- Banned

- #1

There are too many changes for just one thread; it is worth having a few different threads dedicated to individual aspects of last night's 2014 budget imo. And this one definitely deserves some attention.

If I am reading this right, then people who are in uni now will not cop the higher rates until 2020 (at which point they will apply to preexisting debt), whereas people beginning uni from this point on (or beginning 2016, it's not clear) will be hit with the higher rates from the get-go.

Now there are two issues here:

1) Should uni debt provided by government attract an interest rate above inflation?

2) Should those who accrued debt under the inflation-only model be expected to now cop interest as well?

If you believe in the fraudulent economic orthodoxy which dominates discourse today ('governments have to borrow money from other people and can't create their own') then I can see why you might say 'yes' to question 1. Given the smothering we cop from MSM and our 'education' system which tell us that this is the case, I'm not even going to bother arguing on this one.

But what I cannot understand is how it is even legal, let alone fair, to add interest on to debt which people took out under the pretense that it was adjusted for inflation only. That is completely ****ed up. You might argue, 'well you've got six years, you can pay the debt off in that time', but that fails to see the principle behind the point being made.

People have entered into a deal to pay back an amount at one rate and will now have to pay it back at a much higher rate. But this isn't simply a matter of increased interest payments, this is a matter of adding interest payments where none existed before. Some of us detest the idea of usury and entered into these loans in the knowledge that the payment mechanism was not usurious. Now all of a sudden we have tens of thousands of dollars of debt that is going to attract interest?

That s**t is ****ed up on a fundamental level.

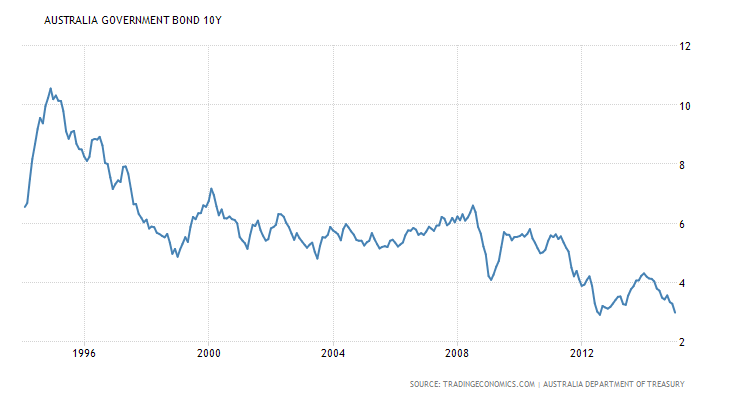

http://www.abc.net.au/news/2014-05-...e-university-students-pay-more-budget/5450878The Government is also increasing student loan interest rates to reflect the cost of Government borrowing. The rates will be allowed to rise to up to 6 per cent, instead of being set at the the rate of inflation - currently sitting at 2.9 per cent.

If I am reading this right, then people who are in uni now will not cop the higher rates until 2020 (at which point they will apply to preexisting debt), whereas people beginning uni from this point on (or beginning 2016, it's not clear) will be hit with the higher rates from the get-go.

Now there are two issues here:

1) Should uni debt provided by government attract an interest rate above inflation?

2) Should those who accrued debt under the inflation-only model be expected to now cop interest as well?

If you believe in the fraudulent economic orthodoxy which dominates discourse today ('governments have to borrow money from other people and can't create their own') then I can see why you might say 'yes' to question 1. Given the smothering we cop from MSM and our 'education' system which tell us that this is the case, I'm not even going to bother arguing on this one.

But what I cannot understand is how it is even legal, let alone fair, to add interest on to debt which people took out under the pretense that it was adjusted for inflation only. That is completely ****ed up. You might argue, 'well you've got six years, you can pay the debt off in that time', but that fails to see the principle behind the point being made.

People have entered into a deal to pay back an amount at one rate and will now have to pay it back at a much higher rate. But this isn't simply a matter of increased interest payments, this is a matter of adding interest payments where none existed before. Some of us detest the idea of usury and entered into these loans in the knowledge that the payment mechanism was not usurious. Now all of a sudden we have tens of thousands of dollars of debt that is going to attract interest?

That s**t is ****ed up on a fundamental level.

Last edited: