Is a global energy crisis unfolding as we sleep:

Wall Street Breakfast: Global Energy Crisis

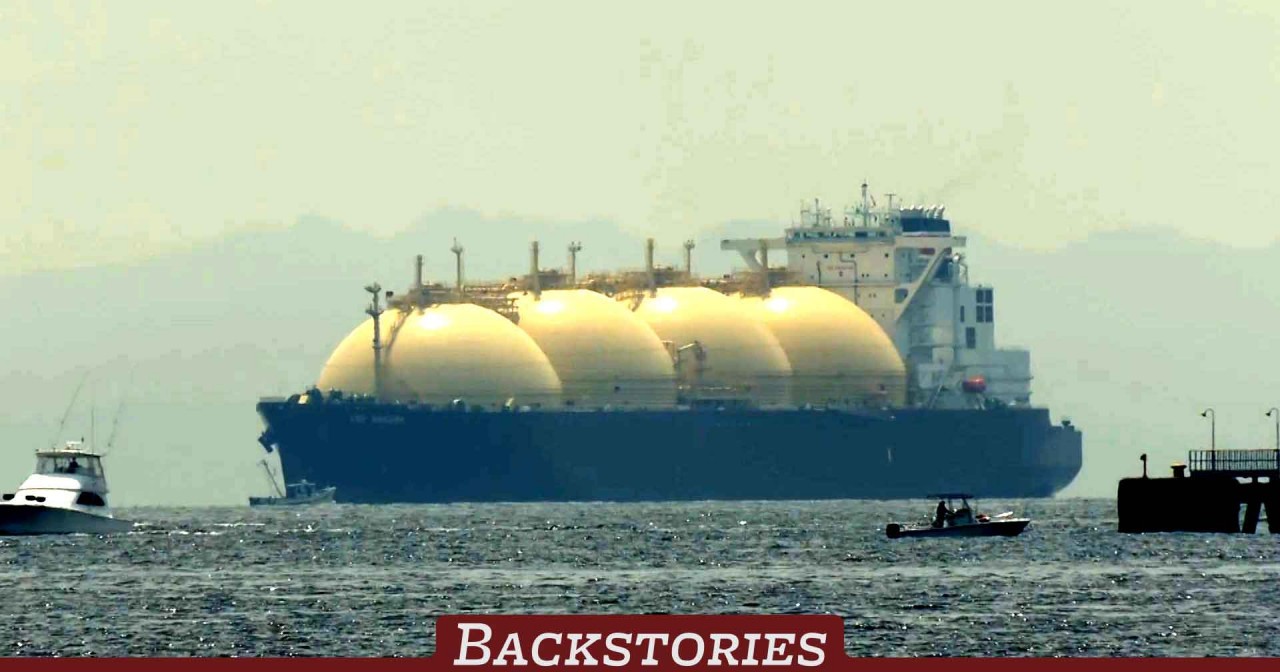

Energy prices continue to surge to fresh records as renewed fears stoke panic of the worst shortage in decades. India has warned it has only four days of coal reserves left, German power plants are running out of fuel and China just unloaded an Australian coal shipment despite an import ban and icy relations. Supply is just not there as economies rebound from a pandemic-induced lull, while problems like logistical logjams and transport bottlenecks are adding to the pressure.

Bigger picture: OPEC+ didn't come to the rescue yesterday as the group decided to continue its original plan of gradually releasing 400,000 additional barrels of oil per month. That's despite calls from world leaders, including the White House, to bring more crude on to the market and keep a lid on prices. According to the EIA, average daily crude production in the U.S. has been 6.7% lower than last year, while commercial stockpiles of crude, excluding the Strategic Petroleum Reserve, are off by 15% compared to 2020.

That's helping send oil prices to their highest levels in three years, with Brent (CO1:COM) and WTI crude (CL1:COM) touching $82 and $78 a barrel, respectively. High natural gas prices (NG1:COM) are also prompting American utilities to switch to coal this year, but their supply is constrained by miners that have cut capacity by 40% over the last six years. This past week, coal from the central Appalachia region rose $2.20 to $73.25, up 35% YTD and the highest level since May 2019.

Thought bubble: "Investors are underappreciating the structural changes that have taken place in the North American energy landscape that could lead to these higher prices persisting for some time," wrote Lucas Pipes, an analyst with B. Riley Securities. Some are even calling the current situation the first major energy crisis of the clean power transition, with President Biden setting a goal to decarbonize the economy by 2050 (power demand is expected to increase 60% by then). "It is a cautionary message about how complex the energy transition is going to be," added Daniel Yergin, author of The New Map: Energy, Climate and the Clash of Nations

seekingalpha.com

seekingalpha.com

Wall Street Breakfast: Global Energy Crisis

Energy prices continue to surge to fresh records as renewed fears stoke panic of the worst shortage in decades. India has warned it has only four days of coal reserves left, German power plants are running out of fuel and China just unloaded an Australian coal shipment despite an import ban and icy relations. Supply is just not there as economies rebound from a pandemic-induced lull, while problems like logistical logjams and transport bottlenecks are adding to the pressure.

Bigger picture: OPEC+ didn't come to the rescue yesterday as the group decided to continue its original plan of gradually releasing 400,000 additional barrels of oil per month. That's despite calls from world leaders, including the White House, to bring more crude on to the market and keep a lid on prices. According to the EIA, average daily crude production in the U.S. has been 6.7% lower than last year, while commercial stockpiles of crude, excluding the Strategic Petroleum Reserve, are off by 15% compared to 2020.

That's helping send oil prices to their highest levels in three years, with Brent (CO1:COM) and WTI crude (CL1:COM) touching $82 and $78 a barrel, respectively. High natural gas prices (NG1:COM) are also prompting American utilities to switch to coal this year, but their supply is constrained by miners that have cut capacity by 40% over the last six years. This past week, coal from the central Appalachia region rose $2.20 to $73.25, up 35% YTD and the highest level since May 2019.

Thought bubble: "Investors are underappreciating the structural changes that have taken place in the North American energy landscape that could lead to these higher prices persisting for some time," wrote Lucas Pipes, an analyst with B. Riley Securities. Some are even calling the current situation the first major energy crisis of the clean power transition, with President Biden setting a goal to decarbonize the economy by 2050 (power demand is expected to increase 60% by then). "It is a cautionary message about how complex the energy transition is going to be," added Daniel Yergin, author of The New Map: Energy, Climate and the Clash of Nations

Wall Street Breakfast: Global Energy Crisis

Listen on the go! A daily podcast of Wall Street Breakfast will be available by 8:00 a.m. on Seeking Alpha, iTunes, Stitcher and Spotify.

Last edited: