those who value what they buy and who purchase good quality assets.

The fate of more passive or index-like investors who don’t value anything and may buy everything is more dependent on markets as a whole. Many equity markets still impute low long-term returns, and hence their investors can continue to expect mediocre long-term returns, even if short-term returns improve.

The Case for Persistent Bearishness and a Prolonged Bear Market

There are two big unappreciated reasons for being persistently bearish (again, the first relating to the next few weeks and months, and the second having a multi-year relevance):

(1) We are heading for imminent recession, and Central Banks are making a huge policy mistake - continuing to tighten into a recessionary and stagflationary environment (potentially for political reasons but also because currently, inflation appears out of control). The last two quarters in the US may illustrate a technical recession, and leading indicators are rolling over fast, suggesting central banks may well get the reduced demand needed to slow current inflationary pressures they’ve been looking to create, and soon – but will it be enough for them to stop their current trajectory? Long-term inflationary expectations are not high. Yet Central Banks are committed to imminent hikes and will hike – as they have in every other cycle – until something big breaks. Furthermore, we should rely on current central banks being backwards-looking, unreliable and making huge policy mistakes - as they have persistently demonstrated in recent years!

The fringes are already broken, including entire countries, and preeminent economies are under immense stress, e.g. emerging markets such as Sri Lanka, cryptocurrency exchanges, Chinese mortgagees, and European energy policy. The Russia-Ukraine conflict and geopolitical tensions are unresolved and could unexpectedly escalate. Investors are still heavily allocated to risk assets, even if they feel bearish, and may hence be about to capitulate - deciding to redeem in mass when there are one too many interest rates increases and if central banks demonstrate they are more committed to killing inflation than bailing out asset prices….

(2) Bear Markets which coincide with recession are usually longer and larger than a simple 20% drawdown, averaging about 33% losses. Given where valuations have come from and the economic fragilities, we should expect losses to be at least the average of circa one-third from the peak in such circumstances with any normalisation of monetary policy. Many investors have been conditioned to using the last 20 years of data rather than considering the stagflation of the 1970s, the post-war supply-side constrained 1940s, or the early 1990s Australian recession when considering the derating potential of market valuations in an inflationary environment. Indeed, losses could eventually exceed 50% in worst-case scenarios. We should hence expect more pain from current conditions.

In summary, the bull case relies on central banks realising they need some inflation to prolong the Ponzi, and destroying further demand is a hazardous policy in current circumstances and not useful to the main need to continue an era of financial repression - keeping interest rates low but debt holders whole. The bear case relies upon continuing to bet on more central bank hikes despite the mounting evidence they’ll kill the economy. Both have a case; hence, the outlook is nuanced and unsuitable for any extreme positioning. Some investors have gone entirely to cash (effectively betting on a prolonged bear market or a depression), however currently, we prefer to take a medium-term outlook with a more inflationary bias, backing the case that central banks are about to slow or cease their current trajectory, or if central banks are a little slow to get it, they’ll fairly quickly be forced to attempt to right the ship as a crisis will make them. We hence see supply starved commodities as good value already with a strong fundamental medium-term outlook. We are warming to equity positions; particularly should we see signs of real market capitulation and/or policy change. We reiterate – some policy change (versus expectations) is more likely than not coming soon (within weeks or months), and investors are likely better off investing something now or gradually easing in than not being invested at all or being late once a policy change is effected.

Remember, small losses are much better than big ones and are quickly recoverable. It remains a risky world with a wide range of outcomes, so if you are investing, it is prudent to invest with those who emphasise risk management and who haven’t demonstrated a predisposition to setting large amounts of your money on fire.

Investors who’ve gone to cash will do what investors who’ve gone to cash always do – and not get back into markets early enough when the opportunity is there. An opportunity is quite possibly already here now or shortly - this month or next. Being excessively invested in cash is also unnecessary when there are alternatives to being invested which have already demonstrated their ability to reduce the equity downside and provide some positive return expectation over a reasonable time frame, even in the challenging market conditions of the recent past. Extrapolating the past is what central banks do, and I’m sorry, but those lucrative positions are already taken - Don’t be a central banker with your money, but equally, don’t go all in fighting the FED!

I want a Tesla since I heard about the self driving features.$7,000/t for 5.5% con is INSANE. Not sustainable unless people think Teslas are just far too cheap.

I want a Tesla since I heard about the self driving features.