- Thread starter

- #51

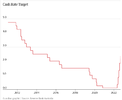

I'd be interested in a step by step explanation of how QE in the US, is dictating price inflation in Australia?The RBA can only do so much when the US Federal Reserve created money like crazy during covid and both Trump and Biden had big spending bills.

As the dominant causative factor.

The whole point of the RBAs QT program and interest rate rises is to increase unemployment and thus depress wages. Interest rate rises were not sat on "for too long" despite increase in the price of oil and other commodities powering global inflation, they were sat on because the RBA was waiting for updated wage data.

That is what is behind the stoush between the BCA types shoveled into RBA roles and Labor.

It's a fight over monetary policy not actually matching inflationary conditions, something increased interest rates in Australia won't depress. Instead the RBA is being guided by the demands of big employers whose profit yields and price gouging are actually tied up with current inflationary pressures.

Basically, it's a very obvious, very risky and very open con. Something that has obliquely been admitted to by the likes of Chris Kent et al.

But nobody bothers to read their press releases and speeches.