Debt is very modest in regards to % of GNP. What the budget problem is long term. John Howard with his baby bonus and family concessions to the middle and upper class. Labor should have done something about but didn't.

So we need to be at what 60-70% of GDP before we worry about it?

While the total isn't high its one of the fastest growing in the developed world.

The real problem is this is all happening while our economy is apparently in a massive boom. If it wasn't for the mining boom where would we be?

What happens if the global economy tanks or China hits the skids? We have no savings and are already in debt.

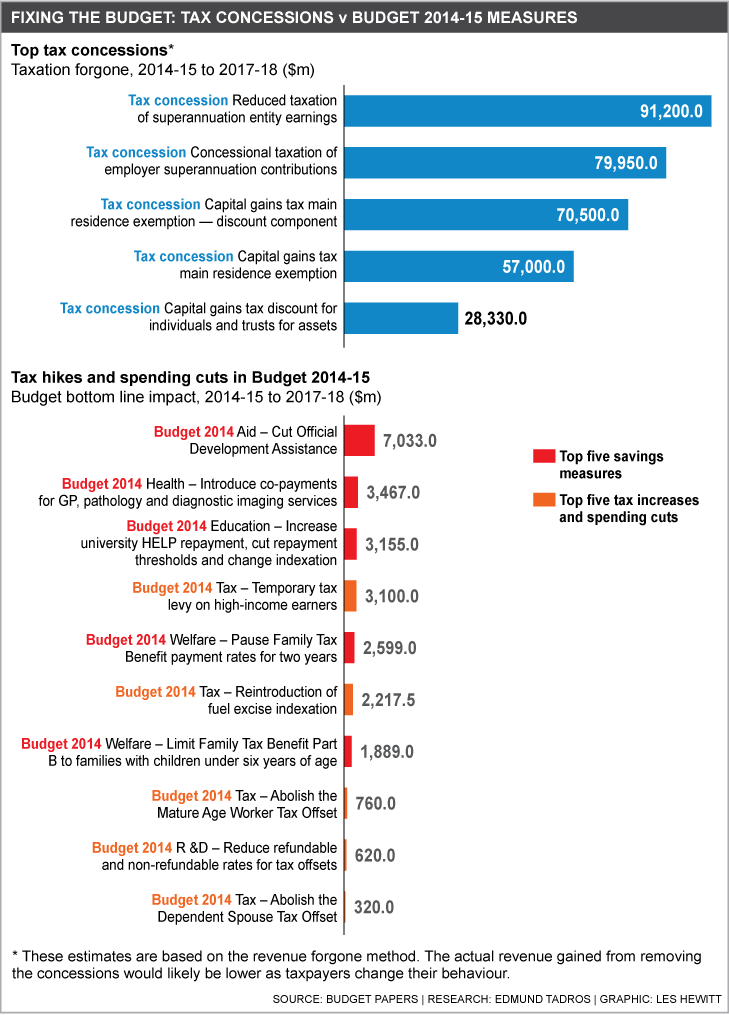

What can't our government (either type) save money?

Where is our 950 billion dollor sovereign wealth fund based on mining proceeds? We collect plenty in tax and royalties (far more then Norway). So why do they have plenty of savings and us none?

Where is all our money going?