What a s**t week. Down 150k from my all time high literally 2 weeks ago lol. Still I've made some decent trades and looking to re enter. RNU top of list for mine. Fundamentals are still there.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General Markets Talk

- Thread starter Jimmy_the_Gent

- Start date

- Tagged users None

- Oct 9, 2006

- 22,624

- 29,344

- AFL Club

- Hawthorn

- Other Teams

- Super Tottenham....from the Lane.

Had to make a quick run to woolies to pick up some more lube as my arse is getting red raw from the almighty rodgering i am receiving.

I'm looking at investing into ETFs for diversification and long term hold, crypto was too volatile for me.

I'm planning on investing 40-50k and add 5k every year after, but looking at the current market.

Was going to spread it over three, SP500, vanguard australia and international.

I'm fairly new to this game, just been doing self research, anything else I should keep an eye on or watch out for?

Seems like I should hold off abit, crashing hard by the looks of it.

I'm planning on investing 40-50k and add 5k every year after, but looking at the current market.

Was going to spread it over three, SP500, vanguard australia and international.

I'm fairly new to this game, just been doing self research, anything else I should keep an eye on or watch out for?

Seems like I should hold off abit, crashing hard by the looks of it.

- Oct 9, 2006

- 22,624

- 29,344

- AFL Club

- Hawthorn

- Other Teams

- Super Tottenham....from the Lane.

Had to make a quick run to woolies to pick up some more lube as my arse is getting red raw from the almighty rodgering i am receiving.

Sorry mate, did I leave you a tube?

- Mar 27, 2018

- 7,224

- 18,912

- AFL Club

- Collingwood

- Other Teams

- Cleveland Browns, Tony Ferguson

- Thread starter

- #2,732

Can anyone recommend a good brand of noodles?

- Thread starter

- #2,733

- Apr 10, 2017

- 2,164

- 4,070

- AFL Club

- Hawthorn

- Other Teams

- Saints

ETF's a good way to start... I think Morningstar have some good & free ETF comparisons.. Or, just register for a free trial account.I'm looking at investing into ETFs for diversification and long term hold, crypto was too volatile for me.

I'm planning on investing 40-50k and add 5k every year after, but looking at the current market.

Was going to spread it over three, SP500, vanguard australia and international.

I'm fairly new to this game, just been doing self research, anything else I should keep an eye on or watch out for?

Seems like I should hold off abit, crashing hard by the looks of it.

Your last line is the most relevant. IMHO - things are about to get very ugly.

BTW - go backwards through this thread. Someone on here posted a pretty good ETF strategy in Dec or Jan. Sorry, cant recall who..

- Apr 10, 2017

- 2,164

- 4,070

- AFL Club

- Hawthorn

- Other Teams

- Saints

Found the poster - DaRick...ETF's a good way to start... I think Morningstar have some good & free ETF comparisons.. Or, just register for a free trial account.

Your last line is the most relevant. IMHO - things are about to get very ugly.

BTW - go backwards through this thread. Someone on here posted a pretty good ETF strategy in Dec or Jan. Sorry, cant recall who..

cant find the actual post - so just look for their posts in here.

Falchoon

Brownlow Medallist

- Feb 15, 2002

- 29,562

- 10,747

- AFL Club

- St Kilda

- Other Teams

- Bluestar Airlines, Anacott Steel

I just went up to Springvale for a Pho and some meat/fish veg. Hoping that my -6% for the day came back to -4%.

Get home and I'm -10%.

Last 3 days have been -5.8%, -5.6% -10.0%

Get home and I'm -10%.

Last 3 days have been -5.8%, -5.6% -10.0%

- Oct 9, 2006

- 22,624

- 29,344

- AFL Club

- Hawthorn

- Other Teams

- Super Tottenham....from the Lane.

I just went up to Springvale for a Pho and some meat/fish veg. Hoping that my -6% for the day came back to -4%.

Get home and I'm -10%.

Last 3 days have been -5.8%, -5.6% -10.0%

Yep, my lithium/uranium hold is down 20% over the last 3 days. Super balance down about 4%.

Well I did buy just a few CSL shares today, exciting huh.

?Feel like a big short?

I leave that to people far smarter than me!Feel like a big short?

Say, putting a few 100k on BBUS or BBOZ?

- Sep 2, 2014

- 16,668

- 32,003

- AFL Club

- Hawthorn

- Other Teams

- Liverpool

Bro, I aint reading that. I have sound financial advice at my feet and whilst they say be cautious all my regrets have come from not buying when I thought, I have no regrets the other way and that's over a 7-10 year period.Resist the pressing temptation.

You can see a lot more clearly once the dust has settled.

I’ve been making and losing shitloads of money over the last three decades and this not a safe buying opportunity compared to various entry points available April to November 2020.

However, if you truly believe that this market is unstoppable then knock yourself out.

This might be the start of a bit of deleveraging and from the chart action at the end of last week US markets were seeing the phenomena of medium investors selling into to strength in the afternoon.

There is huge difference between the institutional investors and large private investors.

In the first case the traders are managers of other peoples money so they:

i. They really don’t give a rats over losing other peoples’ money, particularly in the super funds space, as long they “outperform the market” meaning as they don’t lose more than there peers, in which case they might get sacked and be cut off from their inflated unearned salary and perks they believe they are justly entitled to what can gouge out from being parasites.

ii. As a former Aus funds manager who had 1% of the ASX in his keeping, confided on me, the liquidity in our market is just soooo low you can’t even lightened positions without moving the price down. That is why there is so much intra-institutional over the counter (a US term) trading or as we call it off market trading. The only way this bloke, ever reduced a holding in a top 50 ASX was to keep buying a huge line of out of the money puts from some idiot who was naive enough to sell him so much. Once he had the out position in place he dumped the stock driving the price down so the outs were in the money and exercised the puts. Needless to say the counter party got sacked and that was the end of him in that space.

To illustrate how captive to the market the big funds are look at CBA today. At end of trading today, CBA had a market cap of $166 billion shares, their price fell 2.04% on a volume of a bit over 5 million shares for $578 million in traded value. So on the fourth biggest volume day over the last 3-4 months only 0.035% of their stock changed hands.

iii. As a consequence of i and ii, huge funds like the super funds have to identify what they consider investment grade stocks and hold them, only playing around at the margins margins. Hence the olden day full service brokers like JB Were, Potters, and me own Ord (Minett), used to couch there stock recommendations in terms of underweight, lighten, strongly overweight etc.. Where they can make money and do is with out of the money, script covered option writing, having serious access to the institutional tranches of capital raisings and IPOs. When so much money is on the table then it is too easy just backing the safe and make enough money to keep the plebs quiescent and take in the undeserved bonuses.

However, large private investors, sophisticated investors, the top 1% of retirees (+10 million in net worth, ie mainly former business owners) and maybe down to sophisticated investors, also including family offices, see it differently:

i. It is there hard earned generally (inherited wealth is not that prevalent in Australia eg where are the Armitages now?) so they take losing money personally as we here all do, as for them it is their money.

ii. Like us they are just small enough to lighten holdings without crashing stock prices, if they do it carefully and can execute divestments even in some of the more liquid small caps who are non-speculative in that they make money eg smaller gold producers etc..

This retreat won’t prove serious from a technical perspective until the S&P 500 breaches the 4,300 support level set on 4 Oct 2021. Interestingly it breached this support intraday but that is not technically significant. But we are on the edge.

Personally I would feel a lot safer going forward in this decade with far lower low in the next year or so.

Unfortunately I can’t see that happening.

Haha, that brings back memories. I think I got our just in time before losing too much in 2020.Feel like a big short?

Say, putting a few 100k on BBUS or BBOZ?

An alternative to a straight ETF to consider is LIC's

www2.asx.com.au

www2.asx.com.au

www2.asx.com.au

www2.asx.com.au

Investing in LICs and LITs

Listed Investment Companies (LICs) and Listed Investment Trusts (LITs) enable you to gain exposure to a broad range of assets in a single transaction.

Listed Investment Companies: fact, fiction and future

https://www.livewiremarkets.com/wires/share-market-falls-7-things-for-investors-to-keep-in-mind

Share market falls: 7 things for investors to keep in mind

Most of the time, share markets are relatively calm and don’t make the headlines. But every so often they have a tumble and make the “front page” with headlines (or these days clickbait) like “billions wiped off share market” and “biggest share plunge since…” Each one is met with lots of analysis and prognostication from experts.

Sometimes the plunge ends quickly and the market heads back up again and is forgotten about (like last September when I last wrote a note like this). But once every so often, share markets keep falling for a while. Sometimes the falls are foreseeable, but rarely are they forecastable (which requires a call as to timing and magnitude)…despite many (who got lucky) claiming otherwise. In my career, I have seen many share market falls, and I even saw the market fall 25% one day.

Key points

And so it is again - with share markets starting the year on a sour note. From their highs, US shares have fallen 8%, with the tech-heavy Nasdaq down 14%, global shares are down 7% and Australian shares are also down 7%. Always the drivers are slightly different. But as Mark Twain is said to have said “history doesn’t repeat but it rhymes”, and so it is with share market falls. This means that from the point of basic investment principles, it’s hard to say anything new. So apologies if you have seen my “seven things for investors to keep in mind” before, but at times like this, they are worth reiterating.

- Share markets have fallen in recent weeks on the back of worries about inflation, monetary tightening, the Omicron disruption and the rising risk of a Russian invasion of Ukraine.

- It's too early to say markets have bottomed.

- Key things for investors to bear in mind are that: corrections are healthy and normal; in the absence of a renewed recession share market falls may be limited; selling shares after a fall locks in a loss; share pullbacks provide opportunities for investors to buy them more cheaply; shares offer an attractive income flow; and finally, to avoid getting thrown off a long-term investment strategy it’s best to turn down the noise.

What’s driving the fall in share markets

The decline in share markets reflects a range of factors.

- Inflation readings have continued to surprise on the upside most recently for the US where inflation is now 7% and is at its highest in nearly 40 years. But Europe, the UK and Canada have also reported sharp increases in inflation.

- Along with hawkish comments from central banks, this has seen increased expectations for central bank interest rate hikes this year. Markets now expect four or more rate hikes from the Fed, Bank of England, Bank of Canada, Reserve Bank of New Zealand and the RBA this year.

- This has come at a time when the surge in Omicron cases globally has disrupted economic activity, recent economic releases have been mixed and investors fret the rate hikes will depress economic activity and hence profits.

- There is a high risk that Russia will invade Ukraine or part of it as talks around its demand for Ukraine not to join NATO and NATO countries not to station strategic weapons there failed to resolve the issue. While it’s hard to see NATO countries going to war with Russia in Ukraine, an invasion will likely trigger sanctions on Russia, further worsening Europe’s gas shortage and threatening European growth and inflation.

- And share markets have had huge gains since their March 2020 lows. US shares rose 114% and Australian shares rose 68% to their recent highs. Shares are no longer dirt cheap. There has been froth with meme stocks, SPACs and the crypto craze. And relatively calm years – with the biggest drawdowns last year being 5% in US shares and 6% in Australian shares – are often followed by a rough year. So, some are talking of crashes (as they often do).

Seven things for investors to bear in mind

Sharp market falls are stressful for investors as no one likes to see their investments fall in value. But at times like these there are seven things investors should keep in mind:

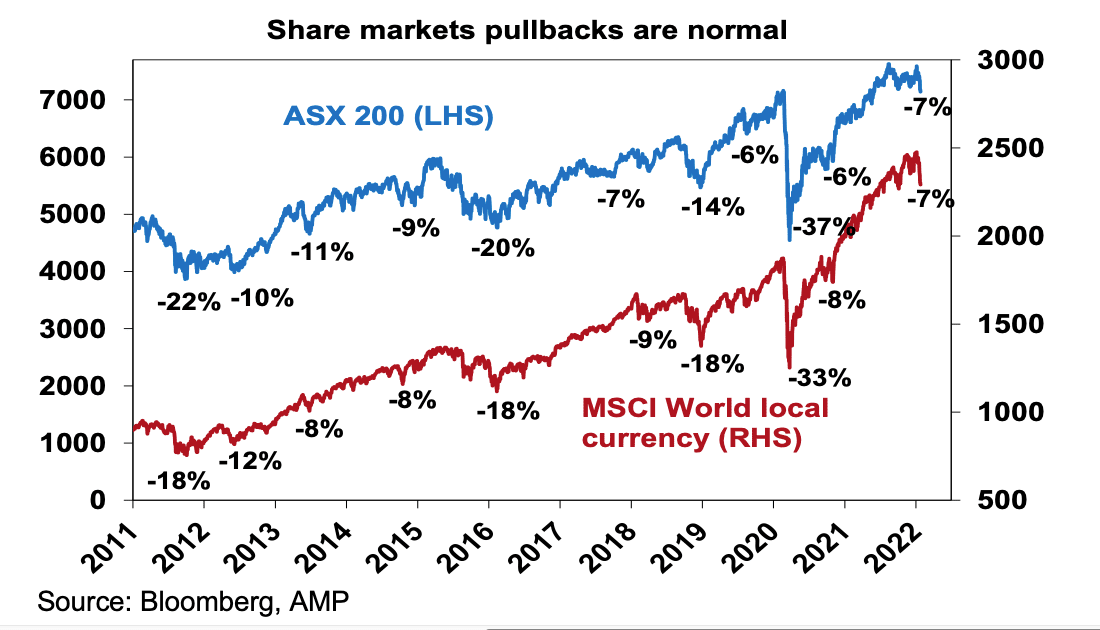

1. They all have different triggers and unfold differently, periodic share market corrections of the order of 5%, 15% and even 20% are healthy and normal. For example, during the tech/dot-com boom from 1995 to early 2000, the US share market had seven pullbacks ranging from 6% to 19% with an average decline of 10%. During the same period, Australian shares had eight pullbacks ranging from 5% to 16%. All against a backdrop of strong returns every year. During the 2003 to 2007 bull market, the Australian share market had five 5% plus corrections ranging from 7% to 12%, again with strong positive returns every year. And the last decade regularly saw major pullbacks. See the next chart.

Source: Bloomberg, AMP

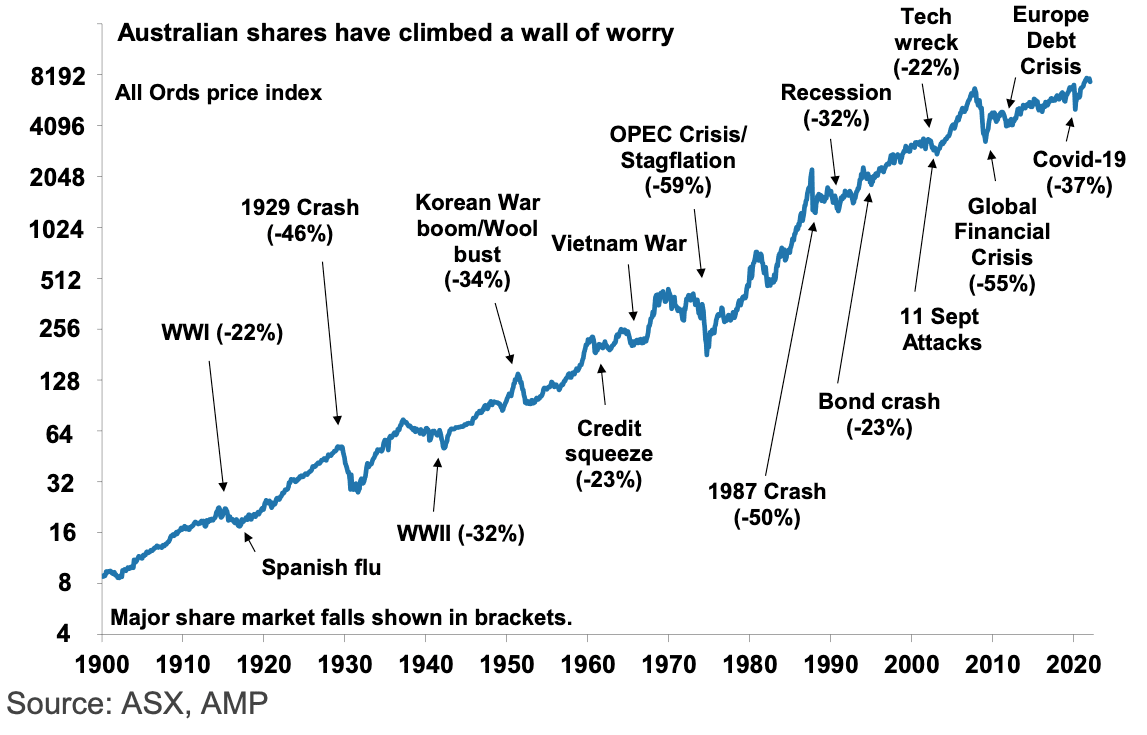

But while share market pullbacks can be painful, they are healthy as they help limit complacency and excessive risk-taking. Related to this, shares climb a wall of worry over many years with numerous events dragging them down periodically (see the next chart), but with the long-term trend ultimately up & providing higher returns than other more stable assets. Bouts of volatility are the price we pay for the higher longer-term returns from shares.

Source: ASX, AMP

2. Historically, the main driver of whether we see a correction (a fall of say 5% to 15%) or even a mild bear market (with say a 20% decline that turns around relatively quickly as we saw in 2015-2016 in Australia or in 2018 in the US) as opposed to a major bear market (like that seen in the global financial crisis (GFC), or the 35% or so falls seen in early 2020 going into the coronavirus pandemic) is whether we see a recession or not – notably in the US, as the US share market tends to lead most major global markets. Of course, short term forecasting is fraught with difficulty and should not be the basis for a long-term investment strategy, but right now, while inflation and worries about monetary tightening are concerning, it seems premature to expect a US, global or Australian recession:

3. Selling shares or switching to a more conservative investment strategy whenever shares suffer a setback just turns a paper loss into a real loss with no hope of recovering. Even if you get out and miss a further fall, trying to time a market recovery is very hard. And the risk is you don’t feel confident to get back in until long after the market has fully recovered. The best way to guard against deciding to sell on the basis of emotion after weakness in markets is to adopt a well thought out, long-term strategy and stick to it.

- New coronavirus cases in the US, Europe and Australia are slowing with vaccines providing protection against serious illness and the Omicron variant proving less harmful than prior variants. This should see business conditions indicators rebound. While the risk remains high, coronavirus could finally be moving from a pandemic to being endemic.

- Excess savings of around $US2.3 trillion in the US and $250 billion in Australia will provide an ongoing boost to spending.

- While central banks will tighten monetary policy this year it will still be easy as rates will still be very low.

- It’s usually only when monetary policy becomes tight that it ends the economic cycle & the bull market and that’s a fair way off.

- Inventories are low and will need to be rebuilt which will provide a boost to production.

- Positive wealth effects from the stronger than expected rise in share markets and home prices since early 2020 are still feeding through and will help boost consumer spending.

- China is starting to ease policy which will boost Chinese growth over the next 6 to 12 months.

- Global growth is likely to slow this year but to a still strong 5%, with Australian growth of around 4%, despite the Omicron wave resulting in a brief setback in the March quarter.

4. When shares and growth assets fall, they’re cheaper and offer higher long-term return prospects. So, the key is to look for opportunities’ pullbacks provide. It’s impossible to time the bottom but one way to do it is to “average in” over time.

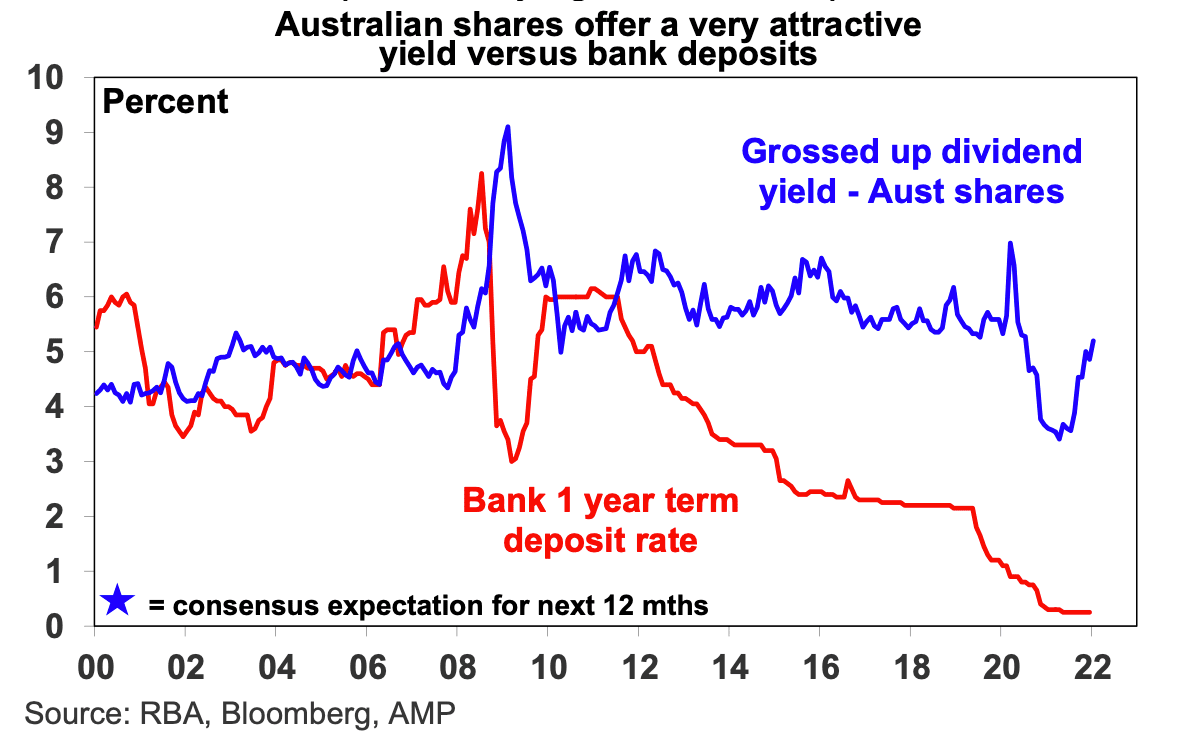

5. Australian shares are offering a very attractive dividend yield compared to banks deposits. Companies don’t like to cut their dividends, so the income flow you are receiving from a well-diversified portfolio of shares is likely to remain attractive, particularly against bank deposits.

Source: RBA, Bloomberg, AMP

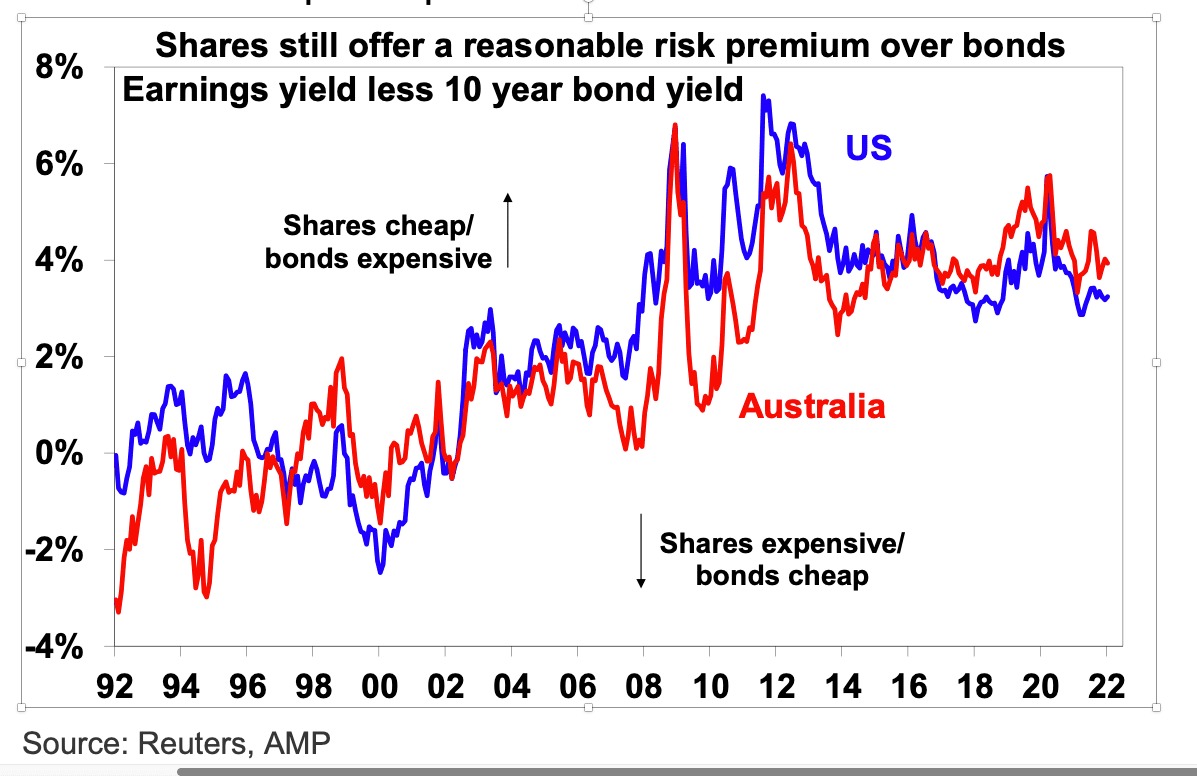

More broadly, while bond yields are well up from their lows the risk premium shares offer over bonds – as proxied by their earnings yield less the bond yield – remains relatively attractive. And in the last few days, bond yields have started to fall again, reflecting safe-haven demand which along with the fall in share markets has helped improve share market valuations.

Source: Reuters, AMP

6. Shares and other related assets often bottom at the point of maximum bearishness, ie, just when you and everyone else feel most negative towards them. So, the trick is to buck the crowd. “Be fearful when others are greedy. Be greedy when others are fearful,” as Warren Buffett has said. The last month has seen investor sentiment swing negative again which is positive from a contrarian perspective. Of course, investor sentiment could still get more negative in the short term before it bottoms.

7. Finally, turn down the noise. At times like the present, the flow of negative news reaches a fever pitch – and this is being accentuated by the growth of social media. Talk of billions wiped off share markets and talk of “crashes” help sell copy and generate clicks and views. But such headlines are often just a distortion. We are never told of the billions that market rebounds and the rising long-term trend in share prices add to the share market. All of this makes it harder to stick to an appropriate long-term strategy let alone see the opportunities that are thrown up. So best to turn down the noise and watch Brady Bunch, 90210 or Gilmore Girls re-runs!

- Thread starter

- #2,747

I like Shane Oliver and I know he's providing a good, long-term perspective for people who might be a little freaked out but articles like this one are also why we have people who blindly buy the dip every time.

That's all well and good - buying the dip has been happening for years and lots of (extra) money has been made as a result. Unfortunately, a bit like a Ponzi scheme, it has to come to an end when new (or additional) money no longer like their chances of getting a decent return. I think that's happening now and part of me wants to see anyone buying this dip get burned by a recovery that takes ages. Something long enough to flush heaps of people out of markets so that I can buy in at reasonable prices one day. I mean this more for US stocks. My uneducated opinion is that buying the dip for Aussie stocks should be ok here.

And, obviously, Oliver is right, US shares will make new all-time highs again at some stage. I just don't want it to be too soon.

- Apr 10, 2017

- 2,164

- 4,070

- AFL Club

- Hawthorn

- Other Teams

- Saints

90 minutes after the market close and MSFT is down more than 5%

Some companies are overvalued by inconceivable amounts but if youre holding good stocks (everyone thinks they are but time to be honest with yourself) you'll be fine.

For example IXR sold off 17% yesterday before recovering slightly to close 12% down. That is a massive overreaction compared to the rest of the market and for a company that is making progress/growing. Did it get ahead of itself a bit? Probably did so a pullback is fine but as much as it did? Im not so sure, add on support levels imo.

I have IBX which I am happy to hold but as someone said in here, it has been a bit of a bin fire. If one were to cut their losses here I wouldnt blame them.

Im no expert on this s**t but ive taken some profit the last 2 months and have money ready to put back in. Spend the day updating your watch list, noting support levels and watching. There's definitely some growth areas still

Gold, oil, coal, rare earths, batteries, green energy, gambling (expanding in US like PBH/BET). To me, in 12 months good stocks in these areas will be better off than we are now. WHC is likely to pay a .18 div, possibly higher for example. Coal isnt going anywhere, no need to panic even in unloved sectors...

Only thing id avoid atm is tech?

For example IXR sold off 17% yesterday before recovering slightly to close 12% down. That is a massive overreaction compared to the rest of the market and for a company that is making progress/growing. Did it get ahead of itself a bit? Probably did so a pullback is fine but as much as it did? Im not so sure, add on support levels imo.

I have IBX which I am happy to hold but as someone said in here, it has been a bit of a bin fire. If one were to cut their losses here I wouldnt blame them.

Im no expert on this s**t but ive taken some profit the last 2 months and have money ready to put back in. Spend the day updating your watch list, noting support levels and watching. There's definitely some growth areas still

Gold, oil, coal, rare earths, batteries, green energy, gambling (expanding in US like PBH/BET). To me, in 12 months good stocks in these areas will be better off than we are now. WHC is likely to pay a .18 div, possibly higher for example. Coal isnt going anywhere, no need to panic even in unloved sectors...

Only thing id avoid atm is tech?

Doesn't this market have record levels of retail involvement as well?I like Shane Oliver and I know he's providing a good, long-term perspective for people who might be a little freaked out but articles like this one are also why we have people who blindly buy the dip every time.

That's all well and good - buying the dip has been happening for years and lots of (extra) money has been made as a result. Unfortunately, a bit like a Ponzi scheme, it has to come to an end when new (or additional) money no longer like their chances of getting a decent return. I think that's happening now and part of me wants to see anyone buying this dip get burned by a recovery that takes ages. Something long enough to flush heaps of people out of markets so that I can buy in at reasonable prices one day. I mean this more for US stocks. My uneducated opinion is that buying the dip for Aussie stocks should be ok here.

And, obviously, Oliver is right, US shares will make new all-time highs again at some stage. I just don't want it to be too soon.

I might even look at some top ups this week but it will be in like very small $2k buys.