Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Society/Culture Australian Property Prices to Crash?

- Thread starter CheapCharlie

- Start date

- Tagged users None

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,393

- 15,527

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

'Even though i am rich, earn big dollars and have an investment property'......toot toot

yeah spot on. I'm not allowed to think wealthy people shouldn't be allowed to have tax breaks. Even though i'm one of them.

shame on me for admitting it.

Madas

Norm Smith Medallist

- Aug 16, 2020

- 6,140

- 7,778

- AFL Club

- Fremantle

What about those of us who ( including yourself) are pretty chuffed they have an investment property to aid their retirement?You must be new to the thread.

I have said repeatedly in this thread and others that's Affordable Housing will never be fixed in this country for the exact reason you have stated, so i'm not sure what you think i don't understand about it?. I am not oblivious that the problem at it roots will continue to be ignored.

Sitting members of Australia parliament own a combined $300m of investment properties and are currently going at a rate of 2 x Investment properties on AVG each. Even if people would vote for it i doubt ministers would s**t on their own money.

just because the fix is too hard, doesn't mean you don't talk about it.

It’s actually a fantastic way to keep people working because they have a tangible asset that they can see growing which gives them hope for the future.

And for plenty of us that investment property is our superannuation.

The laws aren’t going to change in the near future so how about using some of your limitless expendable energy and thinking outside the square .

Land value anywhere decent is not going down and is only going to get worse as the population grows .

So the answers lie elsewhere, like :

•Government opens up very cheap land for first home buyers only , ( instead of paying out incentives they use the money to develop the land)

•New building materials ( 3D printing) in the future may make construction cheaper and quicker

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,393

- 15,527

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

What about those of us who ( including yourself) are pretty chuffed they have an investment property to aid their retirement?

It’s actually a fantastic way to keep people working because they have a tangible asset that they can see growing which gives them hope for the future.

And for plenty of us that investment property is our superannuation.

The laws aren’t going to change in the near future so how about using some of your limitless expendable energy and thinking outside the square .

Land value anywhere decent is not going down and is only going to get worse as the population grows .

So the answers lie elsewhere, like :

•Government opens up very cheap land for first home buyers only , ( instead of paying out incentives they use the money to develop the land)

•New building materials ( 3D printing) in the future may make construction cheaper and quicker

1) Well i mean, i'm not thinking of myself. You are. I suppose that's the difference? I genuinely care about housing affordability. My retirement portfolio is superannuation + stock portfolio based. My investment property is for my daughter. I would much rather my daughter grow up having a fair chance at housing affordability though again, i'm no idiot to reality.

2) I agree that things will not change soon. Hence I am willing to partake for a financial benefit though i disagree with the principal of it in term of housing affordability. Giving people like me tax benefits to buy housing is not going to fix affordability. I am no activist. If the government is going to give me free money i am going to take the piss out of it. Doesn't mean i think its the right thing.

3) Those answers will not assist in making property more accessible.

- Cheap land on it own is not going to change anything. You need the infrastructure in place to service it which Governments will simply not build.

- New Building Materials is a pipe dream. Housing construction costs has always generally gone up with inline with CPI. Yes pandemic issues has blown this out of proportion but housing materials will get cheaper once competition brings it back down as supply issues ease.

There are many things that impact housing affordability, sure. But there is not a single thing more so than investment, that's just an utterly simple fact.

- Banned

- #3,330

If people really want a house then there are plenty of options out there - even land & package deals...

www.metricon.com.au

www.metricon.com.au

'but i dont want to live there'.....well in that case, continue to rent and pay off someone's investment property (funnily enough being a part of the 'problem').

Prices are not going to come down to the levels these people need it come down to. Even if they make changes (which we all know they wont), itll be 10-15% tops

Its been happening the last 45+ years minimum, houses get more expensive the closer they are to the city, my folks had to move out 20mins from where they grew up because they couldnt afford where they grew up, we moved out 20mins from where we grew up because we couldnt afford where we grew up. And if you are smart, you'll buy a house that you can afford, you'll hopefully get better at your job and get paid more over time, be able to save up and afford a different house later on in life (we just moved from a 3 bed, 1 bath, 1 living/dining to a 4 bed, 2 bath, 2 living area house - because over time we saved)

View Upto 319 House & Land Packages In Melbourne - Metricon Homes

Metricon has over 300 house and land packages in Melbourne to suit your style and budget. Browse our award winning range of house and land packages now!

'but i dont want to live there'.....well in that case, continue to rent and pay off someone's investment property (funnily enough being a part of the 'problem').

Prices are not going to come down to the levels these people need it come down to. Even if they make changes (which we all know they wont), itll be 10-15% tops

Its been happening the last 45+ years minimum, houses get more expensive the closer they are to the city, my folks had to move out 20mins from where they grew up because they couldnt afford where they grew up, we moved out 20mins from where we grew up because we couldnt afford where we grew up. And if you are smart, you'll buy a house that you can afford, you'll hopefully get better at your job and get paid more over time, be able to save up and afford a different house later on in life (we just moved from a 3 bed, 1 bath, 1 living/dining to a 4 bed, 2 bath, 2 living area house - because over time we saved)

I'm onto you don't worry. Force them to sell so you can buy them up on the cheap and own all the property. The gap widens.%&$^ me dead mate.

I have said 1 million times in this thread the ability to buy a house should be based on your ability to have a good education and then getting a good job.

If your ability to own a property relies on you getting tax rorts from NG and other tax's that means you cannot afford them, and IMO should be forced to sell them.

I can afford my other properties without NG, which I am happy to accept for the good of housing affordability, would i actually keep them if NG and the likes goes? Would depend on the resulting finances. If you cant, that is your problem resulting from your shitty choices.

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,393

- 15,527

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

I'm onto you don't worry. Force them to sell so you can buy them up on the cheap and own all the property. The gap widens.

you got it.

my master plan.

- Sep 21, 2004

- 37,287

- 26,217

- AFL Club

- West Coast

- Other Teams

- Norwood & Liverpool.

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,393

- 15,527

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

i reckon 0.35 - 0.40

Their minutes from last month had both of these as options. I'd say we are in more of a rush now than we were last month get on top of inflation so id argue they will be more aggressive.

at worst case its a .65% rise in two months. This is enough to at least slow peoples entry into the market.i reckon 0.35 - 0.40

Their minutes from last month had both of these as options. I'd say we are in more of a rush now than we were last month get on top of inflation so id argue they will be more aggressive.

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,393

- 15,527

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

at worst case its a .65% rise in two months. This is enough to at least slow peoples entry into the market.

They will be 1.5-2.0 by December

- Sep 21, 2004

- 37,287

- 26,217

- AFL Club

- West Coast

- Other Teams

- Norwood & Liverpool.

- Banned

- #3,339

i would presume those who borrowed at record low interest rates and dont plan/think ahead for when interest rates rise.....

'oh, interest rates rise? im ****ed, poor me'

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,393

- 15,527

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

depends how lenient banks are allowing people movement.

A lot of people will be paying negative asset debt though.

Number37

Anyhow, have a Winfield 25.

- Oct 5, 2013

- 22,240

- 24,289

- AFL Club

- Sydney

Anyone hear the news today about the regulator questioning lenders about lending 9x income on very large loans?

With banks responding by adjusting to 7x income as the limit. LOL

Is it about to get harder to get a big home loan?

With banks responding by adjusting to 7x income as the limit. LOL

Is it about to get harder to get a big home loan?

Purple7x08_24

President: Galactic Federation

- May 8, 2022

- 7,547

- 12,686

- AFL Club

- Fremantle

- Other Teams

- Eagles NFL, 76ers, Blue Jays

I did the calculations and I'm 0.4 Anyone over 7.5 is playing with fire.Anyone hear the news today about the regulator questioning lenders about lending 9x income on very large loans?

With banks responding by adjusting to 7x income as the limit. LOL

Is it about to get harder to get a big home loan?

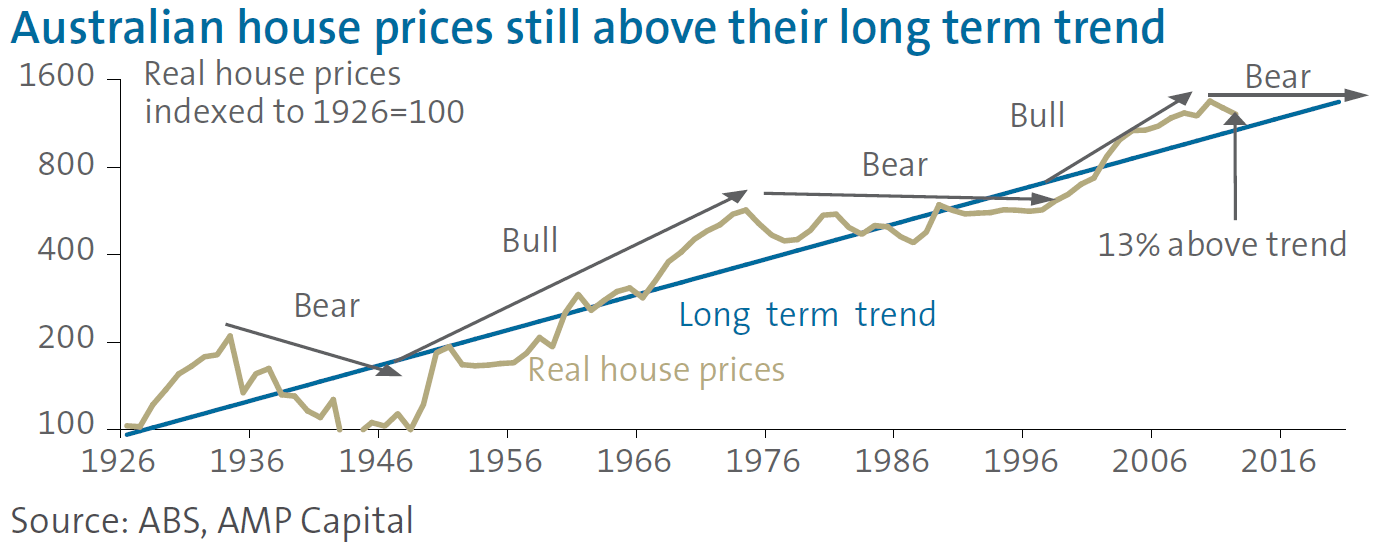

I don't see how property prices crash. At no point Post war have housing prices crashed. Even with super high interest rates, there will always be someone to come along and buy a property.

Properties are priced on supply and demand. Supply is low, and demand is high. In Sydney which is land locked by forests property prices cannot fall without massive density increases.

Number37

Anyhow, have a Winfield 25.

- Oct 5, 2013

- 22,240

- 24,289

- AFL Club

- Sydney

I did the calculations and I'm 0.4 Anyone over 7.5 is playing with fire.

I don't see how property prices crash. At no point Post war have housing prices crashed. Even with super high interest rates, there will always be someone to come along and buy a property.

Properties are priced on supply and demand. Supply is low, and demand is high. In Sydney which is land locked by forests property prices cannot fall without massive density increases.

Most of the supply-demand gap is a result of investors crowding out first home buyers.

At some point govts are going to stop pandering to the Property Council & property developers. The Greens may just accellerate that process in the upcoming parliament.

I wonder with builders collapsing left right and centre, who in their right mind would be game enough to lay down a deposit to build a new house in those satellite suburbs.

Pre existing homes might hold value or climb.

Pre existing homes might hold value or climb.

Purple7x08_24

President: Galactic Federation

- May 8, 2022

- 7,547

- 12,686

- AFL Club

- Fremantle

- Other Teams

- Eagles NFL, 76ers, Blue Jays

Edit: oof, land sold for 350k in 2004 and sold for 2.75M in 2008Most of the supply-demand gap is a result of investors crowding out first home buyers.

At some point govts are going to stop pandering to the Property Council & property developers. The Greens may just accellerate that process in the upcoming parliament.

I am watching a series of townhouses going up in a regional city (off the plan build) and I'm not sure any are getting sold. They're selling for $795K minimum and I wonder if there is a demand for town houses of that value in a regional city. I wonder how much money this developer is making. I'd say they may have spent 2.4Million acquiring the properties and 300K all costs for each town house.

Last edited:

Gigantic

Brownlow Medallist

A proper bubble bursting crash is unlikely. But the con concensus seems to be a correction is definitely on the cards.I did the calculations and I'm 0.4 Anyone over 7.5 is playing with fire.

I don't see how property prices crash. At no point Post war have housing prices crashed. Even with super high interest rates, there will always be someone to come along and buy a property.

Properties are priced on supply and demand. Supply is low, and demand is high. In Sydney which is land locked by forests property prices cannot fall without massive density increases.

Not because of supply factors but entirely by demand factors. We're already seeing slowing down of new mortgage debt, which is a leading indicator for change in house prices.

Number37

Anyhow, have a Winfield 25.

- Oct 5, 2013

- 22,240

- 24,289

- AFL Club

- Sydney

Edit: oof, land sold for 350k in 2004 and sold for 2.75M in 2008

I am watching a series of townhouses going up in a regional city (off the plan build) and I'm not sure any are getting sold. They're selling for $795K minimum and I wonder if there is a demand for town houses of that value in a regional city. I wonder how much money this developer is making. I'd say they may have spent 2.4Million acquiring the properties and 300K all costs for each town house.

The regions property prices have done quite well since Covid.

Would be a shame to see a property developer lose money on a deal, wouldn't it.

Purple7x08_24

President: Galactic Federation

- May 8, 2022

- 7,547

- 12,686

- AFL Club

- Fremantle

- Other Teams

- Eagles NFL, 76ers, Blue Jays

I don't get it though. I can find a house like 300m away in an ideal location with 800sqm property, fully renovated for 50K less. Why the hell would anyone buy a town house incorporating strata fees for more than a well rounded house.The regions property prices have done quite well since Covid.

Would be a shame to see a property developer lose money on a deal, wouldn't it.

Number37

Anyhow, have a Winfield 25.

- Oct 5, 2013

- 22,240

- 24,289

- AFL Club

- Sydney

I don't get it though. I can find a house like 300m away in an ideal location with 800sqm property, fully renovated for 50K less. Why the hell would anyone buy a town house incorporating strata fees for more than a well rounded house.

Seems absurd to move to the regions to live in a townhouse, but townhouses have become very popular in regional centres on the NSW North Coast.

HirdsTheWord

🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆🏆

- Jun 19, 2014

- 13,393

- 15,527

- AFL Club

- Essendon

- Other Teams

- New York Rangers, New York Knicks

I did the calculations and I'm 0.4 Anyone over 7.5 is playing with fire.

I don't see how property prices crash. At no point Post war have housing prices crashed. Even with super high interest rates, there will always be someone to come along and buy a property.

Properties are priced on supply and demand. Supply is low, and demand is high. In Sydney which is land locked by forests property prices cannot fall without massive density increases.

it depends what you define a crash as. Is a Sydney property all of a sudden going to half? No. but anything more than 10% is certainly a crash in the scheme of things, and 10% is more likely looking like the minimum amount prices are going to drop. It could be 30%. Sydney property dropped 1% off the back of a 0.25 rate rise. What do you think will happen when it gets to 2% or even 3% as some are forecasting?

The problem with the current situation is is that we have mega inflation at the same time properties have just gone up 30% not sure if this has EVER occurred in history thus hard to use history as a judge, historically in Australia governments have just bailed people out and lowered rates in order to protect housing. They cant do that now.

Whats occurring is a perfect s**t storm due to utter ineptitude of successive Australian governments who have allowed their citizens to become among the most mortgage indebted people on planet earth. This is what happens where there is ZERO long term housing affordability policy.

The current AVG New mortgage in NSW is $800,000, most of which is on variable loans. Interest rates rises on this number are simply massive.

The piper is about to be paid for a lot of people. I hope hey can hold on.

Last edited:

Similar threads

- Replies

- 2

- Views

- 353

- Replies

- 211

- Views

- 6K

- Replies

- 446

- Views

- 12K

- Replies

- 60

- Views

- 3K

- Replies

- 40

- Views

- 2K

- Replies

- 1

- Views

- 334

- Replies

- 16

- Views

- 973