Gigantic

Brownlow Medallist

- Joined

- Aug 31, 2014

- Posts

- 13,506

- Reaction score

- 17,691

- Location

- Sydney

- AFL Club

- GWS

- Other Teams

- PHX Suns

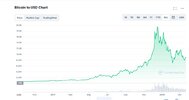

In the history of financial assets even? I don't know a single stock that has collapsed like this by magnitude and velocity.LUNA is now at 5 cents, I mean far out, is this the largest and quickest collapse in crypto history?