- May 5, 2006

- 62,726

- 70,017

- AFL Club

- West Coast

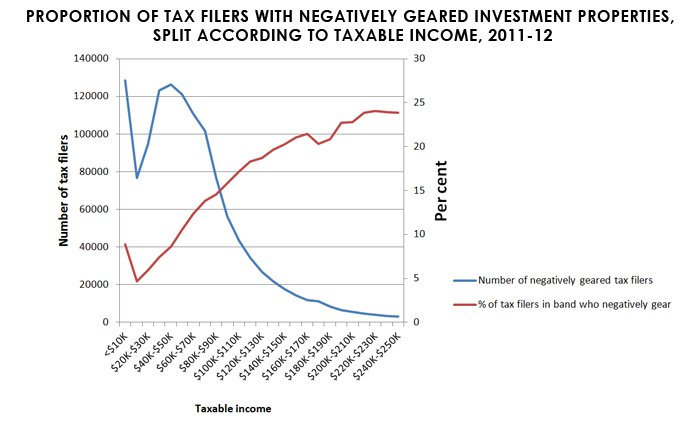

That spike at the beginning plus the numbers up to the tax free threshold equals ~250,000 people who can afford an investment property, but who pay no tax at all via their income — thanks to negative gearing.

So you're telling me that I can earn $20k a year and own an investment property? Cool!