- Sep 22, 2008

- 25,524

- 34,634

- AFL Club

- Western Bulldogs

- Banned

- #26

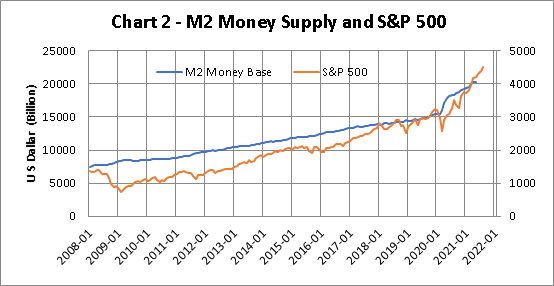

Surely there’s better ways to bring down inflation than making everyone poor and struggling to pay their debts in a ridiculously quick time?

I dunno maybe investing in Australian manufacturing and automation to bring costs down whilst making us less reliant on the global supply chain? Limiting profit margin & price gouging by large corporations?

Nah making young people who had to borrow ridiculous amounts beyond their means just to even get a sniff of a chance to get into the housing market, now unable to pay their bills, within a matter of months, that’s the best option

I dunno maybe investing in Australian manufacturing and automation to bring costs down whilst making us less reliant on the global supply chain? Limiting profit margin & price gouging by large corporations?

Nah making young people who had to borrow ridiculous amounts beyond their means just to even get a sniff of a chance to get into the housing market, now unable to pay their bills, within a matter of months, that’s the best option