Falchoon

Brownlow Medallist

- Feb 15, 2002

- 29,574

- 10,761

- AFL Club

- St Kilda

- Other Teams

- Bluestar Airlines, Anacott Steel

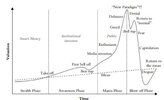

Tax should of course be a consideration of course but probably have to careful with it overriding your overall decision making or strategy on something speculative too much?

Falchoon a much smarter man (or woman) than me iirc recently held out to get a CGT discount and sold some right at the top of the spike!

I wish, 80% of my profits are in my name (thanks LTR & LPD) and 80% of my investments are in my wife's name. With a 50% CGT discount I'm still paying more tax than her! She even has a $10k capital loss offset sitting there (no thanks KEY).

I think the problem with retail investors as a whole with tax is we only want to account for it when it is realised, a business would provision for it on the journey - but to paraphrase Tom Cruise in The Firm, delaying paying it is the best free loan you can have.