Hank93

Brownlow Medallist

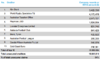

This is brutal in its assessment

Cooked

https://www.ppbadvisory.com/uploads/i470-7-December-2016-Administrators-Report-to-Creditors.pdf

Cooked

https://www.ppbadvisory.com/uploads/i470-7-December-2016-Administrators-Report-to-Creditors.pdf