Anybody seen The Upside? Kevin Hart, Bryan Cranston & Nicole Kidman. Highly recommend.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The off topic thread 4.0

- Thread starter chef

- Start date

- Tagged users None

- Status

- Not open for further replies.

Bojan KantKick

Man United Legacy Supporter

- Sep 5, 2014

- 30,087

- 28,684

- AFL Club

- North Melbourne

- Other Teams

- Manchester United, Stevenage FC

Good news

Bojan KantKick

Man United Legacy Supporter

- Sep 5, 2014

- 30,087

- 28,684

- AFL Club

- North Melbourne

- Other Teams

- Manchester United, Stevenage FC

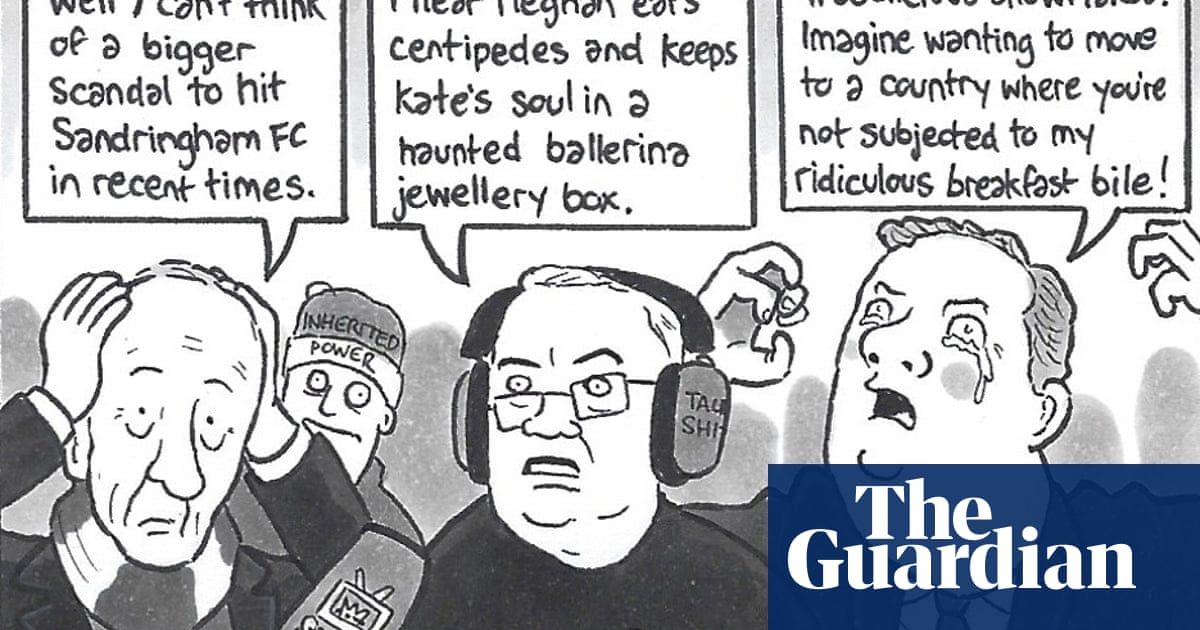

David Squires on … everything kicking off at Sandringham FC

Our cartoonist checks in on the biggest deal involving wantaway big names in the January window

Class

moomba

TheBrownDog

Ha. You can bring your ******* dinner.

- Dec 22, 2009

- 62,724

- 36,767

- AFL Club

- Hawthorn

- Other Teams

- Matildas/Socceroos/LFC/MVFC/RCStrasbourg

Good news

Bad news for arbitrage betting. I use my credit card all the time on betfair to offset betting promotions on other betting sites. If that happened in Australia I would have to fund lay bets on betfair from my bank account which sometimes run into the thousands. Good doing it on CC because I am guaranteed a win.

Bojan KantKick

Man United Legacy Supporter

- Sep 5, 2014

- 30,087

- 28,684

- AFL Club

- North Melbourne

- Other Teams

- Manchester United, Stevenage FC

You might have to cop it for the greater good I'm afraid mate.Bad news for arbitrage betting. I use my credit card all the time on betfair to offset betting promotions on other betting sites. If that happened in Australia I would have to fund lay bets on betfair from my bank account which sometimes run into the thousands. Good doing it on CC because I am guaranteed a win.

Bojan KantKick

Man United Legacy Supporter

- Sep 5, 2014

- 30,087

- 28,684

- AFL Club

- North Melbourne

- Other Teams

- Manchester United, Stevenage FC

Tekkers

- Apr 8, 2015

- 17,469

- 9,803

- AFL Club

- Hawthorn

Does anyone here suffer from white privilege? Does anyone know how to cure it?

Bojan KantKick

Man United Legacy Supporter

- Sep 5, 2014

- 30,087

- 28,684

- AFL Club

- North Melbourne

- Other Teams

- Manchester United, Stevenage FC

HahahahahahahaDoes anyone here suffer from white privilege? Does anyone know how to cure it?

SM

Bigfooty Legend

That's a dumb move, I use my credit card all the time to manage cash flow. Would make more sense to introduce a percentage limit of funds that can be tied up on gambling.

Good news

Bojan KantKick

Man United Legacy Supporter

- Sep 5, 2014

- 30,087

- 28,684

- AFL Club

- North Melbourne

- Other Teams

- Manchester United, Stevenage FC

Sadly, I think you are one of the few that do so.That's a dumb move, I use my credit card all the time to manage cash flow. Would make more sense to introduce a percentage limit of funds that can be tied up on gambling.

In the minority here but I don't have a credit card.

I am of the view if you can't afford it, don't buy it - cars and property aside.

Our only debt is our home loan.

I am of the view if you can't afford it, don't buy it - cars and property aside.

Our only debt is our home loan.

- May 12, 2011

- 5,903

- 8,361

- AFL Club

- Fremantle

- Other Teams

- Chelsea, ICT, Glory

Same here. Always try to avoid debt where possible.In the minority here but I don't have a credit card.

I am of the view if you can't afford it, don't buy it - cars and property aside.

Our only debt is our home loan.

SM

Bigfooty Legend

That's not the sole point of a credit card.In the minority here but I don't have a credit card.

I am of the view if you can't afford it, don't buy it - cars and property aside.

Our only debt is our home loan.

If you're not repaying your full balance each month you're doing it wrong.

In the minority here but I don't have a credit card.

I am of the view if you can't afford it, don't buy it - cars and property aside.

Our only debt is our home loan.

Good approach to have. Credit cards can be used for convenience during a month and then paid off at the end to avoid interest etc (like SM suggested).

Where one can start to get into trouble is just paying off the 'minimum amount' and from there, the debt and costs can compound. On a similar note, I'm also not really a huge fan of afterpay or similar methods. Really taps into the consumerism culture and makes it very attractive/appealing for people (who probably don't need it/can't afford it anyway) to keep buying the latest shiny and glitzy things.

Afterpay is ridiculous.

Preys on people who don't earn enough and just love to buy s**t and can't afford to repay it IE uni students.

Preys on people who don't earn enough and just love to buy s**t and can't afford to repay it IE uni students.

- Mar 4, 2002

- 16,181

- 40,073

- AFL Club

- Richmond

- Other Teams

- Liverpool, Red Sox, Melbourne Storm

Good approach to have. Credit cards can be used for convenience during a month and then paid off at the end to avoid interest etc (like SM suggested).

Where one can start to get into trouble is just paying off the 'minimum amount' and from there, the debt and costs can compound. On a similar note, I'm also not really a huge fan of afterpay or similar methods. Really taps into the consumerism culture and makes it very attractive/appealing for people (who probably don't need it/can't afford it anyway) to keep buying the latest shiny and glitzy things.

I’ll use a HSBC interest free period to my advantage, but also steer clear of afterpay and the like for now (I realise they are similar). HSBC would normally give me 24 months interest free on a big ticket item (ie. new TV/iPad etc). I currently am two months into a new TV purchase, with minimum repayments of $73p.m... but I’m already $600 paid off, and wil most likely be paid off in 12 months instead of 24.

Similarly my credit cards are normally paid off by the end of the month or within the 55 day interest free period. I hate haggling for a deal only to pay interest! Credit score has been above 800 for as long as I’ve had one...

I know, but I still don't feel the need for one.That's not the sole point of a credit card.

If you're not repaying your full balance each month you're doing it wrong.

- Mar 4, 2002

- 16,181

- 40,073

- AFL Club

- Richmond

- Other Teams

- Liverpool, Red Sox, Melbourne Storm

I know, but I still don't feel the need for one.

‘they’re also good with your home loan if you have an offset account as you can minimise interest charges by paying your maximum amount available in against your home loan, and only worry about paying off the card at the end of the month

SM

Bigfooty Legend

This as well. Managing cash flow is hugely undervalued it seems.‘they’re also good with your home loan if you have an offset account as you can minimise interest charges by paying your maximum amount available in against your home loan, and only worry about paying off the card at the end of the month

Loonerty

TheBrownDog

I've used Afterpay twice as a broke uni student. Once for shoes and once for a Switch. But in each case I knew that I would be able to afford it over the 8 weeks and wouldn't do more than one at a time.Afterpay is ridiculous.

Preys on people who don't earn enough and just love to buy s**t and can't afford to repay it IE uni students.

I don't think it's uni students that are being targeted. I think it's lower income earners who won't put proper limits in place.

SM

Bigfooty Legend

You don't think having a smooth cash flow instead of a lumpy one is beneficial?I know, but I still don't feel the need for one.

Do you hang out for pay day because it means you can to buy a new shirt or book or whatever?

ossie_21

Premium Platinum

Cash is king

‘they’re also good with your home loan if you have an offset account as you can minimise interest charges by paying your maximum amount available in against your home loan, and only worry about paying off the card at the end of the month

Yes that's another option, or if you're fortunate enough to have funds in at call account (not that the interest rate is that high currently), parking the money there until the end of the month makes a difference. I used to call the petrol fund, the interest we used to earn on that account would usually cover that month's fuel.

Over time as interest rates tumbled, that then became the lunch fund (covered lunch once for that month). Then the coffee fund. Currently, its the chuppa chup fund

Yeah, but many will be irresponsible and reckless and have no idea how to manage their debt. You're obviously an exception to the rule which is good.I've used Afterpay twice as a broke uni student. Once for shoes and once for a Switch. But in each case I knew that I would be able to afford it over the 8 weeks and wouldn't do more than one at a time.

I don't think it's uni students that are being targeted. I think it's lower income earners who won't put proper limits in place.

I reckon it's a culmination

I don't know, I haven't really thought about it.You don't think having a smooth cash flow instead of a lumpy one is beneficial?

Do you hang out for pay day because it means you can to buy a new shirt or book or whatever?

We don't struggle though.

Wife and I get paid on alternating weeks.

Some goes to home loan

Some goes to an annual expenses account (IE for insurances etc)

Bulk goes to long term savings

Remainder stays in every day account

- Status

- Not open for further replies.

Similar threads

- Replies

- 69

- Views

- 4K

- Replies

- 9

- Views

- 645

- Locked

- Replies

- 190

- Views

- 10K