- Moderator

- #1

Financial

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Due to a number of factors, support for the current BigFooty mobile app has been discontinued. Your BigFooty login will no longer work on the Tapatalk or the BigFooty App - which is based on Tapatalk.

Apologies for any inconvenience. We will try to find a replacement.

Log in to remove this Banner Ad

Memberships

AFL club membership reached new heights with 1,113,441 members, surpassing the previous record of 1,057,572 set in 2019.

Ten AFL clubs reached membership records (the Brisbane Lions, Carlton, Geelong Cats, Gold Coast Suns, Melbourne, North Melbourne, Port Adelaide, Richmond, St Kilda and West Coast Eagles) with Richmond and West Coast Eagles each exceeding 100,000 club members in consecutive years.

An AFLW membership record was also set in 2021, with 25,782 fans signing up to show their support of elite women’s football in a year that saw the competition ticketed for the first time.

AFL Members continued their unwavering commitment to Australian Football to record our second-highest membership tally of all-time, with 56,552 AFL members signing up for 2021.

Interesting to see that there are 32k AFL members in Tasmania. It's long been claimed that the state had 100k which always sounded absurd.

Interesting to see that there are 32k AFL members in Tasmania. It's long been claimed that the state had 100k which always sounded absurd.

Was it referring to ex pats included in that figure? As their stats would come in under another state. But I agree seems impossible when w.a and s.a are only in the 100,000s

Ex pats were never referred to and I don't know how that could easily measured as it is not something that clubs ask members. I'm not sure who originally stated it but it was bandied about a fair bit.

Mailing address?

Ex pats were never referred to and I don't know how that could easily measured as it is not something that clubs ask members. I'm not sure who originally stated it but it was bandied about a fair bit.

The EMRS survey, released yesterday, showed stronger support for the idea in the South. Statewide, 48 per cent of Tasmanians would support a Tasmanian AFL team. The number was 55 per cent in the South, 43 per cent in the North, and 39 per cent in the North-West. However the numbers dropped lower when the survey asked if people would put their money where their mouth was. Overall, 23 per cent of Tasmanians would consider becoming members - a number that would give the possible club about 100,000 members. The North-West led that category, with 25 per cent of respondents being interested in taking a membership, followed by 24 per cent in the North and 22 per cent in the South

Survey adds strength to Tassie AFL bid

SUPPORT for a Tasmanian AFL team is lowest in the North- West, but Coastal fans are willing to...www.theadvocate.com.au

I don't see how that could cause a 68k gap.

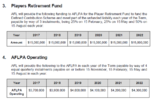

The power of collective bargaining. It is used for player training and education, admin, and banking into a pension/health type fund. This last component is the biggest contribution component the players have negotiated, since 1998 when Demetriou was CEO of the AFLPA.A few questions for those in the know. Having read the report I am unsure on the following:

1. Why do the aflpa get sent so much money? What do they do with it?

Borrowed $200m to buy Docklands in 2017 (took out $280m facility so could have working capital for the stadium).2. Why are liabilities higher than ever before?

They paid $200m - show it at cost not market value. Then depreciate the stadium value by about $30m each year. This is an expense but its non cash so another reason why profit each year and increase in cash has a large difference. Its standard conservatism accounting principle.3. Assets are at a few hundred million, but isn't marvel an asset worth over 1 billion on it's own?

Before Docklands was purchased, AFL Ltd had $78.5m cash and cash equivalents AFL Group had $86.8m. Now they only report group consolidated results.4. How much money/ cash do the AFL now have in the bank to spend? Is It more now than a few years back?

| x | Asset | Asset | X | Liability | Liability | X |

| Year | Cash | Cash in suspense | 2 Totals | Deferred Rev | Loans | 2 Totals |

2016 | 86.821 | 0.000 | 86.821 | 19.254 | 0.035 | 19.289 |

2017 | 135.307 | 0.000 | 135.307 | 28.570 | 185.152 | 213.722 |

2018 | 209.237 | 0.000 | 209.237 | 48.260 | 176.660 | 224.920 |

2019 | 184.721 | 0.000 | 184.721 | 48.376 | 95.767 | 144.143 |

2020 | 209.101 | 14.368 | 223.469 | 68.362 | 199.155 | 267.517 |

2021 | 249.313 | 43.586 | 292.899 | 120.687 | 170.003 | 290.690 |

The biggest area of expenditure increase in 2021, was payment to clubs. That increased by $70m, most of that went to the players salaries which increasing by 35% after a 29% cut in 2020.5. The money coming in was more than last year and the expenditure was less than previous years, was the 40 mill loss simply due to the big payment to the aflpa this year as a one off big hit

Gilligan, Demetriou, Jackson, Oakley all spin or have spun how great things are. The AFL is in good shape compared to where they thought they would be when they shut down in March 2020 and went and negotiated a $600m line of credit to survive a year or two of covid.6. Gillon stated the game is in a better position than ever before, I can't see how it's better than 2019 from the data provided, am I missing something?

The power of collective bargaining. It is used for player training and education, admin, and banking into a pension/health type fund. This last component is the biggest contribution component the players have negotiated, since 1998 when Demetriou was CEO of the AFLPA.

At the end of 2020 financial year, "The players’ retirement account investments totalled $131.5 million. Here is their 2020 annual report."

Prior years at

AFLPA Annual Reports

The AFLPA releases its annual report in March every year in line with its Annual General Meeting. Reports from 2018-present can be accessed below. Please contact bbeaton@aflplayers.com.au if you are…www.aflplayers.com.au

From the 2017-22 CBA page 63.

Schedule B – Total Player Payments and Benefits

Item 1 is TPP amounts over 6 seasons and item 2 is ASA amounts

View attachment 1343114

View attachment 1343144

Borrowed $200m to buy Docklands in 2017 (took out $280m facility so could have working capital for the stadium).

2 years of large covid losses funded by borrowings.

Plus looks like they have got TV monies up front and monies from the Vic government for the upgrade of Docklands, so that is cash in but the other side of the equation isn't revenue but a liability called deferred revenue. See cash comment below for more details.

They paid $200m - show it at cost not market value. Then depreciate the stadium value by about $30m each year. This is an expense but its non cash so another reason why profit each year and increase in cash has a large difference. Its standard conservatism accounting principle.

Wouldn't be worth $1bil - not before government has spent $300m on improving it and bought it for $200m in late October 2016. Don't believe everything you read or hear in the media.

Before Docklands was purchased, AFL Ltd had $78.5m cash and cash equivalents AFL Group had $86.8m. Now they only report group consolidated results.

In 2021 - "an increase in deferred income totalling $52.5 million, largely due to the receipt of funds from the Victorian State Government to be spent on the upgrade of Marvel Stadium;"

That's part of reason why cash increased by $69m when making a statutory loss of loss of $29m. But looks like some cash was given by the Vic government but was actually spent as on page 160 it says';

Discussion and Analysis of the Consolidated Statement of Profit and Loss and Other Comprehensive Income

The underlying operating loss in 2021 was $43.0 million which compared with a loss of $22.7 million in 2020. The variance between the underlying operating loss of $43.0 million and the statutory loss of $29.5 million is due to recognition of Government grant revenue of $13.5 million toward the redevelopment of Marvel Stadium and the surrounding precinct.

The previous year

Income

The underlying operating loss in 2020 was $22.7 million which compared with a profit of $27.9 million in 2019. The variance between the underlying operating loss of $22.7 million and the statutory loss of $8.4 million is due to recognition of Government grant revenue of $14.3 million toward the redevelopment of Marvel Stadium and the surrounding precinct.

Below is the group position as the last 3 years the AFL has stopped reporting individual and group accounts lodged with ASIC.

x Asset Asset X Liability Liability X Year Cash Cash in suspense 2 Totals Deferred Rev Loans 2 Totals

2017 the 2017-2022 TV deal kicks in with an extra $150+m cash/revenue per year coming in from that item and

2017 is when revenues and expenses of Docklands come thru the group accounts. The deal was signed in October 2016 but settlement happened after the 2017 year started (ie 1st November)

The biggest area of expenditure increase in 2021, was payment to clubs. That increased by $70m, most of that went to the players salaries which increasing by 35% after a 29% cut in 2020.

Also a lot of clubs have facilities expenditure that they are committed to that the AFL has said they will help fund.

The payments to AFLPA are negotiated upfront as part of the CBA. .

Looks like if you add $18m in 2020 + $60m in 2021 it's basically the same as $36m in 2018 + $37m in 2019.

Gilligan, Demetriou, Jackson, Oakley all spin or have spun how great things are. The AFL is in good shape compared to where they thought they would be when they shut down in March 2020 and went and negotiated a $600m line of credit to survive a year or two of covid.

They were forced to make some big cuts in areas that weren't really essential. Keep that expenditure under control whilst revenues get back to normal, ie broadcasting, finals ticket sales, commercial revenue, Docklands etc and they will be doing well again.

The $130m fund is mainly for injury issues rather than a pension, but they also help out ex players who have fallen on hard times.Thanks a great breakdown there. A few points.

- The funding for the AFLPA is massive, I understand the injury fund but all the other stuff seems like massive overs. I would have thought they'd just get super whilst playing similar to everybody else but they have an extra retirement fund too. It also looks like they withheld some payment in 2020 which they had to make up for in 2021.

The land as a piece of vacant land isn't worth that much. The $30mil the AFL put in, in 2000 to be able to buy the freehold land and stadium and any buildings which were built and owned by the consortium on 31/12/2025 for $30, basically bought the land.

- On docklands i thought 1 billion includes the land the stadium is on too, which in that location and that size would be accurate I think. I wonder if owning and operating a stadium is a big money maker or not in usual times?

I don't think you will get a true figure. All you will get is what the books of the organisation at the head of the codes say. There are a lot of components that make up any code.

- I'd be interested to see a breakdown of the wealth of all the football codes, I know 2019 the AFL was significantly in front but some of the others may have caught up or gone further backwards themselves.