- Moderator

- #276

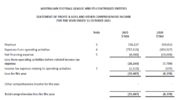

My understanding after reading the financial report was 20 million loss in 2020 and 40 million loss in 2021.

So if you take into account aflw is costing over 20 million annually to run and covid costs reportedly exceed 70 million, there has to be a significant contribution from having so many aflw teams, special flights, accommodation, testing requirements for the players, staff and admin costs over a bigger number of players and running of a bigger competition for longer.

As I said I actually like the concept of AFLW, I just think for the quality of product there are too many teams and some players getting over 100k for a 3 month season in a low quality competition that generates next to no revenue is a significant issue. A gradual increase over decades is more sensible.

Total losses for the AFL were 8m in 2020 and 29m in 2021.

COVID costs were 76m.

. It helps me understand most of it but a few left over questions and statements for you and seeking some clarification.

. It helps me understand most of it but a few left over questions and statements for you and seeking some clarification.