ThePezDispenser

Norm Smith Medallist

- Mar 22, 2010

- 9,715

- 3,649

- AFL Club

- North Melbourne

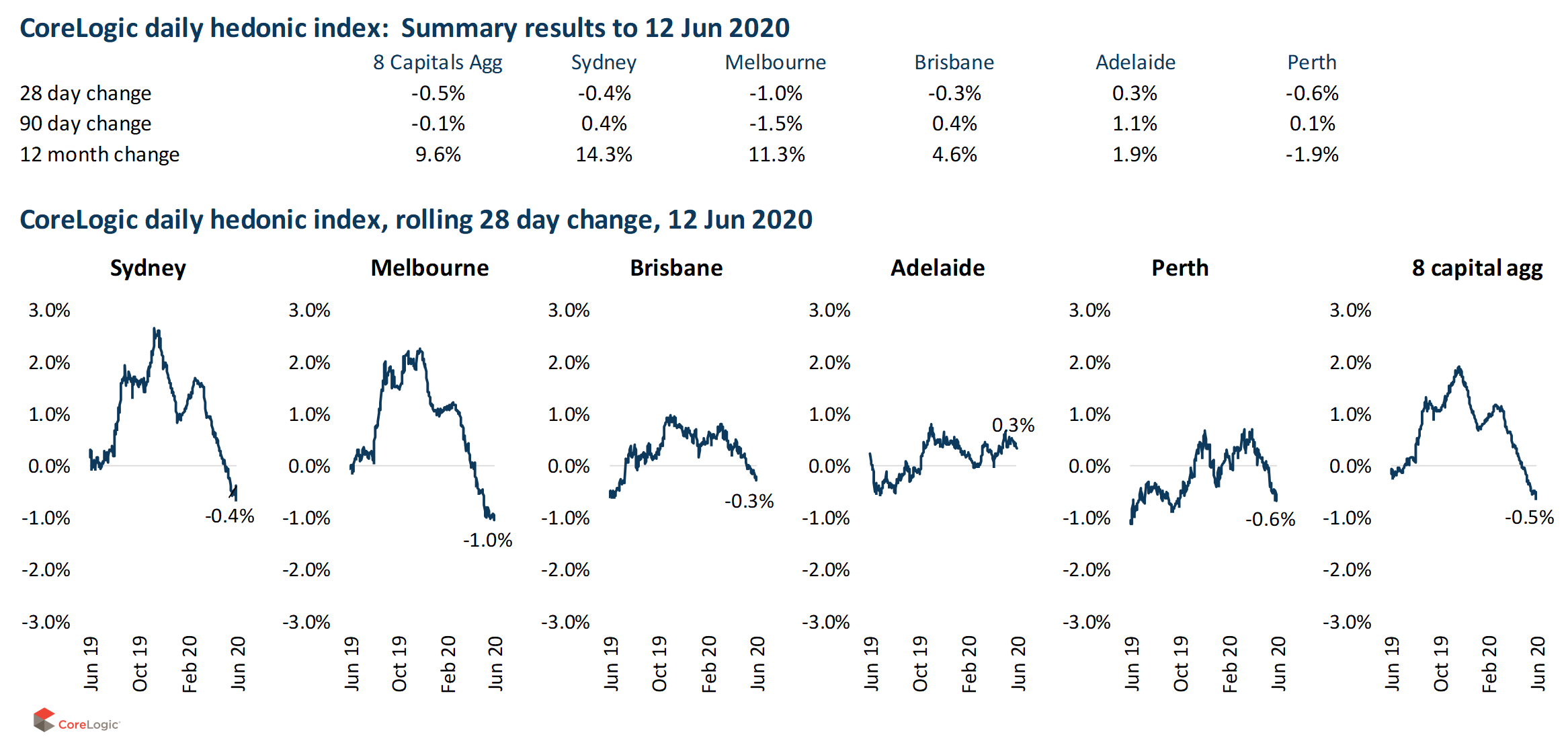

If 1929 repeats, end of August should be a good time to cash out. I'll be seriously considering hedging against at that stage.

Good ol’ 1929.

We’ll encounter some rocky times, but I can’t see a repeat of 1929. Government heavily invested this time.

Last edited: