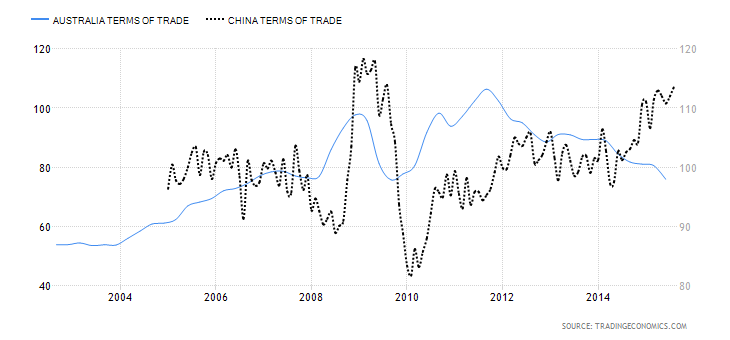

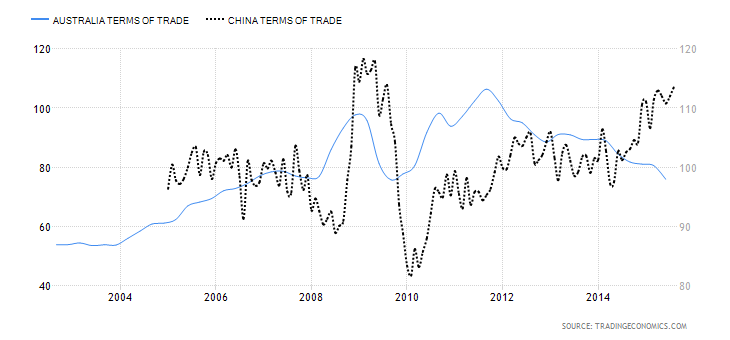

The usual cheerleading fanbois on here cant quite comprehend that commodity prices are now back to 2002 levels.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

The usual cheerleading fanbois on here cant quite comprehend that commodity prices are now back to 2002 levels.

Will be hard from 2017 onwards - manufacturing shutdowns kick in, flow on effects... one analysis estimated 200k jobs in total for the new government (post next Fed election) to deal with.

Headache time - not many signs of a new-world led recovery for bulk commodities either, we could be in for some serious pain.

Some trials in the US have focused on a 36 hour, 4 day week. I'd love that

LOL what does falling commodity prices have to do with a recession?

Dude, it was a joke saying that Power Raid should try to limit his time on BF to 35 hours. As a start.France. Not a raging success.

Dude, it was a joke saying that Power Raid should try to limit his time on BF to 35 hours. As a start.

Wow, you cant even grasp that. Why do you think Canada, Brazil and Russia are in recession?

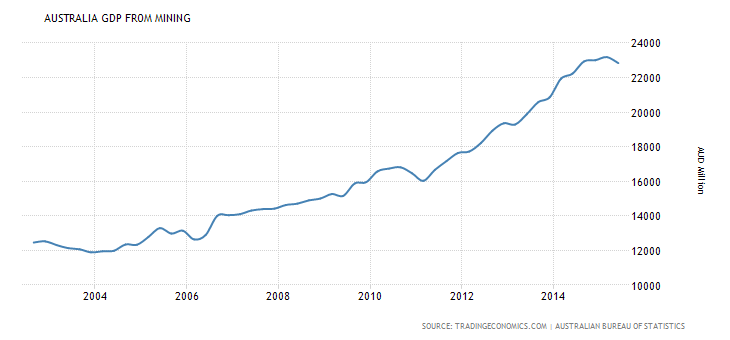

The boom in prices drove a massive investment surge. Now that is about to/ has already hit a wall.

http://www.rba.gov.au/publications/rdp/2014/pdf/rdp2014-08.pdf

The pink line in Figure 4 represents an estimate of the increase in the volume of goods and services produced arising from the boom. Higher mining investment directly contributes to higher aggregate demand. Furthermore, higher national 1 We weight the trading gain using volume weights from the historical baseline. The estimate is not sensitive to this choice of weights. 11 purchasing power boosts consumption and other spending components. Higher mining investment also increases the national capital stock and hence aggregate supply. There are many further compounding and offsetting effects which are discussed below. However, the estimated net effect is to increase real GDP by 6 per cent (Figure 4).

Why do you think Canada, Brazil and Russia are in recession?

You can pretty much lock it in that the states of Vic, NSW, SA and Tasmania will go into recession late this year, early next. The stupidity of the RBA has condemned us.

These idiots have pushed the interest rate button, too hard and too fast. End result is they will have a far greater impact on growth than they think. Consumer confidence had already fallen, retail spending was falling and economic growth was lower than expected.

Throw in the problems in the global credit markets which will not go away and will lead to the banks increasing rates more than the official rate increase (Adelaide Bank has lifted them by .4%) and the economy in these states is going to take a major hit.

Faceless men and women sitting in an ivory tower combined with a new govenrment too scared to rock the boat or show any initiative has condemned the Australian people to a recession we did not have to have.

Its not technically here yet though is it?

2 quarters of negative? I thought we only had 1.

Is that like a law of physics or something?yep

an early call but one that will prove correct next quarter

the good news is recessions usually only last a short time once called (60-120 days from memory)

Is that like a law of physics or something?

yep

an early call but one that will prove correct next quarter

the good news is recessions usually only last a short time once called (60-120 days from memory)

What like the one in the UK from 1978 - 1983 circa?

we aren't a socialist economy, so it is better to compare to our own post late 80s history

however your example, highlights the difference between socialist and capitalist economies. Both can fail but one is faster to rebound and has greater flexibility inbuilt such as bankruptcy.

The second part of the recession happened under the neo-liberal policy of Margaret Thatcher. She was saved by the Falklands war or she may well have been voted out.

No offense, but you clearly know nothing about history. The Great Depression was caused by capitalist over-confidence & in America was allevaited by the Keynsian intervention of Roosevelt. The prevailing Chicago school of economics is more likely to cause depressions as much as end them; if it does end them the resultant wealth is not distributed evenly.