Doubt you will find a a house that cheap in KewIt doesn't have to be that way, if we were smart we'd make people use their house as a retirement fund, instead of paying them the pension so they can hand their $1.5 million dollar house in Kew to their arsehole kids.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

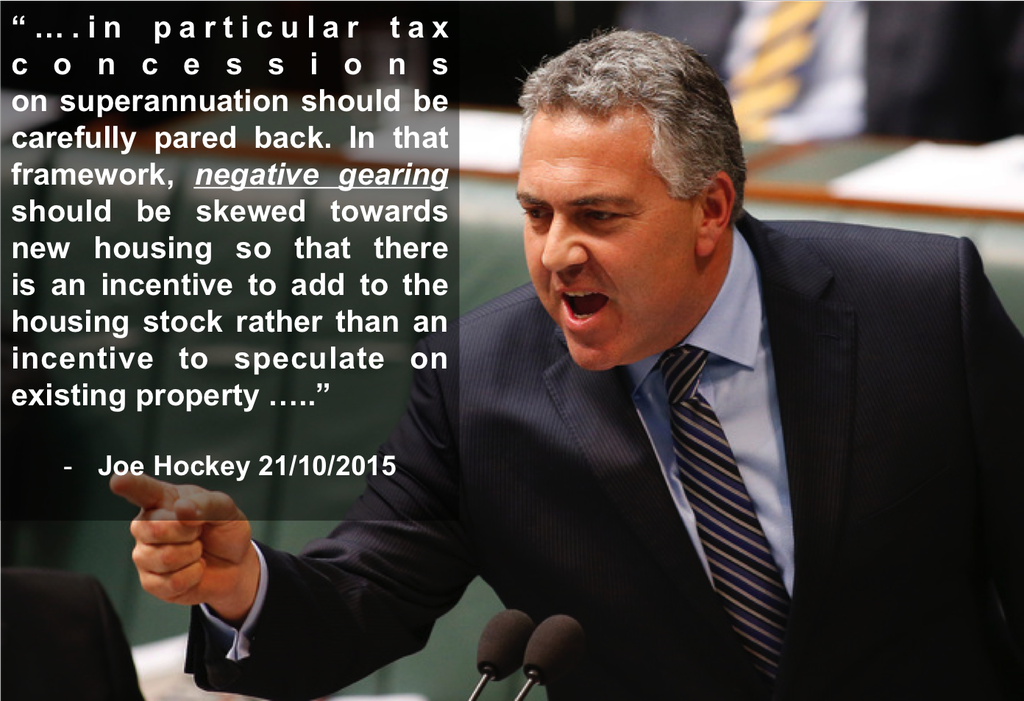

The negative gearing election

- Thread starter coerced

- Start date

- Tagged users None

Nuggs Bunny

Moderator

- Moderator

- #1,102

You will in a few months!Doubt you will find a a house that cheap in Kew

And don't worry, you'll know when it happens too. "I played with fire and got burnt" sob stories in the news for dayssssssssss

Ned_Flanders

Make me an Admin!

- Aug 22, 2009

- 77,158

- 142,364

- AFL Club

- Richmond

- Other Teams

- 76'ers

I Think that with banks tightening up on lending, NG market might be harder to get into.

thats already happened

not a lot of noise, but banks quietly started raising the bar on loans months ago

- Dec 18, 2007

- 10,979

- 6,797

- AFL Club

- Essendon

- Other Teams

- Non that play Essendon

It doesn't have to be that way, if we were smart we'd make people use their house as a retirement fund, instead of paying them the pension so they can hand their $1.5 million dollar house in Kew to their arsehole kids.

An unintended consequence is older people would have to move away from where they live which for many older people is difficult and they would potentially be looking to move into flats and units that otherwise suit first home buyers.

Congratulations australia

In 2018 more australians purchased their SEVENTH home than people did their first.

Absolute shambles.

In 2018 more australians purchased their SEVENTH home than people did their first.

Absolute shambles.

- Jul 30, 2018

- 11,782

- 15,176

- AFL Club

- Fremantle

- Banned

- #1,107

That can’t be true.Congratulations australia

In 2018 more australians purchased their SEVENTH home than people did their first.

Absolute shambles.

- Jul 30, 2018

- 11,782

- 15,176

- AFL Club

- Fremantle

- Banned

- #1,108

That can’t be trueCongratulations australia

In 2018 more australians purchased their SEVENTH home than people did their first.

Absolute shambles.

Nuggs Bunny

Moderator

- Moderator

- #1,110

Flats and units aren't the properties in short supply, that would be three and four bedroom family houses on a single block which older people would be moving away from should they choose to.An unintended consequence is older people would have to move away from where they live which for many older people is difficult and they would potentially be looking to move into flats and units that otherwise suit first home buyers.

I think it’s probably the 7th home they’ve purchased, not the 7th home they currently own.

Still not great, but yeah.

Still not great, but yeah.

- Jul 30, 2018

- 11,782

- 15,176

- AFL Club

- Fremantle

- Banned

- #1,112

The 730 special this week has the distinct smell of being Liberal propaganda.

On the go agsin, planning to sell the family home in the

March quarter hoping Bill will stick to a moratorium on neg gearing ,-

- what chance an uptick in the market to take up the door left open for those in a position to take advantage.

March quarter hoping Bill will stick to a moratorium on neg gearing ,-

- what chance an uptick in the market to take up the door left open for those in a position to take advantage.

Power Raid

We Exist To Win Premierships

Yeah in the 60’s 70’s 80’s 90’s it was attainable - in the early 90’s you could buy a 2 br unit in osborne park for around 72k

Same unit now is 360k - 5 times the price while the minimum wage has maybe doubled.

Yep

My first property was a $27k two bedroom apartment in Semaphore.

My income was very low but renting out and living at home allowed me to cope with the 20+% interest rates.

Interest rates is something people over look when looking back at property prices and just as relevant as wages and disposable income.

Footyfan61

Debutant

- Dec 19, 2018

- 123

- 108

- AFL Club

- Brisbane Lions

Go and read the stats on investorsCongratulations australia

In 2018 more australians purchased their SEVENTH home than people did their first.

Absolute shambles.

It’s only like 15k and under our od 25 million who own 5 or 6 more homes

That is not the problem!

It’s basic supply and demand that has created the housing crisis.

Population boom to Victoria and NSW from interstate migration as well as immigration!

House prices in WA tumbled, Qld did nothing as well as Adelaide & NT

Footyfan61

Debutant

- Dec 19, 2018

- 123

- 108

- AFL Club

- Brisbane Lions

Can you correct me if I’m wrong, but back then they were 10 year loans and only P&I no interest only options?Yep

My first property was a $27k two bedroom apartment in Semaphore.

My income was very low but renting out and living at home allowed me to cope with the 20+% interest rates.

Interest rates is something people over look when looking back at property prices and just as relevant as wages and disposable income.

Power Raid

We Exist To Win Premierships

Can you correct me if I’m wrong, but back then they were 10 year loans and only P&I no interest only options?

I can’t recall the term but yes P&I and definitely no interest only options

Footyfan61

Debutant

- Dec 19, 2018

- 123

- 108

- AFL Club

- Brisbane Lions

To my knowledge they were only 10 year loans but were extended out to 20 & 25 yr loans in the late 80s when several of the banks went broke and had to be bailed out by international banks or mergers. All part of the lead up to the rescission that we had to have.I can’t recall the term but yes P&I and definitely no interest only options

That’s from my sketchy memory from property guru Jan Summers

To my knowledge they were only 10 year loans but were extended out to 20 & 25 yr loans in the late 80s when several of the banks went broke and had to be bailed out by international banks or mergers. All part of the lead up to the rescission that we had to have.

That’s from my sketchy memory from property guru Jan Summers

Wrong.

Footyfan61

Debutant

- Dec 19, 2018

- 123

- 108

- AFL Club

- Brisbane Lions

In what way housing guruWrong.

In what way housing guru

Got a 25 year loan P&I start of the 70s, my folks had a WW2 war service loan that was 30 years in 1946. Used interest only 2nd mortgage on a negatively geared rental property in the 70s.

BS alert: fake news that negative gearing is something new, but then again its coming from the political types where BS is a tool of the trade. Not to mention the journos who are responsible for the rubbish we read, too lazy to look beyond the press release - bloody duds !!

Any thing else I can help you with 61?

Last edited:

Thread title needs a change. No one is buying houses for negative gearing purposes in a falling market. The capital gains tax issue is the more important thing given it will apply to sales of all future properties.

Not all markets are falling - its an ongoing thing - i can understand one house - when people have 5 or 7 or whatever its bs - its locking people out of the market and artificially inflating prices.Thread title needs a change. No one is buying houses for negative gearing purposes in a falling market. The capital gains tax issue is the more important thing given it will apply to sales of all future properties.

- Jan 12, 2011

- 25,401

- 35,580

- AFL Club

- Collingwood

Not all markets are falling - its an ongoing thing - i can understand one house - when people have 5 or 7 or whatever its bs - its locking people out of the market and artificially inflating prices.

Not in favour of self funded retirees, pulling their own weight?

Similar threads

- Replies

- 131

- Views

- 4K