- Joined

- Jun 14, 2013

- Posts

- 13,076

- Reaction score

- 15,697

- AFL Club

- Essendon

Would you like to elaborate?you are missing the point

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

PLUS Your club board comp is now up!

BigFooty Tipping Notice Img

BigFooty Tipping Notice Img

Weekly Prize - Join Any Time - Tip Opening Round

The Golden Ticket - Official AFL on-seller of MCG and Marvel Medallion Club tickets and Corporate Box tickets at the Gabba, MCG and Marvel.

Would you like to elaborate?you are missing the point

‘markets go up and down’ is not a reason to believe that instruments with negligible fundamental value and ever-increasing debt loads will always recoverWould you like to elaborate?

Did you hold the same views 2.5 years ago? Did you miss the entirety of the most recent bull run? Do you understand why others place a value on crypto above todays price of 17k for BTC?‘markets go up and down’ is not a reason to believe that instruments with negligible fundamental value and ever-increasing debt loads will always recover

crypto may well be useful some day, but the sector is now so leveraged up that ‘some day’ isn’t good enough

without a central banking system to prop things up there is no way out of the positive feedback loop of crypto prices falling triggering margin calls triggering selloffs triggering further price falls

basic economics dictates this will continue until the asset reaches its fundamental value - which, given the current usability of crypto, is close to zero

you continue to miss the implications of leverage levelsDid you hold the same views 2.5 years ago? Did you miss the entirety of the most recent bull run? Do you understand why others place a value on crypto above todays price of 17k for BTC?

There's very little point in discussing the topic further with you if you truly believe BTC is worthless. You'll miss the next bull run for the same reasons you missed the last one.

Log in to remove this Banner Ad

‘markets go up and down’ is not a reason to believe that instruments with negligible fundamental value and ever-increasing debt loads will always recover

crypto may well be useful some day, but the sector is now so leveraged up that ‘some day’ isn’t good enough

without a central banking system to prop things up there is no way out of the positive feedback loop of crypto prices falling triggering margin calls triggering selloffs triggering further price falls

basic economics dictates this will continue until the asset reaches its fundamental value - which, given the current usability of crypto, is close to zero

I'm 25% in stables, so 75% of allotted crypto funds are invested. I think we go up from here in the short term tbh (see the chart I posted earlier today in this thread).Evolved1 You said you bought around $16.5k if I remember correctly. Have you maximised your allocation already?

I'm not in a particular rush as prices will likely go lower in the short term, but I think any time between now and March will turn be a great time to buy

if FOMO is your strongest argument for buying crypto then that says it allThe next cycle will be the same as this one and you will miss it once again.

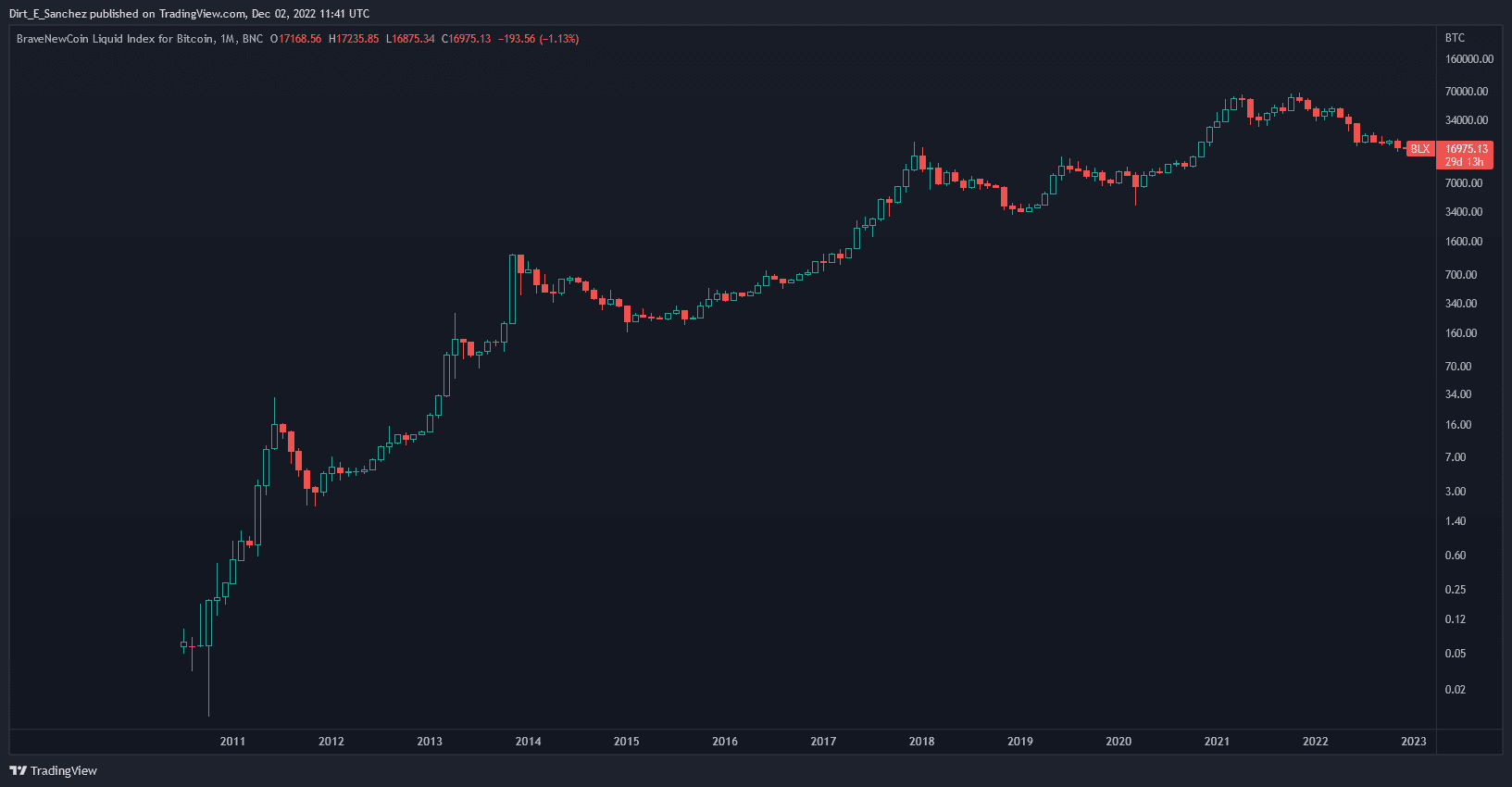

Disagree. Investing in bitcoin is a long term proposition for anyone who can handle volatility. Note the y-axis is logarithmic.I tip my hat to anybody that can make good money off buying and selling it but it honestly scares me how many people refer to speculating on crypto as 'investing'. Again absolutely nothing wrong with the former and I do a lot of it myself on other things but in absolutely no way are you doing the later.

www.forbes.com

www.forbes.com

There were paid advisors telling people to sell 3k BTC during 2019-20 because BTC was definitely going to 1k. You'll never time the bottom exactly, so accumulate at the lows IF you think there's another bull run on the way.Interesting article explaining why there’s every chance the bottom will be lower than where we’re at now. Obviously it’s never easy to time the bottom of anything, but it might be worth waiting a tad longer to start accumulating:

Crypto Winter Unwind Still Has Legs To Run And Run

The potential for contagion remains giant in most areas you look in the centralized segment of crypto.www.forbes.com

Yeah not disagreeing, was just putting the article forward as an alternative opinion. The argument in it was that there are still more dominoes to fall and more incompetent/outright corrupt actors to be exposed in the medium term which in the author’s opinion is likely to drag prices down further.There were paid advisors telling people to sell 3k BTC during 2019-20 because BTC was definitely going to 1k. You'll never time the bottom exactly, so accumulate at the lows IF you think there's another bull run on the way.

Now is the time to accumulate imho.

Who the * is selling 17k BTC? Poors like Caesar can't afford it at these prices so let's keep it out of their reach!

so how do you determine true value?Disagree. Investing in bitcoin is a long term proposition for anyone who can handle volatility. Note the y-axis is logarithmic.

Bitcoin is undervalued at 17k. Wherever we bottom, you'll never get another chance to buy that low again. Bookmark it.

Those paid advisors were right. It is going below 1000 dollars. They have never been wrong.There were paid advisors telling people to sell 3k BTC during 2019-20 because BTC was definitely going to 1k. You'll never time the bottom exactly, so accumulate at the lows IF you think there's another bull run on the way.

Now is the time to accumulate imho.

Who the * is selling 17k BTC? Poors like Caesar can't afford it at these prices so let's keep it out of their reach!

Again, if FOMO is your best argument for investing in crypto that says it allCaesar

You missed the entirety of the bull run from 3k-69k, and come here to teach your wisdom to those of us who rode the wave up by using the same arguments people have been saying since bitcoin was under $1.

Those paid advisors were right. It is going below 1000 dollars. They have never been wrong.

crypto aint the first bubble. Plenty Of people have made money off bubbles. But in the end just as many lose money as make it. The money is made first. The money is lost second. If your only argument for supporting crypto is the bull run that happened made people money in the recent past then thats one big sign to get the hell out. You need another reason.

Any investment is a gamble, with investment vehicles separated by level of risk and reward.Again, if FOMO is your best argument for investing in crypto that says it all

I don’t regret not buying crypto because it was always a gamble, and I am not and have never been a gambler. If I was, I certainly wouldn’t judge the validity of my bets based on how they panned out in retrospect (which is the fool’s approach to gambling).

If you like to gamble, more power to you. You may continue to win. But I do think you are fairly brave to continue placing bets given the level of understanding of basic finance concepts (e.g. leverage, contagion and fundamental value) you’ve displayed in this thread.

Assuming demand remains constant, price will go up because of the reduction in supply at the next halving. I'm also "gambling" on the probability of further adoption being a precursor for higher prices.Those paid advisors were right. It is going below 1000 dollars. They have never been wrong.

crypto aint the first bubble. Plenty Of people have made money off bubbles. But in the end just as many lose money as make it. The money is made first. The money is lost second. If your only argument for supporting crypto is the bull run that happened made people money in the recent past then thats one big sign to get the hell out. You need another reason.

lol of course you are a believer in TA voodooI say price will increase based on historical charts

Its your assumption about demand being constant that i strongly disagree with. The demand is extremely flaky except in the black market where crypto has some actual value. But even that is volatile. on the supply aspect i agree with you in part, although new crypto currencies can be created to compete and provide more supply.Assuming demand remains constant, price will go up because of the reduction in supply at the next halving. I'm also "gambling" on the probability of further adoption being a precursor for higher prices.

I'll bet my left nut we don't go below 1k BTC.

Crypto has consistently grown and crashed in bubbles. Will we have another? I say yes.

Plenty of traders make a living based on their form of TA voodoo. I suppose you think professional poker players are just lucky too.lol of course you are a believer in TA voodoo