Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

General Markets Talk

- Thread starter Jimmy_the_Gent

- Start date

- Tagged users None

- Mar 27, 2018

- 7,223

- 18,908

- AFL Club

- Collingwood

- Other Teams

- Cleveland Browns, Tony Ferguson

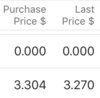

How come when I put in a limit price it then executes the order at that price

View attachment 977799

But when I check the purchase price it’s way above this figure?

View attachment 977800

do you use commsec? This has happened to me too. I don’t know why it happens, couple times I’ve had to edit the purchase price.

do you use commsec? This has happened to me too. I don’t know why it happens, couple times I’ve had to edit the purchase price.

Yeah CommSec

So the executed price is the correct figure?

- Mar 27, 2018

- 7,223

- 18,908

- AFL Club

- Collingwood

- Other Teams

- Cleveland Browns, Tony Ferguson

Yeh always refer to the executed price. Maybe someone could tell us why this happens I’ve had the same thing before .Yeah CommSec

So the executed price is the correct figure?

I use Netwealth and they do this by factoring in the brokerage costYeh always refer to the executed price. Maybe someone could tell us why this happens I’ve had the same thing before .

Gigantic

Brownlow Medallist

Went away this weekend and didn't look at the markets and SPs until late Friday night after a long 7 hour drive.

The MSB SP dive left me shook. I've been in a for a few months so pretty much back at my average buy price.

The MSB SP dive left me shook. I've been in a for a few months so pretty much back at my average buy price.

- Moderator

- #857

Thus current downturn will run for at least another year and at worst two. If the multi-trillion dollar money printing continues then next US deficit will come in around 6 trillion sans any Biden tax increases. This extra tsunami of invented money will drive a spectacular boom 22-26 as it seeps through into asset prices, just as we saw this year after March, except if will be bigger as there will be at least twice that amount created.

It's an interesting point to think about whether the U.S can afford to have the current restrictions for another 1-2 years, particularly as the data on COVID becomes clearer and we can isolate the vulnerable. I'd argue they can't and won't continue the restrictions for long into 2021.

My understanding is that all the money being pumped into the system is through the issuance of bonds (which includes a maturity and interest rate), I find the term "printing of money" to be misleading for those who believe it actually works that way (you seem like a fairly savy investor, so I'm not grouping you in this statement). It all depends on how this money is pumped into the system and then how it is spent, a lot of popular modern economics theory believes that this is the new normal and most economies can support this kind of "money pump".

If you don’t mind riding out this choppy phase and whatever next years low may be then, in 5-6 years time, particularly if you are heavily into the US market, you’ll be laughing. However, once the boom runs for a while, like 2005-7, then you’d better have prepared a sound defensive exit strategy.

We differ here on the fiscal cliff you're referring to, I am in the camp that financial crises are normally as a result of unforeseen events, which like COVID could occur but it is not enough of a reason for me to confident in the US returns over the next 1-2 decades. Time will tell though and I'd certainly never recommend having entire net worths solely in any market (whether that be real estate or the different share markets).

NST and SAR merger will make them a top 10 world gold miner. Guess it makes sense from an operational point of view both owning the Kal super pit.

DOU one that’s going to be great for the day traders. Plenty of hype when it comes to Neobanks. My 5.1c order was missed yesterday which is a pain in the arse

Might look to trade through the day

Might look to trade through the day

Trump being Trump again.

This is the power of social media pumping. DOU does nothing other apps don't and haven't for agesDOU one that’s going to be great for the day traders. Plenty of hype when it comes to Neobanks. My 5.1c order was missed yesterday which is a pain in the arse

Might look to trade through the day

They don't have a banking licence yet everyone thinks they're a bank

Hit a market cap of $50M for doing nothing. Lots of buzzwords like 'AI', 'robo-banking', 'data to give you your financial picture in one spot' (Gee my bank app doesn't do that'. Well done to everyone who made money but it's pretty ridiculous.

My good news for the day, IBX got HREC approval. In what I assume will be a red day, hopefully this goes green

Haha you’re not wrongThis is the power of social media pumping. DOU does nothing other apps don't and haven't for ages

They don't have a banking licence yet everyone thinks they're a bank

Hit a market cap of $50M for doing nothing. Lots of buzzwords like 'AI', 'robo-banking', 'data to give you your financial picture in one spot' (Gee my bank app doesn't do that'. Well done to everyone who made money but it's pretty ridiculous.

My good news for the day, IBX got HREC approval. In what I assume will be a red day, hopefully this goes green

I’m in at 7.2 and out at 7.7

In again at 6.9 and out again at 7.5

$2k in 23 mins

That’ll do me, getting heart palpitations. Better get back to work

Good work. There's no way this should be so popular but hey, doesn't matter if you profit.Haha you’re not wrong

I’m in at 7.2 and out at 7.7

In again at 6.9 and out again at 7.5

$2k in 23 mins

That’ll do me, getting heart palpitations. Better get back to work

Did you end up getting more CRO options? Doubt I use mine, probably sell them. Could be an easy 15x or more on them depending on sentiment after this trading suspension

I tried to get 160x my entitlement thinking I might get 10% of thatGood work. There's no way this should be so popular but hey, doesn't matter if you profit.

Did you end up getting more CRO options? Doubt I use mine, probably sell them. Could be an easy 15x or more on them depending on sentiment after this trading suspension

Looks like they’ve given all additional options to their mates though. Only my entitlement showing up, I have emailed them though. Wouldn’t mind my refund quickly though given I put up a fair bit

Nice. Im holding a heap of NST.NST and SAR merger will make them a top 10 world gold miner. Guess it makes sense from an operational point of view both owning the Kal super pit.

PM miners are a sure thing in these uncertain times.

My take is ultimately (excluding some ups and downs), the winner of the US election (regardless who it is), won't have much of an impact on the markets medium to long-term, even if Trump challenges the result, I think the machine that is the U.S economy will keep on churning.

What will throw the markets any assumption of continued lockdowns into the second half of 2021 or 2022, I think the market has priced in a vaccine early 2021 and back to some normalcy in the second half of 2021.

I'd be looking more at the vaccine progress than the U.S elections, it's just noise.

Trump wins: Protests continue, the wider population loses patience with the protesters and gets back to life

Biden wins: Some token dial-back of the tump era tax cuts, more predictable messaging from the president and life carries on.

The worst part of the US election is the vocal fringes on either side who are within personal networks and having to endure their lectures.

Coronavirus: Doctors told to plan for vaccination scheme

Health bosses say a huge immunisation plan is being readied for the Birmingham area.

Decent run up recently. Does seem you have some substance to it. Not looking like a pump n dump. But ya never know with microcaps.IXR at 0.01 Good news on the horizon

They never ever even give a hint of anything you shouldn't be aware of, apart from noticing they seemed unusually busy in the weeks leading up to the merger I had no idea, but as an average Joe it's interesting knowing someone that works at one of these companies and getting some insight as to what it's like a bit.WTF!!!

I took the day off the market and just saw thus a few hours ago. I finally had to look this up even though I knew it had to be true.

What an amazing merger. I have been holding these companies since 2016 but started trading them a bit this year as part of a money pump idea as their prices have frequent but a periodic multi-month highs as lows. Anyway, the best part of this is they can ditch the rapacious SAR CEO piggy boy, who thinks he deserves 11 million a year! Hit the road Jack. He was the main reason I was happy to pound NST but not build up a larger holding in SAR while this blood sucker drained off a fair whack of the profits.

Still NST up 10.64% in a day is a big move however well deserved.

This mice caught me holding about half my normal NST long position, while I tried to trade a big short on the US market. I was intending to pivot off whatever November. low was on offer, and return solidly to gold trading on the matching low gold prices that would track a fall down in US stocks.

Plus another gold recovery stock recovering m from previous disastrous nuffoidal management DCN, jumped 16.67% today on a good quarterly report. In a clean out Leigh Junk formerly of DRM took over a CEO to recover what he could from the conflagration of a three year 90% SP fall. It is a good thing he was not born black in Compton. I was looking looking to increase to my holding by 50% on continued weakness around 32c, strict price discipline is always a good idea, over the few months, following the fall of my metaphorical Moscow, the NYSE, in November before their winter set in.

Meanwhile the nuffyburgers at DRE are up to 0.036c on a trading halt bending another drilling result, after I refused to chase them at 0.016c in mid September. Bummer! So many fish that get away!

Amazing stuff!

All in just one day, and naturally the first day in months that I ignored the whole day’s trading, thinking nothing much was going to happen after a predictable uptick in the US and a co-commitment small rise in gold.

So much for the best laid plans of mice and men.

Have made $1,000s this week trading DOU. Has been one of the most predictable trades I’ve ever seen

Sell off at close, up 5 to 10% on or not long after open, each and every day without fail

Sell off at close, up 5 to 10% on or not long after open, each and every day without fail

RMX ready to rock with tenement approvals due, new drilling starting at one of their existing tenements and their neighbour MHC drilling results due soon. The third should see a decent boost short term. But overall looks a good medium - long term play.

The Lion back trading and looking good.

And just like clock work...out at 7.5c (+12% from yesterday’s close)Have made $1,000s this week trading DOU. Has been one of the most predictable trades I’ve ever seen

Sell off at close, up 5 to 10% on or not long after open, each and every day without fail

Will probably close under 7 and I’ll be back again

- Sep 2, 2014

- 16,668

- 32,003

- AFL Club

- Hawthorn

- Other Teams

- Liverpool

NPM with a busy few months of news coming up, think a few of you lot were in on this? I'm holding a small parcel.

-Argentine Cachi Gold Project maiden drilling program to commence December 2020 utilising Perforadora Santacruceña Drilling Company with a CS14 diamond coring drilling rig.

- Designed to prove the high grade Gold mineralisation discovered on surface extends at depth, leading towards the ultimate definition of a JORC Gold Resource.

- Cachi is a Caldera hosted epithermal Gold vein system with multiple large targets where rock chips have returned 17.8 g/t Gold and 50 g/t Silver, diamond sawn channel samples of 9 g/t Gold, and trench samples with 1.2g/t Gold over 11m width.

- New Zealand Cap Burn Project drilling program in final stages of design and planning for proposed commencement in December 2020.

- New permit addition to the Otago Gold Project titled Serpentine. The Serpentine EPA is 7,966 ha and NewPeak’s total ground footprint is 51,595 ha. The EPA area covers a possible sheared boundary between two distinct textural terranes similar to the geological setting at Macraes Mine.

- Finland Tampere Gold exploration permits transferred to NewPeak. Drilling program implementation plans in progress.

-Argentine Cachi Gold Project maiden drilling program to commence December 2020 utilising Perforadora Santacruceña Drilling Company with a CS14 diamond coring drilling rig.

- Designed to prove the high grade Gold mineralisation discovered on surface extends at depth, leading towards the ultimate definition of a JORC Gold Resource.

- Cachi is a Caldera hosted epithermal Gold vein system with multiple large targets where rock chips have returned 17.8 g/t Gold and 50 g/t Silver, diamond sawn channel samples of 9 g/t Gold, and trench samples with 1.2g/t Gold over 11m width.

- New Zealand Cap Burn Project drilling program in final stages of design and planning for proposed commencement in December 2020.

- New permit addition to the Otago Gold Project titled Serpentine. The Serpentine EPA is 7,966 ha and NewPeak’s total ground footprint is 51,595 ha. The EPA area covers a possible sheared boundary between two distinct textural terranes similar to the geological setting at Macraes Mine.

- Finland Tampere Gold exploration permits transferred to NewPeak. Drilling program implementation plans in progress.

I saw this pop up on twitter last night randomly. Looked and thought 'it can't get much cheaper. Remember to read into this further in the morning'.NPM with a busy few months of news coming up, think a few of you lot were in on this? I'm holding a small parcel.

-Argentine Cachi Gold Project maiden drilling program to commence December 2020 utilising Perforadora Santacruceña Drilling Company with a CS14 diamond coring drilling rig.

- Designed to prove the high grade Gold mineralisation discovered on surface extends at depth, leading towards the ultimate definition of a JORC Gold Resource.

- Cachi is a Caldera hosted epithermal Gold vein system with multiple large targets where rock chips have returned 17.8 g/t Gold and 50 g/t Silver, diamond sawn channel samples of 9 g/t Gold, and trench samples with 1.2g/t Gold over 11m width.

- New Zealand Cap Burn Project drilling program in final stages of design and planning for proposed commencement in December 2020.

- New permit addition to the Otago Gold Project titled Serpentine. The Serpentine EPA is 7,966 ha and NewPeak’s total ground footprint is 51,595 ha. The EPA area covers a possible sheared boundary between two distinct textural terranes similar to the geological setting at Macraes Mine.

- Finland Tampere Gold exploration permits transferred to NewPeak. Drilling program implementation plans in progress.

Forgot to do that this morning

Up 100% LOL

Bought more IBX this morning at 7.9

HREC approval so trials will start soon. My first buy is 2.7c and was my biggest order so holding that for CGT but the rest I'm happy to sell on good results/spike on price

HREC approval so trials will start soon. My first buy is 2.7c and was my biggest order so holding that for CGT but the rest I'm happy to sell on good results/spike on price