The average worker in South Australia earns 39k. This average wage of 60k is bullshit. Just because a couple of suits will earn 250k while everyone else earns 40k, it doesnt meaan the average wage is 60k. Grt rid of the outliers

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Duncan Storrar is right. Why are only the wealthy entitled to tax cuts under Liberal governments?

- Thread starter A Cut Above

- Start date

- Tagged users None

- May 5, 2006

- 62,726

- 70,017

- AFL Club

- West Coast

The average worker in South Australia earns 39k. This average wage of 60k is bullshit. Just because a couple of suits will earn 250k while everyone else earns 40k, it doesnt meaan the average wage is 60k. Grt rid of the outliers

Actually, yes it does.

The ABS publishes average and median wage statistics.

Lester Burnham

Cancelled

- Jul 9, 2013

- 4,492

- 4,406

- AFL Club

- Geelong

What these guys get on $150,000 per annum, by way of a tax return each year, is more than an unemployed person sees in an entire year....It's Pure ******* greed.

Stop making s**t up.

JoseMourinho

Not A Manager

If you invest in the share market, it takes 2-3 days to get it out with T+2 so not that liquidly challenged. It is what you do when you have a good income that may not last. Save a portion of it for the time where you don't have a job which Income Protection can't cover.I think they might be suggesting that all the rich's money is already divvied up into sundry 'port-folios', thereby rendering them liquidly challenged, should they lose their job/income.....Ooh, the pain & hardship of missing out on the quarterly bank interest payment.

Interest is also calculated daily in a bank.

JoseMourinho

Not A Manager

A person on 150k would pay 46.1k in tax, have to be a private health fund member (or Medicare eats him alive).What these guys get on $150,000 per annum, by way of a tax return each year, is more than an unemployed person sees in an entire year....It's Pure ******* greed.

For this financial year, he'd have to pay 46.4k in tax.

If the person on 150k taxable income receives a refund then that potentially means that his employer was withholding more than what was actually necessary which would be disadvantageous to him (since you do not get interest on your tax refund).

However, the people who minimise their tax as I've said countless times do not let themselves earn that amount of income. They either distribute it among their family or withdraw it in a piecemeal sort of way. (like a salary from a company)

It is incredibly tax ineffective to be earning 300k in a year because it will also hit your Superannuation too.

I am talking from a financial planner's perspective and not from a moral perspective. I am telling you how it is done effectively.

- Feb 24, 2013

- 45,365

- 37,740

- AFL Club

- Hawthorn

- Other Teams

- Man Utd Green Bay Melb Storm

- Banned

- #256

Stop making s**t up.

That's no argument Lester.

At least Jose put some thought into his reply.

Lester Burnham

Cancelled

- Jul 9, 2013

- 4,492

- 4,406

- AFL Club

- Geelong

- Feb 24, 2013

- 45,365

- 37,740

- AFL Club

- Hawthorn

- Other Teams

- Man Utd Green Bay Melb Storm

- Banned

- #258

You want me to show a copy of a tax return?.....Privacy disclosures Lester.

Just know that I've been privy to said tax-return for a person earning that amount.

Ratts of Tobruk

Cancelled

- May 1, 2013

- 9,168

- 5,975

- AFL Club

- Carlton

- Other Teams

- ATV Irdning

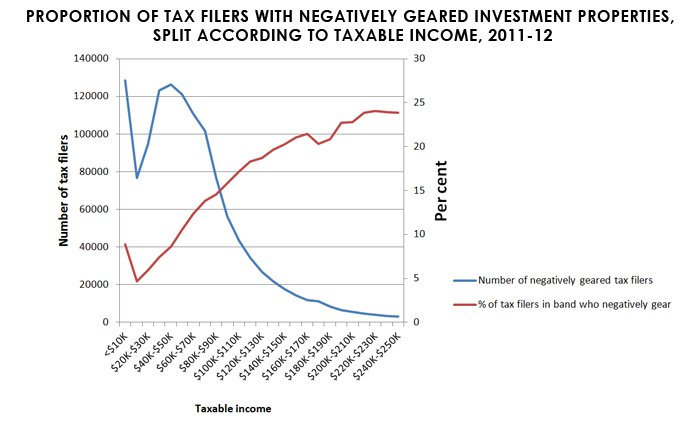

For someone on $150K to have a tax return of $16K, they would simply have to prove their income was $41,025 less than it was expected to be. This may seem a lot, but with negative gearing it can be achieved. The average net rental loss in Turnbull's Wentworth electorate is $20,248. It's similar in Julie Bishop's electorate. You're halfway there if you have the average. Of course if you're on the higher end, you're a lot closer. Plenty of negative gearers own multiple negatively-geared properties. And of course there are other losses that can be claimed.

Procrastinator's anecdote is entirely believable.

Procrastinator's anecdote is entirely believable.

JoseMourinho

Not A Manager

And so have I...You want me to show a copy of a tax return?.....Privacy disclosures Lester.

Just know that I've been privy to said tax-return for a person earning that amount.

And they are losing money to the tune of $25,000 per year due to their poor investment in hope the capital gains outweigh the income lost. If they had a rental gain of $41,025, they would get taxed to the tune of $64For someone on $150K to have a tax return of $16K, they would simply have to prove their income was $41,025 less than it was expected to be. This may seem a lot, but with negative gearing it can be achieved. The average net rental loss in Turnbull's Wentworth electorate is $20,248. It's similar in Julie Bishop's electorate. You're halfway there if you have the average. Of course if you're on the higher end, you're a lot closer. Plenty of negative gearers own multiple negatively-geared properties. And of course there are other losses that can be claimed.

Procrastinator's anecdote is entirely believable.

,704 instead of $46,132. It is key to pay attention to the alternative otherwise you will miss the forest for the trees.

So by negative gearing, they gain $16,000 in tax but if they gain $41,025 then they pay $18,572 in tax.

Now lets look at the source material as per chart below:

Stating that his ancedote is possible is silly because you are extrapolating easily 2 standard deviations out of the data range. That is incredibly poor statistical analysis.

Not to mention the person you referred to wrote the ABC article and also wrote the Australia Institute analysis (which was purely conducted by him and all footnotes refer to him or the ATO). He doesn't discuss why the negative gearing figures are different between different areas because that is actually very vital to why certain electorates have higher negative gearing rates. He instead targets the political party of the member in that region.

Infact, you can check the comments of your article. It isn't just me that shows these concerns on this analysis.

Ratts of Tobruk

Cancelled

- May 1, 2013

- 9,168

- 5,975

- AFL Club

- Carlton

- Other Teams

- ATV Irdning

"The hope"? Have you not seen how property prices have moved over the last 20 years?And they are losing money to the tune of $25,000 per year due to their poor investment in hope the capital gains outweigh the income lost.

What? You're suggesting an alternative reality where they gain $41K instead of losing it? An $82K turnaround? I am indeed missing the forest and the trees - looks like sawdust to me...If they had a rental gain of $41,025, they would get taxed to the tune of $64,704 instead of $46,132. It is key to pay attention to the alternative otherwise you will miss the forest for the trees.

So are you trying to say that because they get taxed they deliberately lose income with only a "hope" of capital gains, just because, um, tax?So by negative gearing, they gain $16,000 in tax but if they gain $41,025 then they pay $18,572 in tax.

That chart plots the averages and then has a trend-line. It's highly possible that some people are a substantial amount above and below the line. Some people own 10+ negatively geared houses. And I actually said that combining these losses with other tax write-offs could get you to that $16K tax return. Given both you and Procrastinator claim to have seen tax returns exactly like this, it's unclear why you would debate it. Is it because I made the direct link with negative gearing and you don't like that Labor are leading on it?Now lets look at the source material as per chart below:

View attachment 247784

Stating that his ancedote is possible is silly because you are extrapolating easily 2 standard deviations out of the data range. That is incredibly poor statistical analysis.

Poppycock. It's obviously easier to negatively gear to high amounts in expensive areas, but it's also patently obvious that areas where people are negatively geared to high amounts aren't going to like the idea of this changing. The fact they're all Liberal seats is indeed an important point when considering why the Liberals don't want to do anything about negative gearing, or revenue loss, or even housing affordability.Not to mention the person you referred to wrote the ABC article and also wrote the Australia Institute analysis (which was purely conducted by him and all footnotes refer to him or the ATO). He doesn't discuss why the negative gearing figures are different between different areas because that is actually very vital to why certain electorates have higher negative gearing rates. He instead targets the political party of the member in that region.

The "comments" thread of a politically-sensitive article is rarely an indicator of anything substantial.Infact, you can check the comments of your article. It isn't just me that shows these concerns on this analysis.

JoseMourinho

Not A Manager

Oh, so they'll keep going up then"The hope"? Have you not seen how property prices have moved over the last 20 years?

Then they would be outliers and unless the ATO has said something stating that is a large majority. I don't know many people that own 10 properties that are all negatively geared. I know two people who have three properties with 1-2 potentially negatively geared but not all of them.That chart plots the averages and then has a trend-line. It's highly possible that some people are a substantial amount above and below the line. Some people own 10+ negatively geared houses. And I actually said that combining these losses with other tax write-offs could get you to that $16K tax return. Given both you and Procrastinator claim to have seen tax returns exactly like this, it's unclear why you would debate it. Is it because I made the direct link with negative gearing and you don't like that Labor are leading on it?

I said that I have seen tax returns, you're putting words in my mouth deliberately to manipulate opinion (as you always do). I don't give a s**t if Liberal, Labor, Green, Nationals, Sex Party or whoever introduced this.

It is poor policy because it won't solve the actual underlying problem regarding property prices. It isn't negative gearing that is driving property, it is the scarcity of land which the property developers will now adjust for if people decide to not go into property due to it being non-tax effective.

I won't be surprised if people move into Margin Loans instead and negative gear through there by investing in shares with low dividend yields.

Attacking my credibility has always been a hallmark of this forum because I can count about 10-15 times where I disagree with the status quo that I'm called a "right wing blow hard", "liberal voter", "a cold and heartless person who knows nothing about human suffering" and what not. I do appreciate CM86 and Maggie6 (OT: Where is maggie?)

Yeah, it would because you seem to focus on the losses instead of if they had a gain because that is what people evaluate before they go into investments. The entire reason why people negatively gear is hoping for the capital gain to be large enough to offset their negative cashflow. They use NPV and various of other measures to calculate it.What? You're suggesting an alternative reality where they gain $41K instead of losing it? An $82K turnaround? I am indeed missing the forest and the trees - looks like sawdust to me...

It is because they become taxed at a higher rate and that the capital gains discount of 50% that they choose to negatively gear and let it appreciate in capital value (while maximising depreciation). It is more tax-effective and valuable to them because of the 50% discount which is why I support a removal of it.

Yes...? Why are you implying that my thinking is stupid? That is what people do when they put money into any structure is that is it tax-effective and will it build wealth over time?So are you trying to say that because they get taxed they deliberately lose income with only a "hope" of capital gains, just because, um, tax?

If you're investing into something because of tax benefits purely and not expecting some sort of gain then you better have other cash flows covering for it.

Poppycock. It's obviously easier to negatively gear to high amounts in expensive areas, but it's also patently obvious that areas where people are negatively geared to high amounts aren't going to like the idea of this changing. The fact they're all Liberal seats is indeed an important point when considering why the Liberals don't want to do anything about negative gearing, or revenue loss, or even housing affordability.

So pretty much the article you linked is a political hit at the Liberals instead of actually looking at why negative gearing is prevalent in rich suburbs as you call it and not at all prevalent in regional areas. I mean some of the Labor areas also have negative gearing in it as well so it isn't a unique predicament to the Liberal Party.

The "comments" thread of a politically-sensitive article is rarely an indicator of anything substantial.

Usually, it is the spouting of party lines back and forth but this comments section actually discusses the analysis is being simplistic and wasn't investigative enough. I completely agree because it isn't. It is to serve as confirmation bias for those who want to get rid of negative gearing instead of digging deeper to look at it.

Number37

Anyhow, have a Winfield 25.

- Oct 5, 2013

- 22,242

- 24,290

- AFL Club

- Sydney

And if we increase welfare, sorry, "give tax breaks" to the poor, that money comes from...?

Do you know how a society works?

Hint: it is impossible for everyone to have money to get by.

Lester Burnham

Cancelled

- Jul 9, 2013

- 4,492

- 4,406

- AFL Club

- Geelong

You want me to show a copy of a tax return?.....Privacy disclosures Lester.

Just know that I've been privy to said tax-return for a person earning that amount.

Only 20% of people earning $150k have negatively geared properties. Most of the remaining 80% would be salaried employees who can claim very little in deductions. As JoseMourinho said, this financial year, they'd be up for $46.4k in tax.

- Feb 24, 2013

- 45,365

- 37,740

- AFL Club

- Hawthorn

- Other Teams

- Man Utd Green Bay Melb Storm

- Banned

- #265

The general point is that those earning over $80k, should not be getting any more tax breaks, as it's always felt worst & carried down to the poor & lower-middle classes. Who are struggling to make ends meet enough as it is....It's high time that the pendulum swung back the other way..

If labor were smart, they'd be using the abolition of penalty rates, under a liberal govt, as the core issue of this election.....Their all that's left to the poor working-class as a means of savings & a holiday ffs.

If labor were smart, they'd be using the abolition of penalty rates, under a liberal govt, as the core issue of this election.....Their all that's left to the poor working-class as a means of savings & a holiday ffs.

JoseMourinho

Not A Manager

This would be a very stupid idea because the rich would simply ensure that they did not earn 80k in a financial year personally. Salaried employees who can do nothing but salary sacrifice/negatively gear would be significantly affected by this.The general point is that those earning over $80k, should not be getting any more tax breaks, as it's always felt worst & carried down to the poor & lower-middle classes. Who are struggling to make ends meet enough as it is....It's high time that the pendulum swung back the other way..

Business owners with companies/trusts can manipulate their income quite easily.

JoseMourinho

Not A Manager

Well, the government usually gets the funds back if you do try to rort it.Does a statistical analysis of the percentage of the welfare budget that goes to the genuinely needy vs people who sort the system exist?

- May 5, 2006

- 62,726

- 70,017

- AFL Club

- West Coast

The general point is that those earning over $80k, should not be getting any more tax breaks, as it's always felt worst & carried down to the poor & lower-middle classes. Who are struggling to make ends meet enough as it is....It's high time that the pendulum swung back the other way..

If labor were smart, they'd be using the abolition of penalty rates, under a liberal govt, as the core issue of this election.....Their all that's left to the poor working-class as a means of savings & a holiday ffs.

Extra money above what one needs... shouldn't it be taxed at a higher rate?

- May 5, 2006

- 62,726

- 70,017

- AFL Club

- West Coast

Do you know how a society works?

Hint: it is impossible for everyone to have money to get by.

There is enough money in Australia for everyone to get by.

Lester Burnham

Cancelled

- Jul 9, 2013

- 4,492

- 4,406

- AFL Club

- Geelong

The general point is that those earning over $80k, should not be getting any more tax breaks, as it's always felt worst & carried down to the poor & lower-middle classes. Who are struggling to make ends meet enough as it is....It's high time that the pendulum swung back the other way..

Perhaps the general point should be that people who are net contributors year after year should get a tax break. They are paying for everyone else who are net tax/welfare recipients. In recent years we have seen the tax free bracket tripled, increased number of people receiving more benefits than tax paid and more and more people claiming disability pension. It's high time that the pendulum swung back the other way.

If labor were smart, they'd be using the abolition of penalty rates, under a liberal govt, as the core issue of this election.....Their all that's left to the poor working-class as a means of savings & a holiday ffs.

Labor is not smart. Their own 'Independent umpire', Fair Work Australia, are going to recommend lowering of penalty rates. The ALP won't commit to what FWA might stipulate. Partly to appease their union paymasters and partly to avoid upsetting their likely coalition partners, The Greens.

- May 5, 2006

- 62,726

- 70,017

- AFL Club

- West Coast

Perhaps the general point should be that people who are net contributors year after year should get a tax break. They are paying for everyone else who are net tax/welfare recipients. In recent years we have seen the tax free bracket tripled, increased number of people receiving more benefits than tax paid and more and more people claiming disability pension. It's high time that the pendulum swung back the other way.

I don't think net contributors necessarily deserve a tax break for simply being net contributors, but the level of contribution and the balance of the budget need to be kept in check.

Ratts of Tobruk

Cancelled

- May 1, 2013

- 9,168

- 5,975

- AFL Club

- Carlton

- Other Teams

- ATV Irdning

Ah, no. We were talking about potential tax returns now. Consequently that means they're negatively geared now and would have started that at some point during the property boom.Oh, so they'll keep going up then. This is basic "you can't look at past performance is an indicator of future performance".

I don't know what point you are trying to make. You and Procrastinator have both seen tax returns worth $16K. I explained a fairly easy way to get to that number using negative gearing and other deductions.Then they would be outliers and unless the ATO has said something stating that is a large majority. I don't know many people that own 10 properties that are all negatively geared. I know two people who have three properties with 1-2 potentially negatively geared but not all of them.

I haven't put words in your mouth at all. You said "And so have I" in response to Procrastinator saying he had seen tax returns worth $16K. I don't know why you are saying "as you always do" - but it looks a lot like you are trying to "manipulate opinion".I said that I have seen tax returns, you're putting words in my mouth deliberately to manipulate opinion (as you always do). I don't give a s**t if Liberal, Labor, Green, Nationals, Sex Party or whoever introduced this

It will help solve the problem of property prices and new builds are still encouraged as they are still elligible, so new land will not be effected by Labor's policy. Negative gearing is also a huge revenue leak as people can massively reduce their tax bills via it. Hence this discussion. And we need revenue.It is poor policy because it won't solve the actual underlying problem regarding property prices. It isn't negative gearing that is driving property, it is the scarcity of land which the property developers will now adjust for if people decide to not go into property due to it being non-tax effective.

'Attacking your credibility'? I asked you if the fact this was a Labor policy was the reason why you were annoyed I'd brought up neg gearing. You haven't provided a viable alternate theory for why you have attempted to attack my posts on the matter. You say it will effect land availability (or not address that need), and that is untrue. You say it won't help effect housing affordability and it will help that.Attacking my credibility has always been a hallmark of this forum because I can count about 10-15 times where I disagree with the status quo that I'm called a "right wing blow hard", "liberal voter", "a cold and heartless person who knows nothing about human suffering" and what not. I do appreciate CM86 and Maggie6 (OT: Where is maggie?)

I'm querying it, because you seem to be choosing a complicated way to explain why someone negatively gears. You don't need to invent an $82K turnaround. A lot of people avoid tax if they can - we all know this. Negative gearing allows you to avoid tax while the value of a property goes up. The idea that people would also do it because if they made money they'd be taxed is a bit of a stretch. If you could make $41K a year renting, you would. That's a lot of money and the property value still goes up. So, yes, I still don't know what point you were trying to make.Yes...? Why are you implying that my thinking is stupid? That is what people do when they put money into any structure is that is it tax-effective and will it build wealth over time

I disagree on your dismissing the article and its implications.So pretty much the article you linked is a political hit at the Liberals instead of actually looking at why negative gearing is prevalent in rich suburbs as you call it and not at all prevalent in regional areas. I mean some of the Labor areas also have negative gearing in it as well so it isn't a unique predicament to the Liberal Party.

Usually, it is the spouting of party lines back and forth but this comments section actually discusses the analysis is being simplistic and wasn't investigative enough. I completely agree because it isn't. It is to serve as confirmation bias for those who want to get rid of negative gearing instead of digging deeper to look at it.

Ratts of Tobruk

Cancelled

- May 1, 2013

- 9,168

- 5,975

- AFL Club

- Carlton

- Other Teams

- ATV Irdning

That is "taxable income" - i.e. their income after negatively gearing. That's why you have 130,000 people who use it despite seemingly earning under $10K. It's a really great illustration of why this is a massive revenue leak, which has also helped massively inflate property prices since Howard gave the 50% capital gains tax discount in 1999.20% of people earning $150k have negatively geared properties. Most of the remaining 80% would be salaried employees who can claim very little in deductions. As JoseMourinho said, this financial year, they'd be up for $46.4k in tax.

- Feb 24, 2013

- 45,365

- 37,740

- AFL Club

- Hawthorn

- Other Teams

- Man Utd Green Bay Melb Storm

- Banned

- #275

This would be a very stupid idea because the rich would simply ensure that they did not earn 80k in a financial year personally. Salaried employees who can do nothing but salary sacrifice/negatively gear would be significantly affected by this.

Business owners with companies/trusts can manipulate their income quite easily.

Well Jose, I'll be sure and p.m you, by running by you, any more 'stupid tax ideas' before posting again.

Similar threads

- Replies

- 1

- Views

- 412

- Locked

- Replies

- 29

- Views

- 915

- Replies

- 150

- Views

- 6K

- Replies

- 62

- Views

- 3K

- Replies

- 36

- Views

- 1K