Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inequality is out of control in Australia

- Thread starter QuietB

- Start date

- Tagged users None

Not sure where to put this so I started a new thread - this is grim

Yes, perhaps one of the most fundamental problems we have is the growing disparity between rich and poor. Greed. I'm sure there will be much handwringing and demanding we do something about it, unfortunately it won't be met with a willingness for rich folks to pay more tax, get rid of middle class welfare or pay workers better wages. So probably nothing will change.

The Guardian has an article discussing it.

Australia’s richest captured 93% of economic growth between 2009 financial crisis and Covid, paper shows

Wealthiest 10% captured growth in company profits while most Australians watched their real wages shrink, Australia Institute finds

Can't wait for the stage 3 tax cuts so the well-off can have even more money!

Too focused on campaigning for a voice that achieves nothing than actual tangible metrics like this one. Identity politics > real politics...What are you going to do about it, besides whinging on a footy forum?

Aussies are piss weak.

- Thread starter

- #7

Dutton is doing all the campaigning for a yes vote at the moment - all the decent people are just standing back laughing at him.Too focused on campaigning for a voice that achieves nothing than actual tangible metrics like this one. Identity politics > real politics...

owen87

Premium Gold

- Apr 23, 2016

- 30,959

- 43,400

- AFL Club

- Essendon

What are you going to do about it, besides whinging on a footy forum?

Too focused on campaigning for a voice that achieves nothing than actual tangible metrics like this one. Identity politics > real politics...

The irony that the first person to reply is the poster child for whining on a football forum...

- Mar 16, 2002

- 21,720

- 13,436

- AFL Club

- Richmond

- Other Teams

- Richmond

Can't wait for the stage 3 tax cuts so the well-off can have even more money!

Yep … and more services will be to be cut… leading to more poor people that can then be blamed for being poor.

Power Raid

We Exist To Win Premierships

if we want equality

1) introduce a proper property tax

2) increase social housing with a rent to buy/ islamic banking model

3) increase GST

1) introduce a proper property tax

2) increase social housing with a rent to buy/ islamic banking model

3) increase GST

- Oct 7, 2002

- 15,885

- 16,323

- AFL Club

- Collingwood

A prize to anyone who has Islamic banking on their Power Raid bingo card this week

said in jest

said in jest

- Thread starter

- #14

Or we could just tax people and business properly and pay people properly.if we want equality

1) introduce a proper property tax

2) increase social housing with a rent to buy/ islamic banking model

3) increase GST

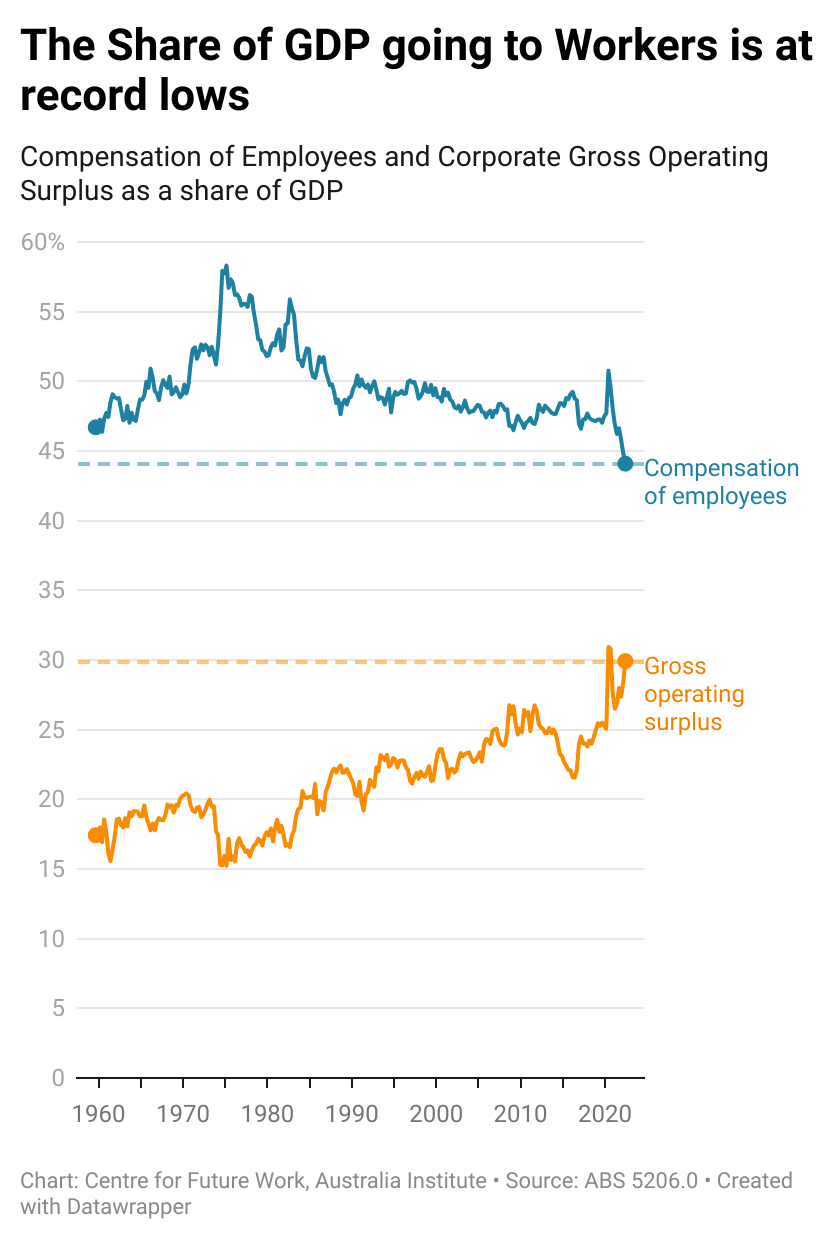

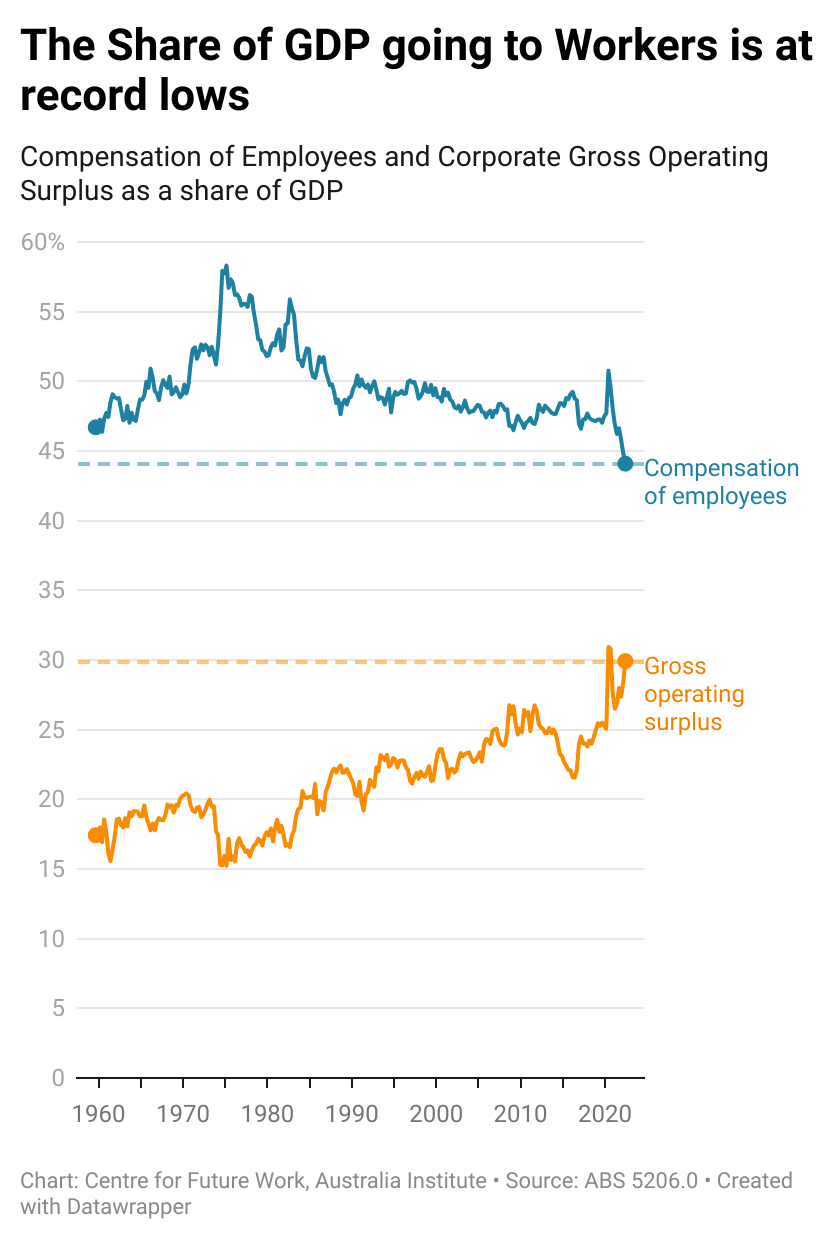

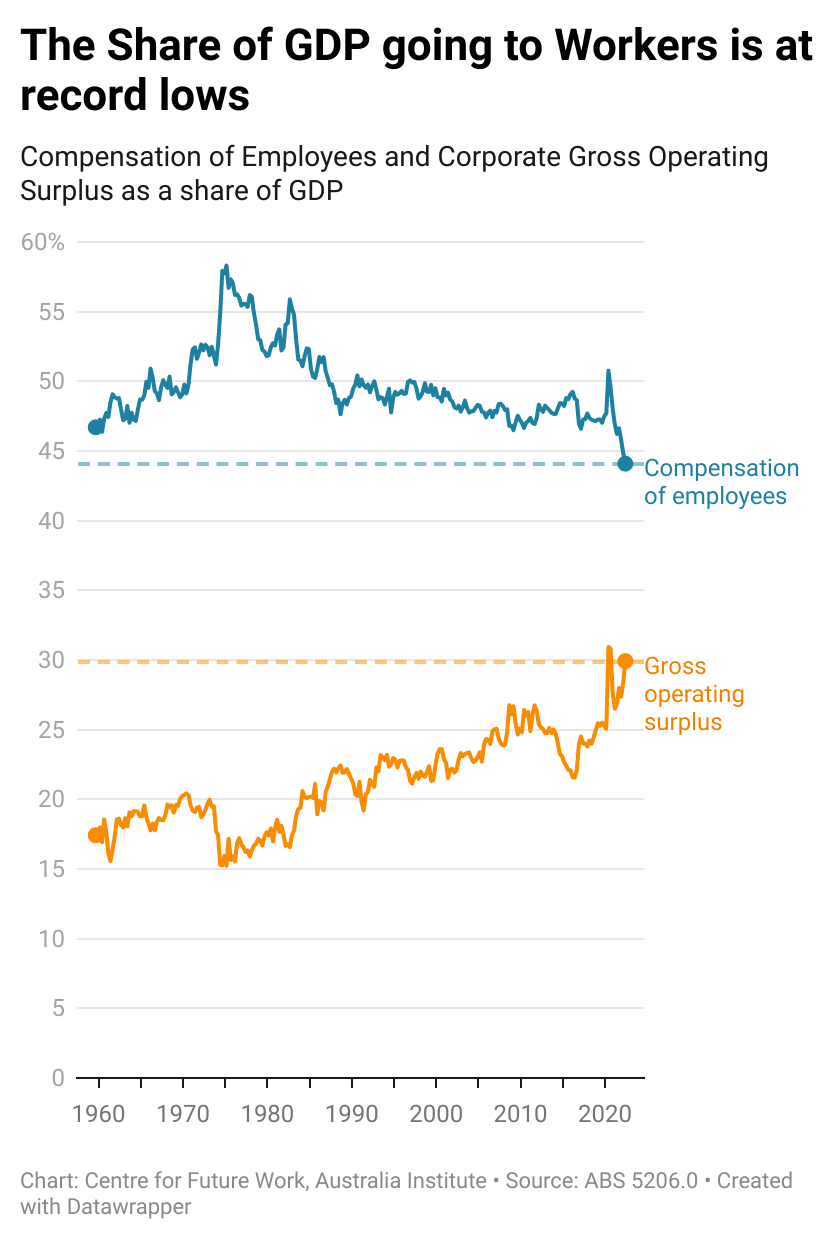

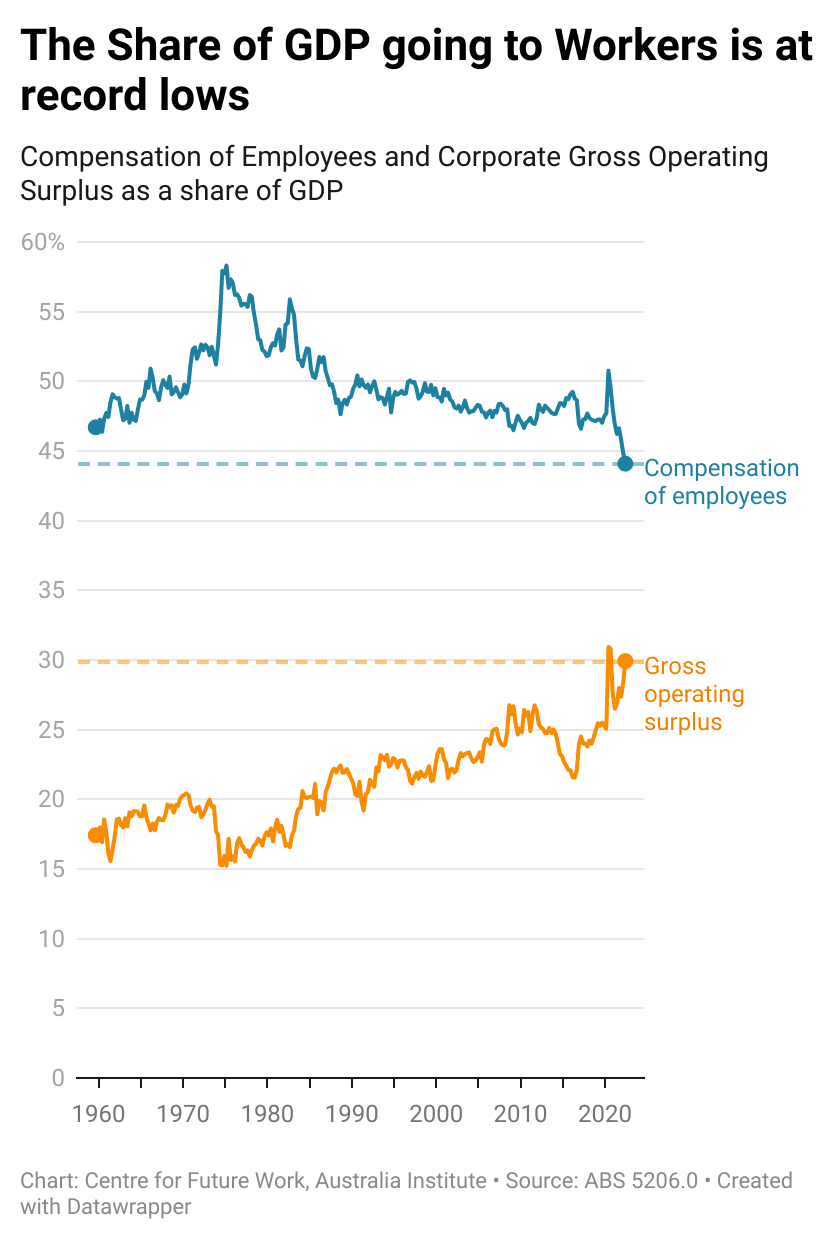

Less of Australia's national income is going to workers than ever before

The latest GDP figures show more than ever before workers are getting less than their fair share

Or we could just tax people and business properly and pay people properly.

Less of Australia's national income is going to workers than ever before

The latest GDP figures show more than ever before workers are getting less than their fair shareaustraliainstitute.org.au

View attachment 1657503

You mean appropriately.

I can't for the life of me understand why the top tax rate has to cut in at only $180,000. Surely there could be another tax bracket that kicks in at, say $300,000 with a higher rate.

Also, we'd get a lot further with tax simplification than increasing taxes. Every deduction is attached to a behaviour that at one stage a government thought was something they would like to encourage. All those have to be looked at to ensure effectiveness. Simplifying the tax laws would enable much more revenue to be raised without increasing any rate of tax.

Final tip: don't confuse revenue with profits - a common tool of those trying to make the "they don't pay enough tax" point.

- Thread starter

- #16

There has not been a significant rise in real wages for decades.You mean appropriately.

I can't for the life of me understand why the top tax rate has to cut in at only $180,000. Surely there could be another tax bracket that kicks in at, say $300,000 with a higher rate.

Also, we'd get a lot further with tax simplification than increasing taxes. Every deduction is attached to a behaviour that at one stage a government thought was something they would like to encourage. All those have to be looked at to ensure effectiveness. Simplifying the tax laws would enable much more revenue to be raised without increasing any rate of tax.

Final tip: don't confuse revenue with profits - a common tool of those trying to make the "they don't pay enough tax" point.

In March 2019, then Federal Finance Minister, Mathias Cormann, described low wage growth as “a deliberate design feature of our economic architecture.”

The complete bullshit line perpetuated by successive Liberal governments that lower taxes are good for the economy is precisely bullshit. All it does is shift shortfalls in government revenue to national debt - something younger generations can also look forward to getting screwed on.

I have heard many many people complain about tax. I have never heard anyone stopped working because they were making money (and therefore paying tax).

I've been watching to see how the Murdoch press respond. So far I don't see any reporting. Perhaps deciding on a corporate strategy to denigrate the report or possibly they will simply ignore it and hope it goes away. It's pretty damning indictment of recent economic outcomes, much of which will be blamed on 'neoliberal' economic policy of the sort Murdoch shills advocate.

I suspect the Feds will use it to try to wind back stage 3 tax cuts.

I suspect the Feds will use it to try to wind back stage 3 tax cuts.

Concerning trend there.Or we could just tax people and business properly and pay people properly.

Less of Australia's national income is going to workers than ever before

The latest GDP figures show more than ever before workers are getting less than their fair shareaustraliainstitute.org.au

View attachment 1657503

If that continues, socially we'll be trending back to the 1840s.

sataris

Chief Toastie Officer

- Feb 15, 2015

- 10,116

- 20,177

- AFL Club

- Sydney

Or we could just tax people and business properly and pay people properly.

Less of Australia's national income is going to workers than ever before

The latest GDP figures show more than ever before workers are getting less than their fair shareaustraliainstitute.org.au

View attachment 1657503

But what about the poor shareholders of Exxon, Rio Tinto?

Does nobody think about them?

beez

A*mazing

What do you think of removing negative gearing as it currently stands and offering tax benefits only to those who invest in social housing? Either a company that builds/develops social housing through a tender process or individuals/companies investing for the future? I'm not sure how social housing currently operates, but the public/private partnership with safeguards put in place for those accessing housing and income guarantees for individuals investing in this form of housing, would surely be a better option than the current model.if we want equality

1) introduce a proper property tax

2) increase social housing with a rent to buy/ islamic banking model

3) increase GST

That way we still allow people to invest in real estate but it is done in a more socially conscious manner.

Well we voted the Liberals/Nationals out of office on mainland Australia.What do you suggest he do?

That's important as the ALP are traditionally the party bringing in legislation for social and economic reforms.

With time, and support at the ballot box, we could see significant changes.

What do you think of removing negative gearing as it currently stands and offering tax benefits only to those who invest in social housing? Either a company that builds/develops social housing through a tender process or individuals/companies investing for the future? I'm not sure how social housing currently operates, but the public/private partnership with safeguards put in place for those accessing housing and income guarantees for individuals investing in this form of housing, would surely be a better option than the current model.

That way we still allow people to invest in real estate but it is done in a more socially conscious manner.

Considering the level of the problem with housing affordability in Australia, we shouldn't rule anything out as a potential reform.

- Oct 4, 2016

- 7,407

- 11,659

- AFL Club

- Richmond

it's out of control worldwide. as long as there are poor and disenfranchised peace will never be.

Power Raid

We Exist To Win Premierships

What do you think of removing negative gearing as it currently stands and offering tax benefits only to those who invest in social housing? Either a company that builds/develops social housing through a tender process or individuals/companies investing for the future? I'm not sure how social housing currently operates, but the public/private partnership with safeguards put in place for those accessing housing and income guarantees for individuals investing in this form of housing, would surely be a better option than the current model.

That way we still allow people to invest in real estate but it is done in a more socially conscious manner.

Neg Gearing

I'm not a fan of isolating residential housing to other asset classes, as this creates "obvious" unforeseen issues such as we have seen with AirBnB regulatory changes.

I do believe the greens and labor's proposed changes is exactly what we should do. ie:

- we need to promote long term investment in asset classes such as housing, R&D, renewable energy, infrastructure, health and every other similar concept. By removing discounts we promote day trading, speculation and gambling. What we should have done is staged the 50% discount over 3-5 years rather than after 12 months.

Social Housing

In regards to your specific example, yes we need social housing and Singapore's DRB housing model should be investigated. Be it rent to buy/ islamic banking or other, it is important that people have an asset base rather than just rent for a variety of reasons. People who just rent have no care over the home other than the fear of penalties and the bigger issue, they are not building an asset base they can work from.

For me social housing should not be some pathetic home that generates a negative thought when you hear "I live in social housing". It should be quality not a ghetto. Given this is the case, there is no need for different quality to current market designs.

The difference is funding models and one failure in the current system is the 20% deposit requirement. This needs to be eradicated with either the govt paying this % or the bank paying this %.

I would like to see billions invested in social housing schemes including high rise over ever train station, connecting transportation and the people.

Poor Zoning

To reduce costs we need to rethink our poor zoning laws which restrict supply and rethink construction models. Mass produced prefab and 3D printing may offer the solution here in time. In terms of zoning, we live in a time of decentralisation technologies but our mindset on housing is bigger and bigger cities.

We should be nation building and having 10 1m population cities rather than the disasters of Sydney and Melbourne. Even Perth is getting to big.

Property Tax integrated with Income Tax

To pay for this we should have a property tax for all properties which is integrated with income tax. If a piece of land can generate $15k of revenue, the property tax should be $15k * 30% = $4,500 plus a flat rate of $1k being $5,500 per annum. If in the tax return the income tax paid on the property was $4,000, the property tax is reduced to $1,500 ($5,500 less the $4,000). This mitigates tax loss to the govt, where properties being left vacant and or tax avoidance schemes used.

Similar threads

- Replies

- 211

- Views

- 6K

- Replies

- 40

- Views

- 2K

- Replies

- 1

- Views

- 330