Ratts of Tobruk

Cancelled

- May 1, 2013

- 9,168

- 5,975

- AFL Club

- Carlton

- Other Teams

- ATV Irdning

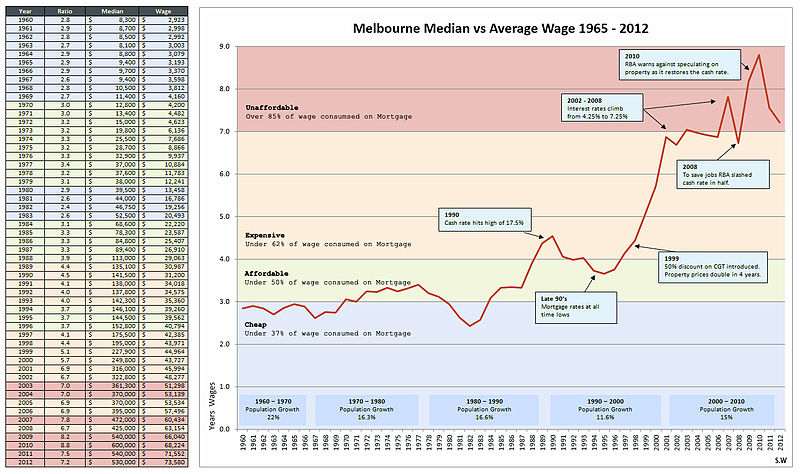

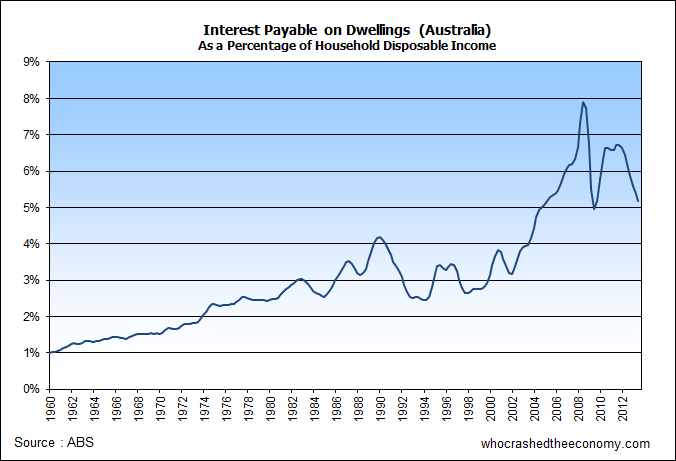

I don't think it was a Rudd change, as I've heard complaints about Chinese buyers from before Labor won govt. But I guess they could have been generic racist complaints and something did change to increase investment 9-fold. More likely: The property 'correction' in Australia was just a plateau, rather than a bubble bursting and so a bunch of investors saw Australian property as a highly reliable asset next to the shaky situations in Europe and the US.