I've just started looking into the investment options offered by the Perth Mint and to diversify a little am thinking of putting a very minimal portion into Gold and Silver.

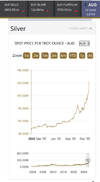

Anyone had any experiences? Long term trends show an upward trajectory so it looks a fairly reasonable long term hold play.

Anyone had any experiences? Long term trends show an upward trajectory so it looks a fairly reasonable long term hold play.