Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Society/Culture Australian Property Prices to Crash?

- Thread starter CheapCharlie

- Start date

- Tagged users None

Just some of us don't think expecting to walk out of school and into owning inner city property is reasonable.

Have you met anybody from Drouin? It's a nice enough place. There's even people there who've had tertiary education. You can get avocado on your schnitzel at the pub.

- Banned

- #1,703

Plenty of options. Rent in a share house, rent an hour from the city, stay with mum and dad for a few years for startersUni grads should just all move to Drouin and suck it up. Because there's so much thriving business out there for them to get a start.

Sent from my CPH2005 using Tapatalk

I'm sure plenty are doing that. Doesn't change the fact that property is at record levels of unaffordability.Plenty of options. Rent in a share house, rent an hour from the city, stay with mum and dad for a few years for starters

Sent from my CPH2005 using Tapatalk

Nuggs Bunny

Moderator

- Oct 12, 2015

- 7,783

- 12,906

- AFL Club

- Essendon

- Other Teams

- Dallas Cowboys

- Moderator

- #1,705

Read the thread, genius. Why even bother responding to somebody if you're not gonna read the discussion they're having with someone else?Why are you (or whoever you are referring to) trying to buy a $900k house if you can't save the deposit and get the loan? There are much cheaper options out there

This is what puzzles alot of people

I presume it's because you want to own where you currently live/rent but the area is out of your range.......which is dumb.

Sent from my CPH2005 using Tapatalk

- Banned

- #1,706

I have read it and had input in this thread. My point still stands and is relevant to this thread/discussion. Genius.....Read the thread, genius. Why even bother responding to somebody if you're not gonna read the discussion they're having with someone else?

Sent from my CPH2005 using Tapatalk

Nuggs Bunny

Moderator

- Oct 12, 2015

- 7,783

- 12,906

- AFL Club

- Essendon

- Other Teams

- Dallas Cowboys

- Moderator

- #1,707

Nah if you read the thread properly you'd understand exactly what I'm getting at, but you clearly haven't because you're persisting with this lame gotcha.I have read it and had input in this thread. My point still stands and is relevant to this thread/discussion. Genius.....

Sent from my CPH2005 using Tapatalk

Nuggs Bunny

Moderator

- Oct 12, 2015

- 7,783

- 12,906

- AFL Club

- Essendon

- Other Teams

- Dallas Cowboys

- Moderator

- #1,708

Thread is just "I got mine, * y'all" at this point. Hope everyone is happy to dip in to their own house equity for a cool $100k so their kids can put down a 10% deposit on a townhouse in the exciting new suburb of Waurn Ponds South or Moe East in a few years because that's where we're heading.Uni grads should just all move to Drouin and suck it up. Because there's so much thriving business out there for them to get a start.

- Banned

- #1,709

Or people who don't know how to save or look beyond their daily coffee and muffin, next overseas holiday and loan for a brand new car and then cry poorThread is just "I got mine, fu** y'all" at this point. Hope everyone is happy to dip in to their own house equity for a cool $100k so their kids can put down a 10% deposit on a townhouse in the exciting new suburb of Waurn Ponds South or Moe East in a few years because that's where we're heading.

Or people who want to live near the city rather than commute an hour each day and pay off someone else's property rather than their own

Sent from my CPH2005 using Tapatalk

Nuggs Bunny

Moderator

- Oct 12, 2015

- 7,783

- 12,906

- AFL Club

- Essendon

- Other Teams

- Dallas Cowboys

- Moderator

- #1,710

Stop reading the Herald Sun and start talking to people under 30.Or people who don't know how to save or look beyond their daily coffee and muffin, next overseas holiday and loan for a brand new car and then cry poor

Or people who want to live near the city rather than commute an hour each day and pay off someone else's property rather than their own

Sent from my CPH2005 using Tapatalk

I think banks have tightened up on people using others property for surety.Thread is just "I got mine, fu** y'all" at this point. Hope everyone is happy to dip in to their own house equity for a cool $100k so their kids can put down a 10% deposit on a townhouse in the exciting new suburb of Waurn Ponds South or Moe East in a few years because that's where we're heading.

- Banned

- #1,712

I do, quite a few at my local footy club etc....and I don't read the Herald Sun.....Stop reading the Herald Sun and start talking to people under 30.

Sent from my CPH2005 using Tapatalk

- May 5, 2006

- 62,726

- 70,017

- AFL Club

- West Coast

Just some of us don't think expecting to walk out of school and into owning inner city property is reasonable.

My parents and most of their friends did that. I guess it was reasonable in the 1970s.

- Jun 14, 2013

- 13,076

- 15,680

- AFL Club

- Essendon

Inner city suburbs weren't always desirable.My parents and most of their friends did that. I guess it was reasonable in the 1970s.

Ned_Flanders

Make me an Admin!

- Aug 22, 2009

- 77,158

- 142,364

- AFL Club

- Richmond

- Other Teams

- 76'ers

We've pretty much screwed over our kids. If I was dipping my toes into the property market for the first time on an above average salary right now, I'd be looking at Pakenham or Melton.

Anywhere along the trainlines

- May 5, 2006

- 62,726

- 70,017

- AFL Club

- West Coast

Inner city suburbs weren't always desirable.

Undesirable suburbs became desirable, values increased

Outer suburbs were replaced by further outer suburbs, values increased

New blocks got smaller, old bigger block values increased

My old man bought a unit in the 1970s in Perth (5-10km out) which was affordable on a single median income. The same place in the same suburb today would be borderline on that metric, and we have historically low interest rates. He sold it after 3 or 4 years and it had tripled in value. Used that money to buy a block (outright) in a suburb 20km ish out and built a home. That doubled in value within 10 years then doubled in value again within another 10. Today it would be worth 10-15 times the cost of the land and build.

My first home was comparable, slightly further out, and more expensive relative to median income. After 10 years it was worth maybe 10-15% more than it cost. Totally different world. Which is OK, people just need to acknowledge that it is.

Typical uni bludgers wanting a house gifted to them on a silver platter.Just some of us don't think expecting to walk out of school and into owning inner city property is reasonable.

IT professional Brendon Miszka and his wife Gauri are inspecting a house in Sydney's north-western suburbs. They're looking to buy their first home but, despite good jobs and a decent deposit, they're finding it tough.

"I think we're competing with a lot of people that would be happier to take a lot more risk," Brendon says.

"There's a general attitude that you go off to the bank and see what's the maximum that the bank is prepared to lend and then go out and try and spend all that money on a property and everything will be OK."

Edwin Almeida is their buyer's agent — he's a property consultant who has 25 years' real estate experience both buying and selling.

"I haven't really seen anything as hot as what it is at the moment," he says.

While real estate agents are often known for their propensity to exaggerate, CoreLogic's latest March house price data backs up his observation.

"Over the month Australian dwelling values rose 2.8 per cent," says Eliza Owen, CoreLogic's head of Australian research.

"That's the highest growth rate we've seen since October 1988 and it's pushed values higher 6.2 per cent over the year."

https://www.abc.net.au/news/2021-04-02/housing-boom-nz-and-australia-lending-tax-crackdown/100046056

They aren't alone - I personally know at least 8 couples/individuals that have healthy deposits/savings and are exasperated with years of routinely being priced out of the market. Not necessarily talking about inner-city either properties either - prices have risen dramatically in outer suburbs and regionally.

Fair dinks. Woulda thought you'd at least need a year to prove to the bank you had secure employment.My parents and most of their friends did that. I guess it was reasonable in the 1970s.

I was surprised to find my folks never had a mortgage. Regional but still, my mum was shocked to know how far in debt i had to go. Think dad was on pretty decent coin back in his day. They bought a block with a tiny cottage at the front which they lived in (with 3 kids) while they built on the back.

Some of that can also be attributed to cost of living. And back in their day I'm not sure building was as lucrative as it is now. They paid less for a house that's still as solid now as it was when it went up. Nowadays they want to charge you a fortune and put something up that they take shortcuts with at every opportunity.

Article doesn't really stipulate what their situation is, other than they are risk averse and one of them works in IT. Your anecdotes hold more weight.Typical uni bludgers wanting a house gifted to them on a silver platter.

IT professional Brendon Miszka and his wife Gauri are inspecting a house in Sydney's north-western suburbs. They're looking to buy their first home but, despite good jobs and a decent deposit, they're finding it tough.

"I think we're competing with a lot of people that would be happier to take a lot more risk," Brendon says.

"There's a general attitude that you go off to the bank and see what's the maximum that the bank is prepared to lend and then go out and try and spend all that money on a property and everything will be OK."

Edwin Almeida is their buyer's agent — he's a property consultant who has 25 years' real estate experience both buying and selling.

"I haven't really seen anything as hot as what it is at the moment," he says.

While real estate agents are often known for their propensity to exaggerate, CoreLogic's latest March house price data backs up his observation.

"Over the month Australian dwelling values rose 2.8 per cent," says Eliza Owen, CoreLogic's head of Australian research.

"That's the highest growth rate we've seen since October 1988 and it's pushed values higher 6.2 per cent over the year."

https://www.abc.net.au/news/2021-04-02/housing-boom-nz-and-australia-lending-tax-crackdown/100046056

They aren't alone - I personally know at least 8 couples/individuals that have healthy deposits/savings and are exasperated with years of routinely being priced out of the market. Not necessarily talking about inner-city either properties either - prices have risen dramatically in outer suburbs and regionally.

- May 5, 2006

- 62,726

- 70,017

- AFL Club

- West Coast

Fair dinks. Woulda thought you'd at least need a year to prove to the bank you had secure employment.

I was surprised to find my folks never had a mortgage. Regional but still, my mum was shocked to know how far in debt i had to go. Think dad was on pretty decent coin back in his day. They bought a block with a tiny cottage at the front which they lived in (with 3 kids) while they built on the back.

Some of that can also be attributed to cost of living. And back in their day I'm not sure building was as lucrative as it is now. They paid less for a house that's still as solid now as it was when it went up. Nowadays they want to charge you a fortune and put something up that they take shortcuts with at every opportunity.

The house I described above seemed great to me as a kid but as an adult having looked at plenty of houses would have plenty of undesirable features by 2020s standards. Smallish bedrooms, no air con, no ensuite on the main bedroom etc. And the overall floor area would be less than most 3 x 1s built today. But whether it was a fibro shack or a palace it's the land appreciation that was absurd.

- Banned

- #1,722

Both look easily 40+ and 'buying their first home'.......where has their money gone over the years?Article doesn't really stipulate what their situation is, other than they are risk averse and one of them works in IT. Your anecdotes hold more weight.

I'm tipping he pimped out his mum's basement until he moved out last year

Sent from my CPH2005 using Tapatalk

That's the other thing. I was whinging to a boomer about being unable to afford to build what i want to and how houses were better back then, he said as much. Parents room, boys' room, girls' room, pokey kitchen less than 20sq all up etcThe house I described above seemed great to me as a kid but as an adult having looked at plenty of houses would have plenty of undesirable features by 2020s standards. Smallish bedrooms, no air con, no ensuite on the main bedroom etc. And the overall floor area would be less than most 3 x 1s built today. But whether it was a fibro shack or a palace it's the land appreciation that was absurd.

Are they standing out the front of somebody else's house? All a bit weird.Both look easily 40+ and 'buying their first home'.......where has their money gone over the years?

I'm tipping he pimped out his mum's basement until he moved out last year

Sent from my CPH2005 using Tapatalk

"good jobs and a decent deposit"Article doesn't really stipulate what their situation is, other than they are risk averse and one of them works in IT. Your anecdotes hold more weight.

Reading comprehension clearly not a strength.

Regardless of their situation, housing affordability is clearly a bigger issue than your reductive view of "uni students not being able to buy houses in the inner-city" makes it out to be.

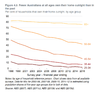

* These figures are five years old - and it has only gotten worse since.

They have good jobs and a decent deposit but were risk averse. Then stood out the front of somebody else's house smiling for some reason."good jobs and a decent deposit"

Reading comprehension clearly not a strength.

Regardless of their situation, housing affordability is clearly a bigger issue than your reductive view of "uni students not being able to buy houses in the inner-city" makes it out to be.

View attachment 1093441

View attachment 1093442

Like your friends who had healthy savings and deposits and chose not to buy, for years, and are whinging that prices have gone up. Maybe they should've bought years ago? The prices went up.

Similar threads

- Replies

- 2

- Views

- 352

- Replies

- 211

- Views

- 6K

- Replies

- 446

- Views

- 12K

- Replies

- 60

- Views

- 3K

- Replies

- 40

- Views

- 2K

- Replies

- 1

- Views

- 330

- Replies

- 16

- Views

- 971