APT take 4% from most retailers with sales of less than $10m per annum. Their higher volume and higher price customers can get down to 2/2.5%Could be different per industry/company but I think APT take 2%?

But yeah, buying now when the directors are dumping is surely going to end badly

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General Markets Talk

- Thread starter Jimmy_the_Gent

- Start date

- Tagged users None

- Moderator

- #527

Gold companies are an interesting play with gold prices at $1800 USD and predicted to continue to rise for the foreseeable future. Most gold companies can produce a bar of gold for around the $1000 USD mark, which at $1300 last year was a decent return, at $1800 is a great return. Assumably most of the gold price appreciation is marked in, that said, a few of these companies will be reinstating/increasing dividend programs which will also add value.

Gigantic

Brownlow Medallist

APT gains 10% in a day.

After Morgan Stanley upgrades price target to $101.

After Morgan Stanley upgrades price target to $101.

- Jan 1, 2007

- 6,665

- 10,137

- AFL Club

- St Kilda

ash_1050 If you're looking for simple strategy, Aave would be your best bet for ETH. XRP no options at the minute, BTC look into renBTC and WBTC (but they're collaterised/tokenised)

* Edit the yield for ETH on Aave looks crap. TBH to get the most out of DeFi there is a bit of research and tinkering required I'd say.

Liquidity mining is what I do mostly. It's basically a reverse ICO - protocols pay you to bootstrap.

* Edit the yield for ETH on Aave looks crap. TBH to get the most out of DeFi there is a bit of research and tinkering required I'd say.

Liquidity mining is what I do mostly. It's basically a reverse ICO - protocols pay you to bootstrap.

Last edited:

- Jan 1, 2007

- 6,665

- 10,137

- AFL Club

- St Kilda

Crazy isn't it? $DOGE coin pumped 100% yesterday because of a tiktok campaign!

On POT-LX1 using BigFooty.com mobile app

Has anyone come across these facebook/twitter groups that pump up stocks? Seems there's a plethora of them and for whatever reason idiots are investing their money based on polls on what stocks will go up.

Might join them and throw up some of my dog stocks that I've been holding for years in the hope of breaking even.

On POT-LX1 using BigFooty.com mobile app

- Jan 1, 2007

- 6,665

- 10,137

- AFL Club

- St Kilda

Nothing to see here, keep moving folks...

On POT-LX1 using BigFooty.com mobile app

So APT is a company worth 18 billion dollars and doesn't make any money yet?

Surely this will all end it tears.

On POT-LX1 using BigFooty.com mobile app

Nearly 20 billion now!

- Sep 2, 2014

- 16,668

- 32,003

- AFL Club

- Hawthorn

- Other Teams

- Liverpool

I never understood the dot com debacle as I was too young for it but with all these BNPL stocks going nuts, I do.

All the people burning through their 10k super withdrawals will live to regret it. Some would have been lucky and made a profit but they'll soon hand it back over.

All the people burning through their 10k super withdrawals will live to regret it. Some would have been lucky and made a profit but they'll soon hand it back over.

Z1P aint even announced their results and up to 7.10 from low $5 2 days ago

It's bubble behaviour.

- Mar 27, 2018

- 7,221

- 18,899

- AFL Club

- Collingwood

- Other Teams

- Cleveland Browns, Tony Ferguson

Added EOS to my watch list

the current trajectory of world relations & the massive funding upgrade to the ADF makes it a very interesting prospect IMO

the current trajectory of world relations & the massive funding upgrade to the ADF makes it a very interesting prospect IMO

Added EOS to my watch list

the current trajectory of world relations & the massive funding upgrade to the ADF makes it a very interesting prospect IMO

I'm also tailing EOS, was going to get in a couple weeks back but didn't and then regretted it with their spike last week. Will get in once it finds its new price floor.

- Sep 2, 2014

- 16,668

- 32,003

- AFL Club

- Hawthorn

- Other Teams

- Liverpool

Should I start buying war bonds?1929/30 recovery:

View attachment 910246

In relative 2020 terms, we are about 3 weeks away from the end of that graph:

View attachment 910251

Now, move forward 12 months into 1931:

View attachment 910252

Question is, will history repeat?

11th Jul, 20

The Afterpay Bubble

Marcus Padley

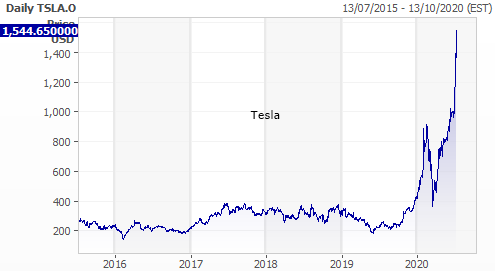

Are you a sensible investor? Then you are almost certainly having a few thoughts about technology stocks, including regret, regret at not holding technology stocks, and regret at not holding Afterpay which is up 856% from the low in March and up 38% in 9 trading days.

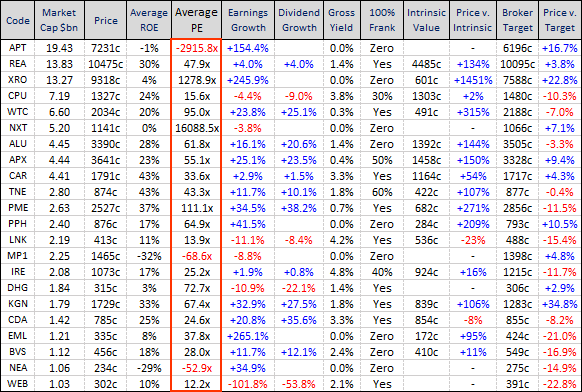

You are probably beginning to question whether you are sensible, or stupid. It is hard to know. Is it sensible or stupid to buy or hold Afterpay on a PE of minus 454x this year, and 237x on 2022 forecasts.

And there are other stocks making you look stupid. Like XRO on a PE of 370x and 98x on 2022 forecasts, REA on 52x and 35x 2022 earnings in the middle of a housing slump, WTC on 93x and 50x on 2022 earnings forecasts, NXT on minus 305x and 231x 2022 forecasts, ALU on 70x and 42x 2022 forecasts and APX on 56x and 32x 2022 forecasts.

But this is not about price, PE, future earnings or intrinsic value, it is about not missing out on easy gains, it is about exploiting extraordinary volatility, and the momentum behind that opportunity is overwhelming the rest of the market, it is overwhelming the virus concerns, and it has taken the US stock market to all-time highs when logic suggests the equity market should be cowed by a global economic disaster.

Some numbers:

I hate finger-waggers. I hate the pious value based investors that miss out on everything because they are long-term and want to see "value" before they buy, but this rally is offending not just them.

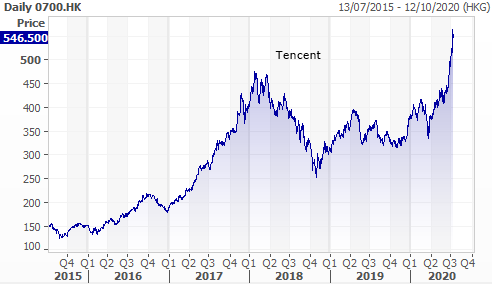

These stocks are being traded as a bloc by the herd. It is not discriminating between really very diverse companies. They are all flying because the US technology sector is flying, and because the alternative investments in Australia are not sexy.

Banks, Staples, Healthcare, Resources. Slow going by comparison. So technology it is, globally, for a quick buck. Even the Chinese market is flying on short term speculative retail buying.

Unfortunately for most sensible (or stupid?) investors, the most compelling argument for an 'investment' in these stocks is momentum. This is a herd phenomenon.

The good news, for research-based, value discerning, Australian fund managers, is that this is a small sector in Australia, otherwise they would be under-performing terribly because of their long-standing, traditional, proven investment techniques that would almost certainly dictate that they do not hold them. But in the US, this is a massive sector, and it too is being pursued higher because S&P 500 benchmarked fund managers can't afford to ignore a massive sector with momentum, whatever the price.

Are they overvalued? I ask you this.

Do you think the CEOs and shareholders of these companies think they are undervalued? No. They are punching the air in delight. And that means one thing. And the APT Management know it. That’s why they are raising capital, and that’s why they are selling some stock.

AS FOR THE BROKERS - don't be too impressed.

This week's high profile, post capital-raising, $101 plus valuation on APT, up from a woefully wrong $36, along with all the other amazing broker valuations, optimism and target prices are all part of a big financial game. And you should not be surprised.

This is how broking works. "Get in the game" would be the instruction from the corporate department to the analyst, from the CEO to the analyst, from the dealers to the analyst. Print that click bait research! If they don't they will miss out on some of the best money making opportunities brokers have had in years. Making trades in a high volume frenzy, and raising capital on the back of flying share prices.

This is not about getting it right, its about having research that attracts attention. Its about attracting trades and its about endearing yourself to companies that are almost certainly going to be doing further capital raisings at these extraordinary share prices.

You have to be at the table when the deals come through, you have to be on the phone to the management of these companies telling them this is a once in a lifetime opportunity to firm up the balance sheet once and for all, to lock in the next five years of funding.

Its worth millions in corporate fees. But you won’t get the deal with a $36 target price. You won’t get the deal saying its expensive. You won’t get the deal saying sell. It’s a game.

SOME CHARTS

And the not as hot to trot charts:

Even my colleague Henry at Marcus Today, a man who likes to do 200 miles an hour with his hair on fire, has started talking about a tech bubble. Because he, like me, has been through one before.

There are similarities. In the 2000 Tech Boom, as now, any finger-wagging cost you a fortune in missed opportunity.

And there are differences. This time there are some very substantial revenue, earnings and profits backing these companies, in 2000 there was nothing but wind.

But even now, even when a company is real, and profitable, there is a price for everything, whatever the prospects, quality, growth potential.

A Porsche is a great car, just as Afterpay is a great company, but you wouldn’t pay $1,000,000 for a Porsche.

You also don't pay the eventual price for a house that is going to be built, up front. Until it is finished and inspected there are risks. In the resources boom from 2004 to 2009, BHP went from $7 to $43. It did not jump from $7 to $43 in 2004. It takes time for the market to trust a company and its value. Sometimes it "Trusteth too much" and too soon.

The market overprices assets regularly. It is doing it now. This is a sentiment extreme. This is not the time to join in. Buy when others are fearful, not greedy..and all that - and there I go, quoting Warren Buffett. I hate people quoting Warren Buffett!

DO NOT SELL YET

For those of you holding a tech stock or ten - don't sell yet. Straight up the advice has to be, trade this rally don’t ‘invest’ in it. This is a wonderful moment for those of you holding these stocks. If I was invested in Afterpay (any of them) I would not be selling, but I would not be making any grand declarations either, about the long-term, about why they are worth buying. I would not be developing faith. This bubble will burst, watch it. BUT - Don’t sell because these stocks have gone up a lot, wait. You never need to predict the top, just wait for the top. The day they fall 10%. That’ll mark the moment. No need to do anything until that day. Enjoy the ride until then.

FOR THOSE THAT ARE MISSING OUT

Don't worry. APT is the stock for everyone that missed out on A2M. A2M was the stock for everyone that missed out on BKL. And so it goes on.

There is another APT on your screen, right in front of you, right now. A company with tremendous opportunity, scalability, and it is almost certainly a technology company. All you have to do is spot it.

I can see my next click bait article - "The next Afterpay" although I'll probably call it "Warren Buffett and his ten reasons for buying the next Afterpay". I'm not stupid.

Any ideas anyone?

https://www.livewiremarkets.com/wires/the-afterpay-bubble/

- Sep 2, 2014

- 16,668

- 32,003

- AFL Club

- Hawthorn

- Other Teams

- Liverpool

1ST Group jumped +100% on an announcement on a strategic partnership with Openpay. Wasn't even considered a price sensitive announcement. Crazy.APT, Z1P etc are an overhyped bubble, APT will hit $40 before it hits $80.

NZS primefor a breakout next week. Have a thread in the watchlist forum - https://www.bigfooty.com/forum/threads/nzs-new-zealand-coastal-seafoods-limited.1243129/

Share price should be 4c plus on 2x revenue already. Extended the size of the warehouse by 6x so expect some news on further deals being done soon

exit of a legacy shareholder is also good news, bodes well that the price was still going up as the major holder was exiting. Even a name change, that is now expected after the exit of the legacy holder, that better represents its move in to more of a biotech should see a substantial increase

AQX another I like. Small gold miner with some really good potential. Golds only going to continue to rise so if it gets some good news from it’s drills then expect it to climb quickly. I sold out of DEG at 0.2c, I’m not going to miss another!

Share price should be 4c plus on 2x revenue already. Extended the size of the warehouse by 6x so expect some news on further deals being done soon

exit of a legacy shareholder is also good news, bodes well that the price was still going up as the major holder was exiting. Even a name change, that is now expected after the exit of the legacy holder, that better represents its move in to more of a biotech should see a substantial increase

AQX another I like. Small gold miner with some really good potential. Golds only going to continue to rise so if it gets some good news from it’s drills then expect it to climb quickly. I sold out of DEG at 0.2c, I’m not going to miss another!

Last edited:

Yeah I use it. It's fine for recreational investors but doubtful it's good enough for really serious day traders. I've never had an issue with it going down or technical problemsAnyone use SelfWealth trading platform? ANZ down again for what seems like the 10th time in a month. Always at the most costly time (for most).

Hope some got on, up 70% today.NZS primefor a breakout next week. Have a thread in the watchlist forum - https://www.bigfooty.com/forum/threads/nzs-new-zealand-coastal-seafoods-limited.1243129/

Share price should be 4c plus on 2x revenue already. Extended the size of the warehouse by 6x so expect some news on further deals being done soon

exit of a legacy shareholder is also good news, bodes well that the price was still going up as the major holder was exiting. Even a name change, that is now expected after the exit of the legacy holder, that better represents its move in to more of a biotech should see a substantial increase

AQX another I like. Small gold miner with some really good potential. Golds only going to continue to rise so if it gets some good news from it’s drills then expect it to climb quickly. I sold out of DEG at 0.2c, I’m not going to miss another!

Expect flatlining or a small dip until the quarterly which will then see it well in to the 3s and 4s

Anyone use SelfWealth trading platform? ANZ down again for what seems like the 10th time in a month. Always at the most costly time (for most).

If you're a 'make 3-4 trades a month' kind of person then Selfwealth works well. Obligatory referral link.

The downside is your main portfolio page is on a 20 minute delay, though the individual pages show the live price.

It's also missing some of the depth that you get with a fully fledged site, however for $9.50/trade you can't go wrong

Just looked on Bell and I've made one trade in the last 3 months, a small sell of LTR a couple of days ago. Talk about sitting on your hands..

Did take part in 5 cap raises though.

Did take part in 5 cap raises though.

Gold continues its march towards $1900 US.