Madas

Norm Smith Medallist

- Aug 16, 2020

- 6,107

- 7,719

- AFL Club

- Fremantle

That’s what I was trying to say but you said it betterUnless you sell out of the market, its a paper loss.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

That’s what I was trying to say but you said it betterUnless you sell out of the market, its a paper loss.

Not sure about other places but our little town isn’t going backwards in a hurryTreechange and seachange places had been pretty stagnant for a decade or more. There was an even than capital city bigger post pandemic boost there. First places to suffer when the R word comes around

RBA spent a good part of the last decade constantly undershooting their 2-3% target. They've not had inflation within target for a while.

And because they're now so far behind the curve, they've overshot it.

All that being said, can only take the words coming out of Dr Lowe's mouth with a fine grain of salt.

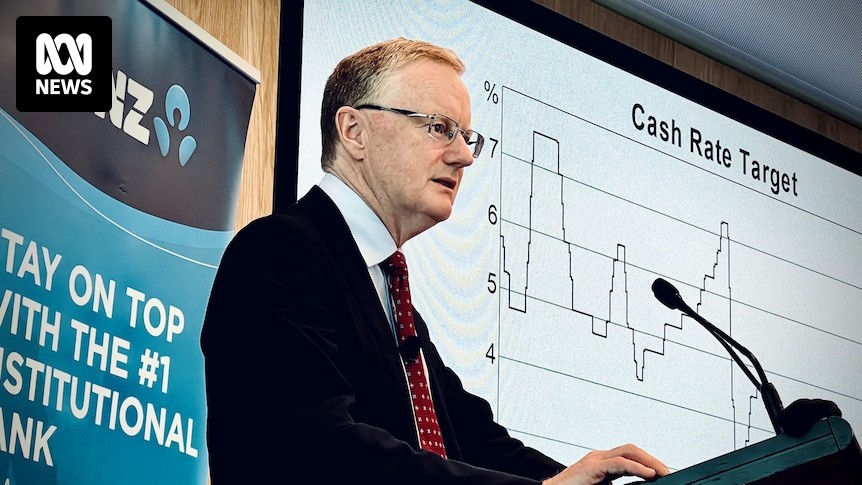

Reserve Bank says inflation is rising, but he doesn't see a recession on the horizon

Reserve Bank governor says inflation is rising, but he doesn't see a recession on the horizon

The RBA admits it suffered "reputational damage" when it tried to wind back its COVID-19 pandemic stimulus program.www.abc.net.au

'He says the RBA still thinks inflation will hit 7 per cent this year, up from 5.1 per cent currently, but it is monitoring the situation.

Mr Lowe has also admitted the RBA suffered "reputational damage" when it tried to wind back its COVID-19 pandemic stimulus program.

Speaking on Tuesday at an event in Sydney, the RBA Governor said the share of items in the consumer price index (CPI) basket experiencing annual price increases greater than 3 per cent was at its highest level since 1990.'

I'd love to believe you Mr Lowe ... sorry Dr Lowe.

The ironic thing thing is that they were reluctant raise rates because they didn't want to be seen as doing it because they are influenced by the upcoming election when not raising them is the result of that perception when in normal times they would have raised them.Lowering rates is fine but they waited way too long. We have known for months that inflation was going to go up a lot. And they sat on their hands.

The longer they waited the worse the housing market got.

The ironic thing thing is that they were reluctant raise rates because they didn't want to be seen as doing it because they are influenced by the upcoming election when not raising them is the result of that perception when in normal times they would have raised them.

RBA spent a good part of the last decade constantly undershooting their 2-3% target. They've not had inflation within target for a while.

And because they're now so far behind the curve, they've overshot it.

All that being said, can only take the words coming out of Dr Lowe's mouth with a fine grain of salt.

Two things that really mean nothing. Property prices and super don’t help with an individuals cash flow and living standards with rising costs. Houses are an inflated asset and somewhat irrelevant (unless you’re buying/selling under different market conditions) and super is more or less irrelevant to most people unless you’re close to retiring.On SBS tonight among all the justified stories about hardship etc, they said mhouseholds got substantially richer in the march quarter alone (mainly property and super)

On SBS tonight among all the justified stories about hardship etc, they said mhouseholds got substantially richer in the march quarter alone (mainly property and super)

Each market and each market segment is different. And each property in each segment is different. Etc.

I just think the 'x% across the board' type statements do nothing but create panic.

On SBS tonight among all the justified stories about hardship etc, they said mhouseholds got substantially richer in the march quarter alone (mainly property and super)

What goes up must come down.

Been in the UK for a few weeks now and there's very little of the doom we get about the economy and inflation and cost of living. It's there, but not shoved in your face every single minute of the day to the point people get so depressed they switch off. It's refreshing.

Also, fruit and vegetables and grocery prices are expensive but still a hell of a lot cheaper than Australia which is insane given the amount of food we produce. Fuel is $2 pound a litre (more than $3.30 Aus) and gas and electricity prices through the roof, inflation very high, but we don't hear about that every bloody minute either. It's a hell of a lot more pleasant.

So basically, I'll be tuning out to Australian media because I've now realised that they are so insular and unique in the world at making us feel like s*** about everything.

Remember a big part of our food issue at the moment is due to weather, not just inflation.Been in the UK for a few weeks now and there's very little of the doom we get about the economy and inflation and cost of living. It's there, but not shoved in your face every single minute of the day to the point people get so depressed they switch off. It's refreshing.

Also, fruit and vegetables and grocery prices are expensive but still a hell of a lot cheaper than Australia which is insane given the amount of food we produce. Fuel is $2 pound a litre (more than $3.30 Aus) and gas and electricity prices through the roof, inflation very high, but we don't hear about that every bloody minute either. It's a hell of a lot more pleasant.

So basically, I'll be tuning out to Australian media because I've now realised that they are so insular and unique in the world at making us feel like s*** about everything.

Remember a big part of our food issue at the moment is due to weather, not just inflation.

Australians are far more indebted than they are in the UK, so whilst its still probably an issue in the UK its far more worrying in Australia for obvious reasons.

All the idiots that went and got overleveraged hoping money was going to be cheap forever are about to pay the piper.

View attachment 1440123

Seems pretty harsh mate. They’ve been told the sky is falling for over a decade and watching the prices continue to increase in that time, so they’ve been forced to choose between the crash that never comes and being priced out of the market for ever.As for the morons on $80k who borrowed $1million for their trendy inner city pads - I have no sympathy. None. They were warned.

Yeah this attitude is pretty distasteful, considering housing market growth is built on people buying in for the first time. Lots of people who've made a fortune off owning property are now laughing at the poor sods left holding the bag.Seems pretty harsh mate. They’ve been told the sky is falling for over a decade and watching the prices continue to increase in that time, so they’ve been forced to choose between the crash that never comes and being priced out of the market for ever.

Yeah this attitude is pretty distasteful, considering housing market growth is built on people buying in for the first time. Lots of people who've made a fortune off owning property are now laughing at the poor sods left holding the bag.

If you didn't buy in, you're a loser. If you did buy in, you're a sucker etc.