Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General Markets Talk

- Thread starter Jimmy_the_Gent

- Start date

- Tagged users None

- Oct 9, 2006

- 22,585

- 29,319

- AFL Club

- Hawthorn

- Other Teams

- Super Tottenham....from the Lane.

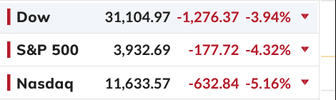

Today is going to be ugly.

- Dec 29, 2000

- 23,690

- 20,987

- AFL Club

- Adelaide

Both the Fed, here and the US, keep increasing interest rates each meeting (we meet the first Tuesday monthly, US meet every 6-7 weeks)

They need to hold off and just let the recent rate increases work thru the economy. They will overcook it if they continue to follow this strategy.

They need to hold off and just let the recent rate increases work thru the economy. They will overcook it if they continue to follow this strategy.

ASX will drop 10% across the board then rebound again from tomorrow. Nothing to see here.

Still waiting for this recession we have to have. A lot of the doomsayers have gone MIA.

Still waiting for this recession we have to have. A lot of the doomsayers have gone MIA.

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,371

- 15,502

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

Both the Fed, here and the US, keep increasing interest rates each meeting (we meet the first Tuesday monthly, US meet every 6-7 weeks)

They need to hold off and just let the recent rate increases work thru the economy. They will overcook it if they continue to follow this strategy.

they cant. Inflation is out of control, & severely out of control in the US. People are still spending at very high levels.

You cant just "whether the storm" with inflation.

We all knew (or should have known) the rate rises would cause a recession. This is just the start of it.

if you cant hold on for the long term, get out now.

Our rates are not even at base level CPI yet lol.

Last edited:

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,371

- 15,502

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

ASX will drop 10% across the board then rebound again from tomorrow. Nothing to see here.

Still waiting for this recession we have to have. A lot of the doomsayers have gone MIA.

we are already in a recession?

Sqotty from office works

Premium Platinum

I'm still here.ASX will drop 10% across the board then rebound again from tomorrow. Nothing to see here.

Still waiting for this recession we have to have. A lot of the doomsayers have gone MIA.

My prediction of disaster after 2023 federal budget stands.

No hope for housing next year unless you're a buyer.

The thatcher wanabee in Britain will lead them into further pain.

Old man USA has no idea.

Trump back on the surface is even worse.

China now in disaster mode.

- Oct 9, 2006

- 22,585

- 29,319

- AFL Club

- Hawthorn

- Other Teams

- Super Tottenham....from the Lane.

I'm still here.

My prediction of disaster after 2023 federal budget stands.

No hope for housing next year unless you're a buyer.

The thatcher wanabee in Britain will lead them into further pain.

Old man USA has no idea.

Trump back on the surface is even worse.

China now in disaster mode.

Inclined to agree. Markets have been dogshit all year and at some point there will be significant foreclosures in the housing market because nobody learned anything from the GFC.

I watched The Big Short again over the weekend. We are making exactly the same mistakes.

- Jun 14, 2013

- 13,076

- 15,680

- AFL Club

- Essendon

The doomsday predictions are more often wrong than right. Michael Burry made his name off that movie and has done little of note since. Robert Kiyosaki has been predicting doomsday for the past 25 years. Even a broken clock is right twice a day.Inclined to agree. Markets have been dogshit all year and at some point there will be significant foreclosures in the housing market because nobody learned anything from the GFC.

I watched The Big Short again over the weekend. We are making exactly the same mistakes.

- Oct 9, 2006

- 22,585

- 29,319

- AFL Club

- Hawthorn

- Other Teams

- Super Tottenham....from the Lane.

The doomsday predictions are more often wrong than right. Michael Burry made his name off that movie and has done little of note since. Robert Kiyosaki has been predicting doomsday for the past 25 years. Even a broken clock is right twice a day.

Mate, not arguing that but with runaway inflation, interest rates going up, no wage growth and far too many people leveraged beyond what they can reasonably afford what do you think will happen?

Nice shirt chicken little, do they make them for men?Inclined to agree. Markets have been dogshit all year and at some point there will be significant foreclosures in the housing market because nobody learned anything from the GFC.

I watched The Big Short again over the weekend. We are making exactly the same mistakes.

- Dec 29, 2000

- 23,690

- 20,987

- AFL Club

- Adelaide

they cant. Inflation is out of control, & severely out of control in the US. People are still spending at very high levels.

You cant just "whether the storm" with inflation.

We all knew (or should have known) the rate rises would cause a recession. This is just the start of it.

if you cant hold on for the long term, get out now.

Our rates are not even at base level CPI yet lol.

Yes, you can when you have increased rates 5 months in a row. Take a breather for a month until new data comes out. Remember, the US does a monthly CPI data, we do a quarterly.

They will overplay their hand just like our RBA did in Nov 2010 when it increased rates and then within a few months reversed and decreased them.

- Dec 29, 2000

- 23,690

- 20,987

- AFL Club

- Adelaide

Inclined to agree. Markets have been dogshit all year and at some point there will be significant foreclosures in the housing market because nobody learned anything from the GFC.

I watched The Big Short again over the weekend. We are making exactly the same mistakes.

The housing market has been overheated for years and needs a significant correction.

If you have bought in the last few years, good luck.

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,371

- 15,502

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

Yes, you can when you have increased rates 5 months in a row. Take a breather for a month until new data comes out. Remember, the US does a monthly CPI data, we do a quarterly.

They will overplay their hand just like our RBA did in Nov 2010 when it increased rates and then within a few months reversed and decreased them.

Australia's inflation will be worse than projected in December.

Even with these rate rises.

- Oct 9, 2006

- 22,585

- 29,319

- AFL Club

- Hawthorn

- Other Teams

- Super Tottenham....from the Lane.

What do people see for a ceiling for Pilbara minerals (PLS)?

Very high given the increasing demand and limited supply of lithium.

I bought at around $1.00 a couple of years ago and am not planning on selling any time soon. They announced a $561m net profit for LY after a loss of $50m the year before.

Hope so!

My first ever purchase on the Asx was a small parcel of PLS at 0.38

My first ever purchase on the Asx was a small parcel of PLS at 0.38

pe sVery high given the increasing demand and limited supply of lithium.

I bought at around $1.00 a couple of years ago and am not planning on selling any time soon. They announced a $561m net profit for LY after a loss of $50m the year before.

RandB

Brownlow Medallist

- Sep 9, 2007

- 16,615

- 12,802

- AFL Club

- Melbourne

- Other Teams

- MUFC Norwood

I want to load up on Aristocrat Leisure (ALL) but the moral side of me says no because it's gambling. The other side says do it because a lot of the revenue comes from fat, stupid Anericans.

What do I do?

What do I do?

Yeah no way would I feel comfortable with anything to do with gambling I mean there's endless other things to invest in but it's just a personal decision and no judgement on anyone that does.

Another down day coming up.

RandB

Brownlow Medallist

- Sep 9, 2007

- 16,615

- 12,802

- AFL Club

- Melbourne

- Other Teams

- MUFC Norwood

What entry price are you looking at?Lake Resources has been smashed - 'never catch a falling knife' but might be one for the watchlist to open a position once the market shake-out is over?

It looks setup for a quick win, not really an investing stock. I might have a nibble.

- Banned

- #3,573

Include old Harry Dents name to the list! The ultimate doomsday cryerThe doomsday predictions are more often wrong than right. Michael Burry made his name off that movie and has done little of note since. Robert Kiyosaki has been predicting doomsday for the past 25 years. Even a broken clock is right twice a day.

Picked up a few Sonic Health today, exciting huh.

- Apr 10, 2017

- 2,159

- 4,063

- AFL Club

- Hawthorn

- Other Teams

- Saints

If any of you follow macro stuff, especially oil and currencies, have a read of this guys work - very informative.

Twitter is full of crackpots, but at least this guy only does chart work so you know what you are dealing with.

IMHO, this bear market has not bottomed. The Fed and Central Banks will not stop until inflation is stopped, and with the US running at over 8% annual rate, there will be no pivot for some time. That 8% is an annual rate, and it needs to wash out.

FWIW - Fedex dropped more than 20% last night. I'm expecting next week to be worse for the general market. My short seems to be holding better this time.

Twitter is full of crackpots, but at least this guy only does chart work so you know what you are dealing with.

IMHO, this bear market has not bottomed. The Fed and Central Banks will not stop until inflation is stopped, and with the US running at over 8% annual rate, there will be no pivot for some time. That 8% is an annual rate, and it needs to wash out.

FWIW - Fedex dropped more than 20% last night. I'm expecting next week to be worse for the general market. My short seems to be holding better this time.