RussellEbertHandball

Flick pass expert

I'm a complete dolt about this sort of thing, but just googling raw materials of plastics brings up encyclopedia-entry-like sites that seem to agree that oil and natural gas are the major raw materials of plastics. Is this wrong?

Anyhow, how is peak oil bad news? Anything that gets us off our petroleum jones is surely a good thing, given that global warming promises worse devastation than any consequence of having no oil. (Although it does somehow seem like a choice between getting seriously old and dying.)

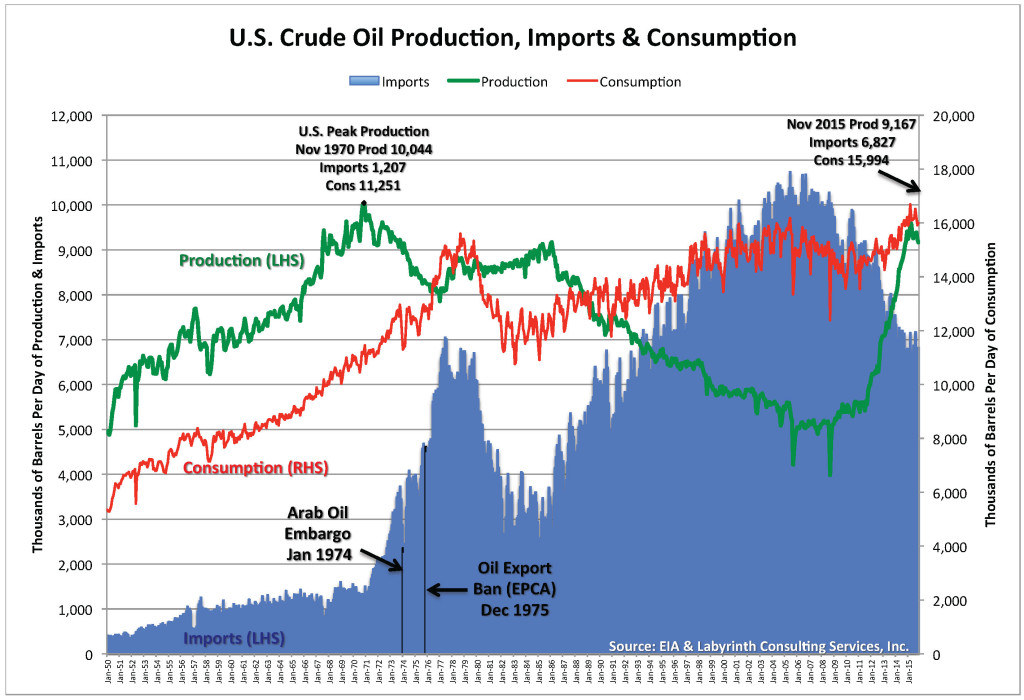

How is Peak oil bad? Well if we get a 400% price increase in 6 months like we did in Oct 73 to March 1974 or a 200% increase like in 1979 and we get inflation over 10%, interest rates over 10%, Unemployment over 10% and growth down to bugger all or negative then we are going to have a lot of pissed off people who might actually be pissed off about more than not being able to buy the latest plasma, take a holiday o's every year and not using the credit card. Then if the poor bastards who live on bugger all per day see what little food they can buy because of a doubling and tripling in prices because petrol goes up and is compounded because farmers are switching from growing food to growing more profitable bio fuel crops you might have one angry planet. A bit extreme, I know, but when people get to the point that they can't afford to buy food, well then interesting things start to happen.